Concept explainers

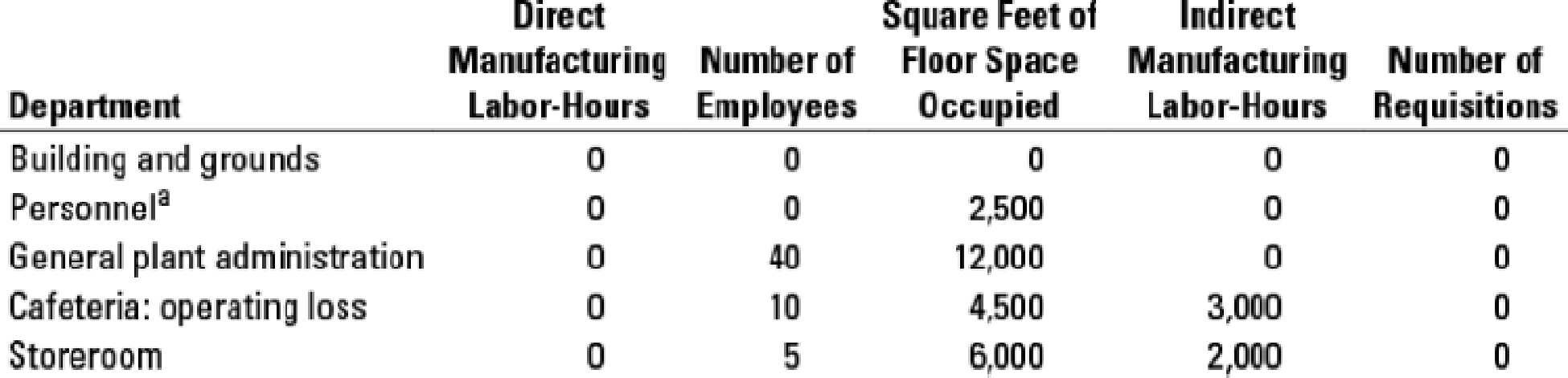

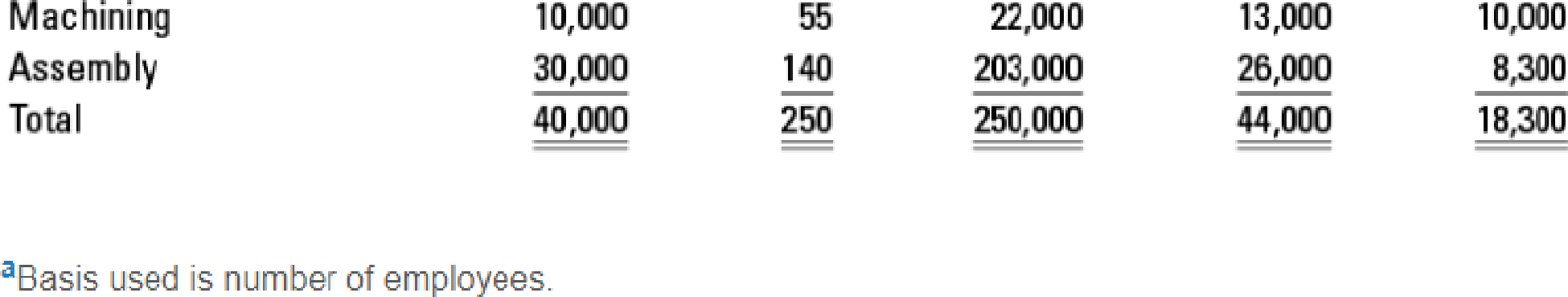

Allocating costs of support departments; step-down and direct methods. The Eastern Summit Company has prepared department

| Support departments: | ||

| Building and grounds | $45,000 | |

| Personnel | 7,800 | |

| General plant administration | 36,120 | |

| Cafeteria: operating loss | 20,670 | |

| Storeroom | 18,300 | $127,890 |

| Operating departments: | ||

| Machining | 536,000 | |

| Assembly | 60,000 | 96,000 |

| Total for support and operating departments | $223,890 |

Management has decided that the most appropriate inventory costs are achieved by using individual-department overhead rates. These rates are developed after support-department costs are allocated to operating departments.

Bases for allocation are to be selected from the following:

- 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate.

- 2. Using the direct method, rework requirement 1.

- 3. Based on the following information about two jobs, determine the total overhead costs for each job by using rates developed in (a) requirement 1 and (b) requirement 2.

| Direct Manufacturing Labor-Hours | ||

| Machining | Assembly | |

| Job 88 | 18 | 8 |

| Job 89 | 10 | 20 |

- 4. The company evaluates the performance of the operating department managers on the basis of how well they managed their total costs, including allocated costs. As the manager of the Machining Department, which allocation method would you prefer from the results obtained in requirements 1 and 2? Explain.

Learn your wayIncludes step-by-step video

Chapter 15 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Additional Business Textbook Solutions

Management (14th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Engineering Economy (17th Edition)

Foundations of Financial Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- On January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to O decimal places, eg. 5,275.) Weighted average number of shares outstandingarrow_forwardOn January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31 Assume that Pharoah earned net income of $3,441,340 during 2023. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per sharearrow_forwardI want to correct answer general accounting questionarrow_forward

- Discuss the following questions below 1. Definition and scope of IAS 38 2. Recognition of criteria of intangible assets 3. Meaurement basis for intangible assets 4. Amortization methods and their implications for financial reportingarrow_forwardPlease solve this problem general accounting questionarrow_forwardWaiting for your solution general accounting questionarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning