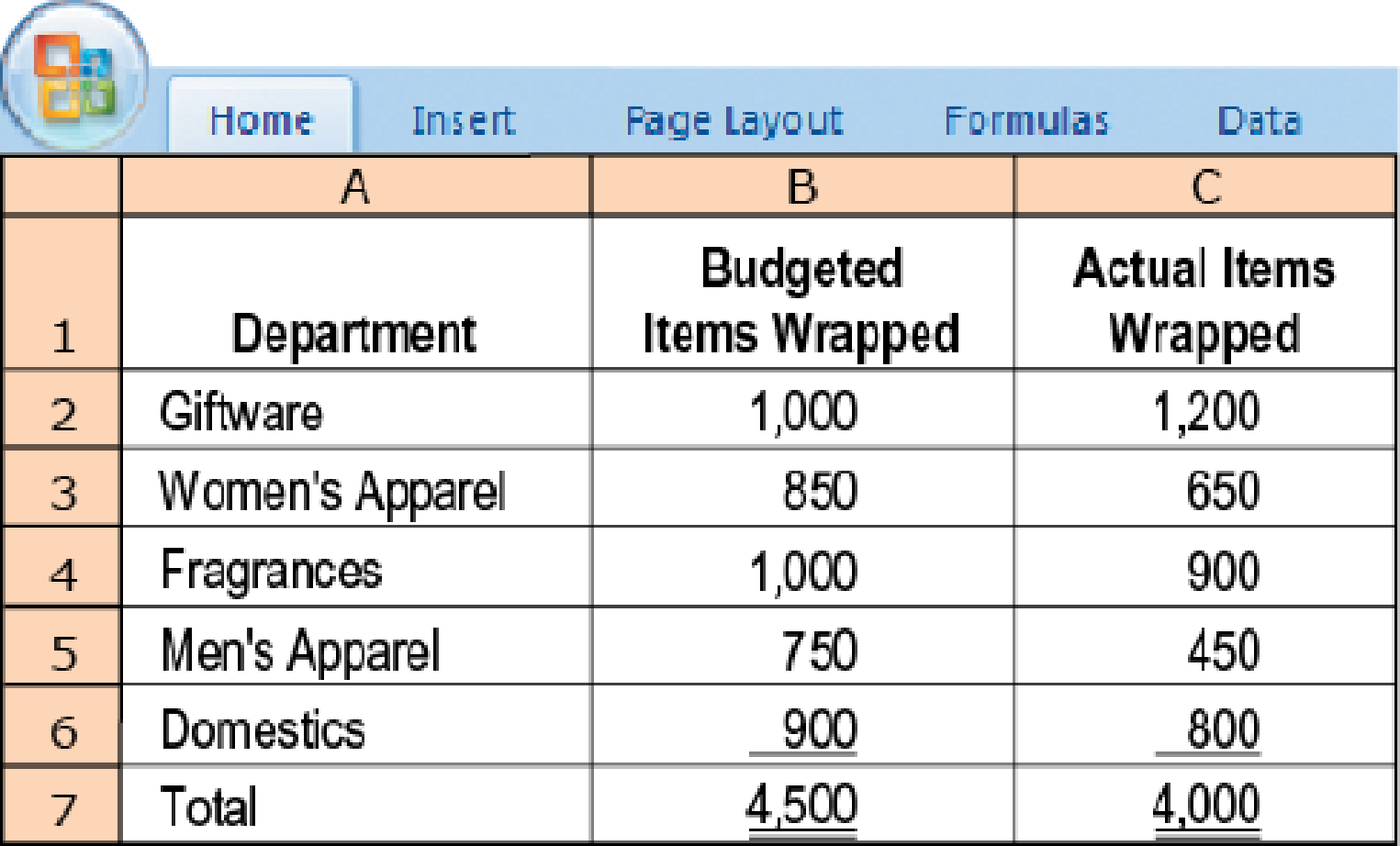

Single-rate, dual-rate, and practical capacity allocation. Preston Department Store has a new promotional program that offers a free gift-wrapping service for its customers. Preston’s customer-service department has practical capacity to wrap 5,000 gifts at a budgeted fixed cost of $4,950 each month. The budgeted variable cost to gift-wrap an item is $0.35. During the most recent month, the department budgeted to wrap 4,500 gifts. Although the service is free to customers, a gift-wrapping service cost allocation is made to the department where the item was purchased. The customer-service department reported the following for the most recent month:

- 1. Using the single-rate method, allocate gift-wrapping costs to different departments in these three ways:

Required

- a. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on the budgeted use (of gift-wrapping services).

- b. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on actual usage.

- c. Calculate the budgeted rate based on the practical gift-wrapping capacity available and allocate costs based on actual usage.

- 2. Using the dual-rate method, compute the amount allocated to each department when (a) the fixed-cost rate is calculated using budgeted fixed costs and the practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted fixed costs and budgeted usage of gift-wrapping services, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage.

- 3. Comment on your results in requirements 1 and 2. Discuss the advantages of the dual-rate method.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Cost Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText -- Access Card Package (15th Edition)

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardSynergy Works had a Work-in-Process balance of $160,000 on January 1, 2023. The year-end balance of Work-in-Process was $142,000, and the Cost of Goods Manufactured was $795,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forward

- Nonearrow_forwardAssume that in 2022, the federal government of Arcadia Republic spent $920 billion and collected $780 billion in taxes. In 2023, government spending increased to $950 billion, while government revenue also increased to $1,050 billion. If the government debt was $7.8 trillion at the beginning of 2022, what will it be at the end of 2023?arrow_forwardProblem related to Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College