Cost Accounting

15th Edition

ISBN: 9780133428834

Author: Horngren

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.27P

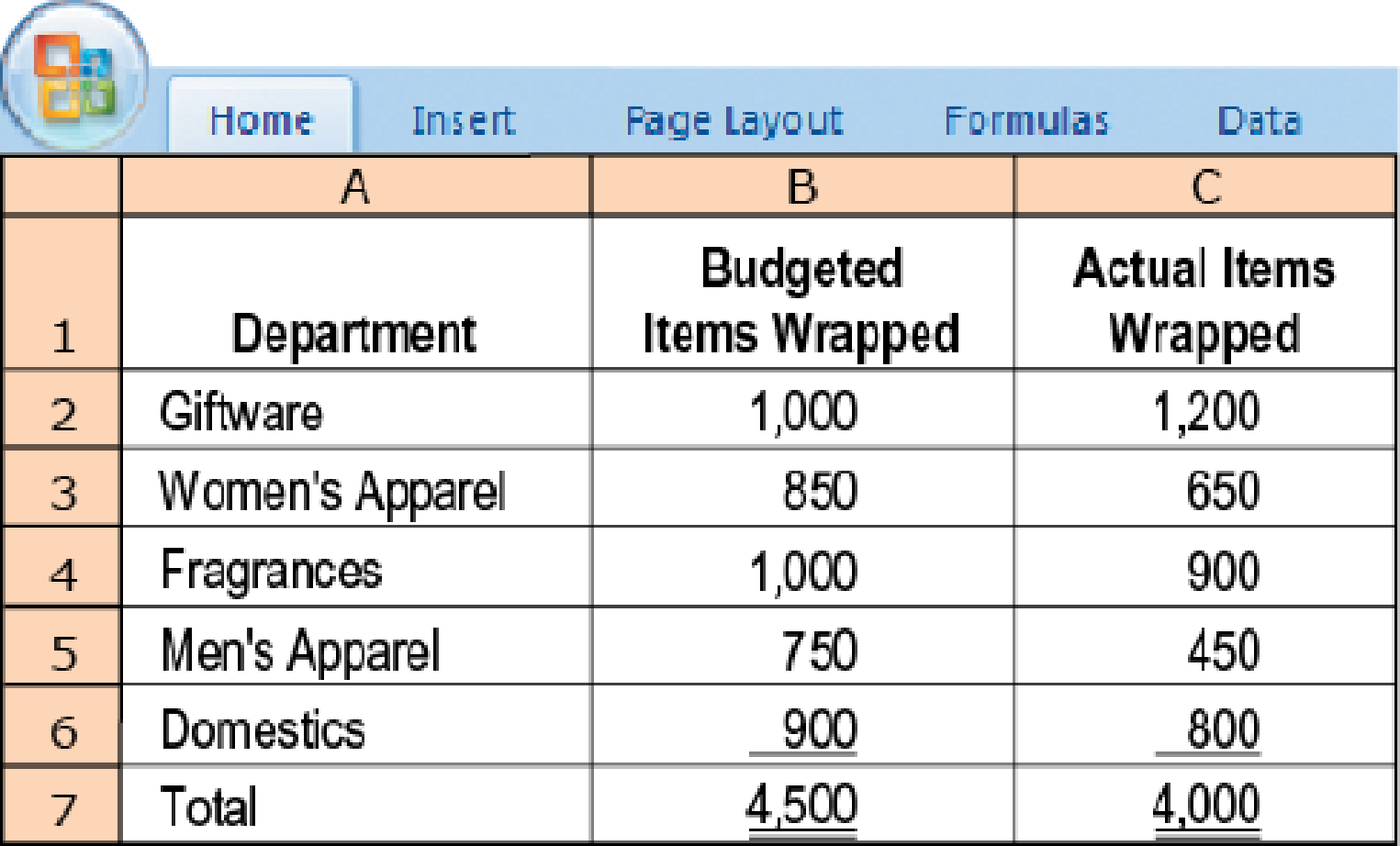

Single-rate, dual-rate, and practical capacity allocation. Preston Department Store has a new promotional program that offers a free gift-wrapping service for its customers. Preston’s customer-service department has practical capacity to wrap 5,000 gifts at a budgeted fixed cost of $4,950 each month. The budgeted variable cost to gift-wrap an item is $0.35. During the most recent month, the department budgeted to wrap 4,500 gifts. Although the service is free to customers, a gift-wrapping service cost allocation is made to the department where the item was purchased. The customer-service department reported the following for the most recent month:

- 1. Using the single-rate method, allocate gift-wrapping costs to different departments in these three ways:

Required

- a. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on the budgeted use (of gift-wrapping services).

- b. Calculate the budgeted rate based on the budgeted number of gifts to be wrapped and allocate costs based on actual usage.

- c. Calculate the budgeted rate based on the practical gift-wrapping capacity available and allocate costs based on actual usage.

- 2. Using the dual-rate method, compute the amount allocated to each department when (a) the fixed-cost rate is calculated using budgeted fixed costs and the practical gift-wrapping capacity, (b) fixed costs are allocated based on budgeted fixed costs and budgeted usage of gift-wrapping services, and (c) variable costs are allocated using the budgeted variable-cost rate and actual usage.

- 3. Comment on your results in requirements 1 and 2. Discuss the advantages of the dual-rate method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting problem using accurate calculation methods?

Please explain the solution to this general accounting problem using the correct accounting principles.

general accounting

Chapter 15 Solutions

Cost Accounting

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - Prob. 15.10Q

Ch. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Prob. 15.15QCh. 15 - Prob. 15.16ECh. 15 - Prob. 15.17ECh. 15 - Prob. 15.18ECh. 15 - Prob. 15.19ECh. 15 - Prob. 15.20ECh. 15 - Prob. 15.21ECh. 15 - Prob. 15.22ECh. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Prob. 15.24ECh. 15 - Prob. 15.25ECh. 15 - Prob. 15.26ECh. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Prob. 15.29PCh. 15 - Prob. 15.30PCh. 15 - Prob. 15.31PCh. 15 - Prob. 15.32PCh. 15 - Prob. 15.33PCh. 15 - Prob. 15.34PCh. 15 - Prob. 15.35PCh. 15 - Prob. 15.36P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardSynergy Works had a Work-in-Process balance of $160,000 on January 1, 2023. The year-end balance of Work-in-Process was $142,000, and the Cost of Goods Manufactured was $795,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forward

- Nonearrow_forwardAssume that in 2022, the federal government of Arcadia Republic spent $920 billion and collected $780 billion in taxes. In 2023, government spending increased to $950 billion, while government revenue also increased to $1,050 billion. If the government debt was $7.8 trillion at the beginning of 2022, what will it be at the end of 2023?arrow_forwardProblem related to Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license