ADVANCED FINANCIAL ACCOUNTING IA

12th Edition

ISBN: 9781260545081

Author: Christensen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.10E

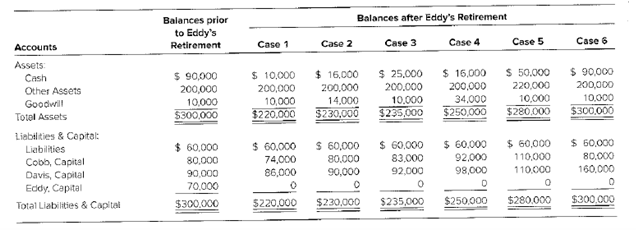

Retirement of a Partner

On January 1, 20X1, Eddy decides to retire from the

Required

Prepare the necessary

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the total amount of manufacturing overhead costs for the month of April?

Varma Corporation distributes property to its sole shareholder, Maya. The property has a fair market value of $675,000 and an adjusted basis of $425,000. With respect to the distribution, Varma has a gain of ____.

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

Chapter 15 Solutions

ADVANCED FINANCIAL ACCOUNTING IA

Ch. 15 - Prob. 15.1QCh. 15 - Prob. 15.2QCh. 15 - Prob. 15.3QCh. 15 - Prob. 15.4QCh. 15 - Under what circumstances would a partner’s capital...Ch. 15 - Prob. 15.6QCh. 15 - Prob. 15.7QCh. 15 - Prob. 15.8QCh. 15 - Prob. 15.9QCh. 15 - Prob. 15.10Q

Ch. 15 - Prob. 15.11QCh. 15 - Prob. 15.12QCh. 15 - Prob. 15.13QCh. 15 - Prob. 15.14QCh. 15 - Prob. 15.15AQCh. 15 - Prob. 15.16BQCh. 15 - Prob. 15.1CCh. 15 - Prob. 15.2CCh. 15 - Prob. 15.3CCh. 15 - Prob. 15.1.1ECh. 15 - Prob. 15.1.2ECh. 15 - Prob. 15.1.3ECh. 15 - Prob. 15.1.4ECh. 15 - Multiple-Choice on Initial Investment [AICPA...Ch. 15 - Prob. 15.2ECh. 15 - Prob. 15.3ECh. 15 - Prob. 15.4ECh. 15 - Prob. 15.5ECh. 15 - Prob. 15.6ECh. 15 - Prob. 15.7ECh. 15 - Prob. 15.8.1ECh. 15 - Prob. 15.8.2ECh. 15 - Prob. 15.8.3ECh. 15 - Prob. 15.8.4ECh. 15 - Prob. 15.8.5ECh. 15 - Prob. 15.8.6ECh. 15 - Prob. 15.8.7ECh. 15 - Prob. 15.8.8ECh. 15 - Prob. 15.9ECh. 15 - Retirement of a Partner On January 1, 20X1, Eddy...Ch. 15 - Prob. 15.11PCh. 15 - Prob. 15.12PCh. 15 - Prob. 15.13PCh. 15 - Prob. 15.14PCh. 15 - Withdrawal of a Partner under Various Alternatives...Ch. 15 - Prob. 15.16.1PCh. 15 - Prob. 15.16.2PCh. 15 - Prob. 15.16.3PCh. 15 - Prob. 15.16.4PCh. 15 - Prob. 15.16.5PCh. 15 - Prob. 15.16.6PCh. 15 - Prob. 15.16.7PCh. 15 - Prob. 15.16.8PCh. 15 - Prob. 15.16.9PCh. 15 - Prob. 15.17PCh. 15 - Prob. 15.18PCh. 15 - Initial investments and Tax Bases [AICPA Adapted]...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me find the accurate solution to this financial accounting problem using valid principles?arrow_forwardTrezor Industries uses a predetermined overhead rate of $50 per machine hour. Estimated machine hours at the beginning of the year were 20,000, and actual machine hours at the end of the year were 19,600. Estimated total manufacturing overhead costs at the beginning of the year were $1,000,000, and actual total manufacturing overhead costs at the end of the year were $980,000. What is the amount of manufacturing overhead that would have been applied to all jobs during the year?arrow_forwardWhat was it's change for depression and amortization ?arrow_forward

- Kepler Manufacturing has $18,000 of ending finished goods inventory as of December 31, 2023. If beginning finished goods inventory was $8,000 and the cost of goods sold (COGS) was $55,000, how much would Kepler report for cost of goods manufactured? Need Answerarrow_forwardHelp this accounting questionarrow_forwardWhich option is correct?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License