Concept explainers

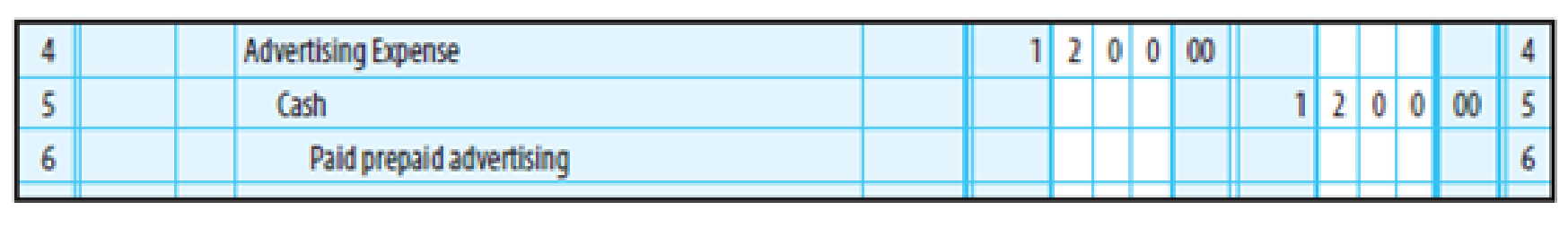

EXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Davidson’s Food Mart paid $1,200 in advance to the local newspaper for advertisements that will appear monthly. The following entry was made:

At the end of the year, December 31, 20--, Davidson received notification that advertisements costing $800 had been run. Prepare the

Prepare the adjusting entry.

Explanation of Solution

The expense method of accounting for prepaid expenses:

In expense method of accounting for prepaid supplies, prepaid expenses and other prepaid items are recorded as purchases during its purchase.

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Record the adjusting entries under prepaid expenses method:

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 31 | Prepaid advertising | 400 | |

| Advertising expense | 400 | ||

| (To record amount of prepaid advertising ) |

Table (1)

- Prepaid advertising is a current asset and it is increased. Therefore, debit prepaid advertising account by $400.

- Advertising expense is a component of stockholders’ equity and it is increased. Therefore, credit advertising expense account by $400.

Want to see more full solutions like this?

Chapter 14A Solutions

College Accounting, Chapters 1-27

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage