Concept explainers

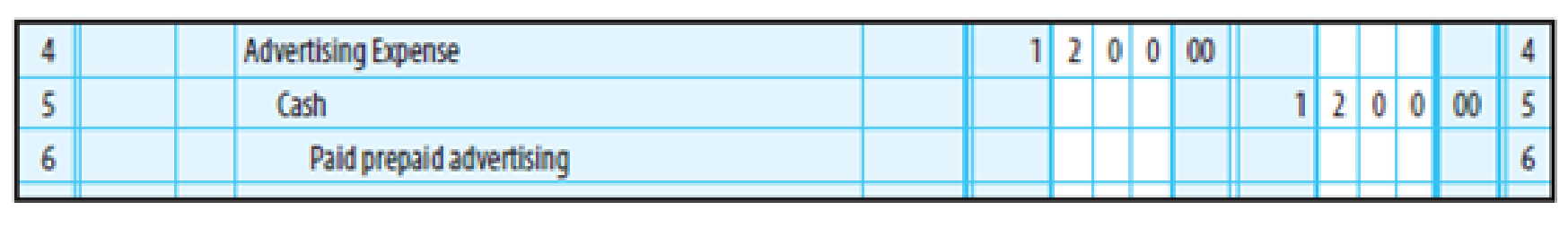

EXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Davidson’s Food Mart paid $1,200 in advance to the local newspaper for advertisements that will appear monthly. The following entry was made:

At the end of the year, December 31, 20--, Davidson received notification that advertisements costing $800 had been run. Prepare the

Prepare the adjusting entry.

Explanation of Solution

The expense method of accounting for prepaid expenses:

In expense method of accounting for prepaid supplies, prepaid expenses and other prepaid items are recorded as purchases during its purchase.

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Record the adjusting entries under prepaid expenses method:

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 31 | Prepaid advertising | 400 | |

| Advertising expense | 400 | ||

| (To record amount of prepaid advertising ) |

Table (1)

- Prepaid advertising is a current asset and it is increased. Therefore, debit prepaid advertising account by $400.

- Advertising expense is a component of stockholders’ equity and it is increased. Therefore, credit advertising expense account by $400.

Want to see more full solutions like this?

Chapter 14A Solutions

College Accounting, Chapters 1-27

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardElizabeth Corp. sold 3,800 units of its product at a price of $92.25 per unit. The total variable cost per unit is $63, consisting of $41.50 in variable production cost and $21.50 in variable selling and administrative cost. Compute the manufacturing margin for the company under variable costing. a. $192,850 b. $94,960 c. $196,140 d. $333,900 e. ($139,180)arrow_forwardBentley Industries applies manufacturing overhead on the basis of direct labor hours. At the beginning of the most recent year, the company based its predetermined overhead rate on a total estimated overhead of $127,500 and 5,100 estimated direct labor hours. Actual manufacturing overhead for the year amounted to $131,200 and actual direct labor hours were 4,800. The applied manufacturing overhead for the year was closest to __.arrow_forward

- Compute the company's predetermined overhead ratearrow_forwardThe Hidalgo Company uses the weighted-average method in its process costing system. The company's ending work in process inventory consists of 18,500 units. The ending work in process inventory is 100% complete with respect to materials and 60% complete with respect to labor and overhead. If the costs per equivalent unit for the period are $3.75 for materials and $5.20 for labor and overhead, what would be the balance of the ending work in process inventory account? (Do not round cost per equivalent unit).arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning