To identify: The expected

Introduction:

Return on Equity:

The return, which is generated on the equity that is invested by the stockholders is known as return on equity.

Explanation of Solution

The capital ratio at 0% and none interest rate.

Compute the expected return on equity.

State-1

Compute the net income.

Given,

The probability is 0.2.

The EBIT is $4,200,000.

Formula to calculate the net income,

Where,

- EBIT is earning before interest and tax.

- I is interest.

- T is tax rate.

Substitute $4,200,000 for EBIT, 0 for I and 0.40 for T.

The net income of state 1 is $2,520,000.

Compute the return on equity of state 1.

The net income is $2,520,000. (Calculated above)

The equity is $14,000,000. (Given)

Formula to calculate the return on equity,

Substitute $2,520,000 for net income and $14,000,000 for equity.

The return on equity of state 1 is 18%.

State-2

Compute the net income.

Given,

The probability is 0.5.

The EBIT is $2,800,000.

Formula to calculate the net income,

Where,

- EBIT is earning before interest and tax.

- I is interest.

- T is tax rate.

Substitute $2,800,000 for EBIT, 0 for I and 0.40 for T.

The net income of state 2 is $1,680,000.

Compute the return on equity of state 2.

The net income is $1,680,000. (Calculated above)

The equity is $14,000,000. (Given)

Formula to calculate the return on equity,

Substitute $1,680,000 for net income and $14,000,000 for equity.

The return on equity on state 2 is 12%.

State-3

Compute the net income.

Given,

The probability is 0.3.

The EBIT is $700,000.

Formula to calculate the net income,

Where,

- EBIT is earning before interest and tax.

- I is interest.

- T is tax rate.

Substitute $700,000 for EBIT, 0 for I and 0.40 for T.

The net income of state 3 is $420,000.

Compute the return on equity of state 3.

The net income is $420,000. (Calculated above)

The equity is $14,000,000. (Given)

Formula to calculate the return on equity,

Substitute $420,000 for net income and $14,000,000 for equity.

The return on equity on state 3 is 3%.

Compute the expected return on equity of 3 states.

The return on equity of state 1 is18%. (Calculated in equation (1))

The return on equity of state 2 is 12%. (Calculated in equation (2))

The return on equity of state 3 is 3%. (Calculated in equation (3))

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 18%, 12% and 3% for return on earnings.

The expected return on earnings is 10.50%.

Compute the standard deviation.

| State | Probability |

Return on Equity (ROE) |

Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 18% | 10.50% | 11.25% |

| 2 | 0.5 | 12% | 10.50% | 1.125% |

| 3 | 0.3 | 3% | 10.50% | 16.88% |

| Variance | 29.25% |

Table (1)

The variance is 29.25%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 29.25% for variance.

The standard deviation is 5.408%.

Compute the coefficient of deviation.

The standard deviation is 5.408%.

The expected return on equity is 10.50%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 5.408% for standard deviation and 10.25% for EROE.

The coefficient of variance is 0.515.

The capital ratio at 10% and interest rateis 9%.

Compute the expected return on equity

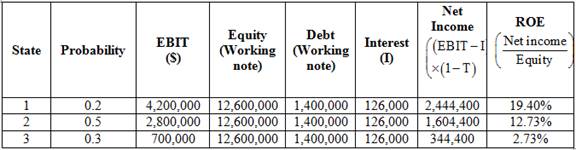

Statement to show the computation of return on equity of each state

Table (2)

Compute expected return on equity of 3 states.

The return on equity of state 1 is 19.40%. (Calculated above)

The return on equity of state 2 is 12.73%. (Calculated above)

The return on equity of state 3 is 2.73%. (Calculated above)

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 19.40%, 12.73% and 2.73% for return on earnings.

The expected return on earnings is 11.07%.

Compute the standard deviation

| State | Probability |

Return on Equity (ROE) |

Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 19.40% | 11.07% | 13.88% |

| 2 | 0.5 | 12.73% | 11.07% | 1.378% |

| 3 | 0.3 | 2.73% | 11.07% | 20.87% |

| Variance | 36.128% |

Table 3

The variance is 36.128%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 36.128% for variance.

The standard deviation is 6.01%.

Compute the coefficient of deviation.

The standard deviation is 6.01%.

The expected return on equity is 11.07%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 6.01% for standard deviation and 11.07% for EROE.

The coefficient of variance is 0.543.

The capital ratio at 50% and none interest rate is 11%.

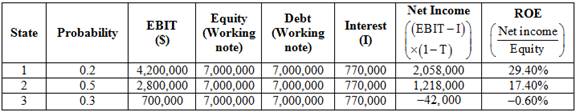

Compute the expected return on equity

Statement to show the computation of return on equity of each state

Table (4)

Compute expected return on equity of 3 states.

The return on equity of state 1 is 29.40%. (Calculated above)

The return on equity of state 2 is 17.40%. (Calculated above)

The return on equity of state 3 is

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 29.40%, 17.40% and

The expected return on earnings is 14.40%.

Compute the standard deviation.

| State | Probability | Return on Equity (ROE) | Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 29.40% | 14.40% | 45% |

| 2 | 0.5 | 17.40% | 14.40% | 4.5% |

| 3 | 0.3 |

| 14.40% | 67.5% |

| Variance | 117% |

Table (5)

The variance is 117%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 117% for variance.

The standard deviation is 10.82%.

Compute the coefficient of deviation.

The standard deviation is 10.82%.

The expected return on equity is 14.40%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 10.82% for standard deviation and 14.40% for EROE.

The coefficient of variance is 0.751.

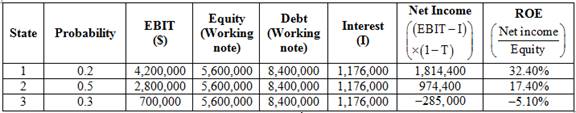

The capital ratio at 60% and none interest rate is 14%.

Compute the expected return on equity.

Statement to show the computation of return on equity of each state,

Table (6)

Computation of expected return on equity of 3 states

The return on equity of state 1 is 32.40%. (Calculated above)

The return on equity of state 2 is 17.40%. (Calculated above)

The return on equity of state 3 is

The probability of state 1 is 0.2. (Given)

The probability of state 2 is 0.5. (Given)

The probability of state 3 is 0.3. (Given)

Formula to calculate the expected return on earnings,

Substitute 0.2, 0.5 and 0.3 for probability and 32.40%, 17.40% and

The expected return on earnings is 13.65%.

Compute the standard deviation.

| State | Probability | Return on Equity (ROE) | Expected Return on Equity (EROE) |

Deviation

|

| 1 | 0.2 | 32.40% | 13.65% | 70.31% |

| 2 | 0.5 | 17.40% | 13.65% | 7.031% |

| 3 | 0.3 |

| 13.65% | 105.47% |

| Variance | 182.8% |

Table (7)

The variance is 182.8%. (Calculated above)

Formula to calculate the standard deviation,

Substitute 182.8% for variance.

The standard deviation is 13.521%.

Compute the coefficient of deviation.

The standard deviation is 13.521%.

The expected return on equity is 13.65%.

Formula to calculate the coefficient of variance,

Where,

- EORE is expected return on equity.

Substitute 13.521% for standard deviation and 13.65% for EROE.

The coefficient of variance is 0.99.

Working note:

Compute the value of debt and equity at capital ratio of 10% and interest rate of 9%.

Given,

Thetotal capital structure is 14 million.

The capital structure is 10.

Compute the debt value,

The debt is $1,400,000.

Compute the equity

The total capital is $14,000,000. (Given)

The debt is $1,400,000. (Calculated)

Compute the equity value,

The equity is $12,600,000.

Compute the interest on debt.

The interest rate is 9% or 0.09. (Given)

The debt is $1,400,000. (Calculated)

Compute the interest on debt,

The interest on debt is $126,000.

Compute the value of debt and equity at capital ratio of 50% and interest rate of 11%.

Given,

The total capital structure is 14 million.

The capital structure is 50.

Compute the debt value,

The debt is $7,000,000.

Compute the equity.

The total capital is $14,000,000. (Given)

The debt is $7,000,000. (Calculated)

Compute the equity value,

The equity is $7,000,000.

Compute the interest on debt.

The interest rate is 11% or 0.11. (Given)

The debt is $7,000,000. (Calculated)

Compute the interest on debt,

The interest on debt is $770,000.

Compute the value of debt and equity at capital ratio of 60% and interest rate of 14%.

Given,

The total capital structure is 14 million.

The capital structure is 60.

Compute the debt value,

The debt is $8,400,000.

Compute the equity.

The total capital is $14,000,000. (Given)

The debt is $8,400,000. (Calculated)

Compute the equity value,

The equity is $5,600,000.

Compute the interest on debt.

The interest rate is 11% or 0.11. (Given)

The debt is $8,400,000. (Calculated)

Compute the interest on debt,

The interest on debt is $1,176,000.

Hence, the ROE, standard deviation, and coefficient of varianceat 0% capital ratio are 10.50%, 5.408% and 0.515.

The ROE, standard deviation, and coefficient of variance at 10% capital ratio and 9% interest are 11.07%, 6.01% and 0.543.

The ROE, standard deviation, and coefficient of variance at 50% capital ratio and 11% interest are 14.40%, 10.82% and 0.751.

The ROE, standard deviation, and coefficient of variance at 60% capital ratio and 14% interest are 13.65%, 13.52% and 0.099.

Want to see more full solutions like this?

Chapter 14 Solutions

Llf Fundamentals Of Financial

- Ends Apr 27 Explain why we start with Sales forecasts when we do our financial forecasting. What are the limitations of the Percent of Sales Forecasting method?arrow_forwardDescribe in detail what exactly is the Cash Conversion Cycle, how is it computed and what is the purpose of this calculation (how is it used).arrow_forwardExplain what Interest Rate Parity is, how it is calculated, and why it is important to a company operating internationally.arrow_forward

- Compare and contrast the three core means of adding shareholder wealth; Cash Dividends, Stock Dividends and Stock Splits, and Stock Repurchases. Include the various advantages and disadvantages of each one.arrow_forwardHow to calculate the future value?arrow_forwardhow to caculate the future value?arrow_forward

- what are some of the question can i asek my prinsiple of finance teache?arrow_forwardA critical discussion of the hockey stick model of start-up financing should be presented, supported by recent in-text citations. Provide a detailed explanation of the model. Describe each of the three stages of the hockey stick model of start-up financing, including a detailed characterisation of each stage. The characterisation of each stage should detail the growth, risk, and funding expectations. Present a critical evaluation and an insightful conclu sion.arrow_forwardQuestion Workspace Check My Work New-Project Analysis The president of your company, MorChuck Enterprises, has asked you to evaluate the proposed acquisition of a new chromatograph for the firm's R&D department. The equipment's basic price is $64,000, and it would cost another $18,000 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $28,400. The MACRS rates for the first three years are 0.3333, 0.4445 and 0.1481. (Ignore the half-year convention for the straight-line method.) Use of the equipment would require an increase in net working capital (spare parts inventory) of $3,000. The machine would have no effect on revenues, but it is expected to save the firm $24,760 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 25%. Cash outflows and negative NPV value, if any, should be indicated by a minus sign. Do not round intermediate…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning