1.

Calculate Company M’s incremental profit or loss from manufacturing the capes and hand bags in conjunction with the dresses.

1.

Explanation of Solution

Incremental Analysis: Incremental analysis refers to the analysis of differential revenue that could be gained or differential cost that could be incurred from the available alternative options of business.

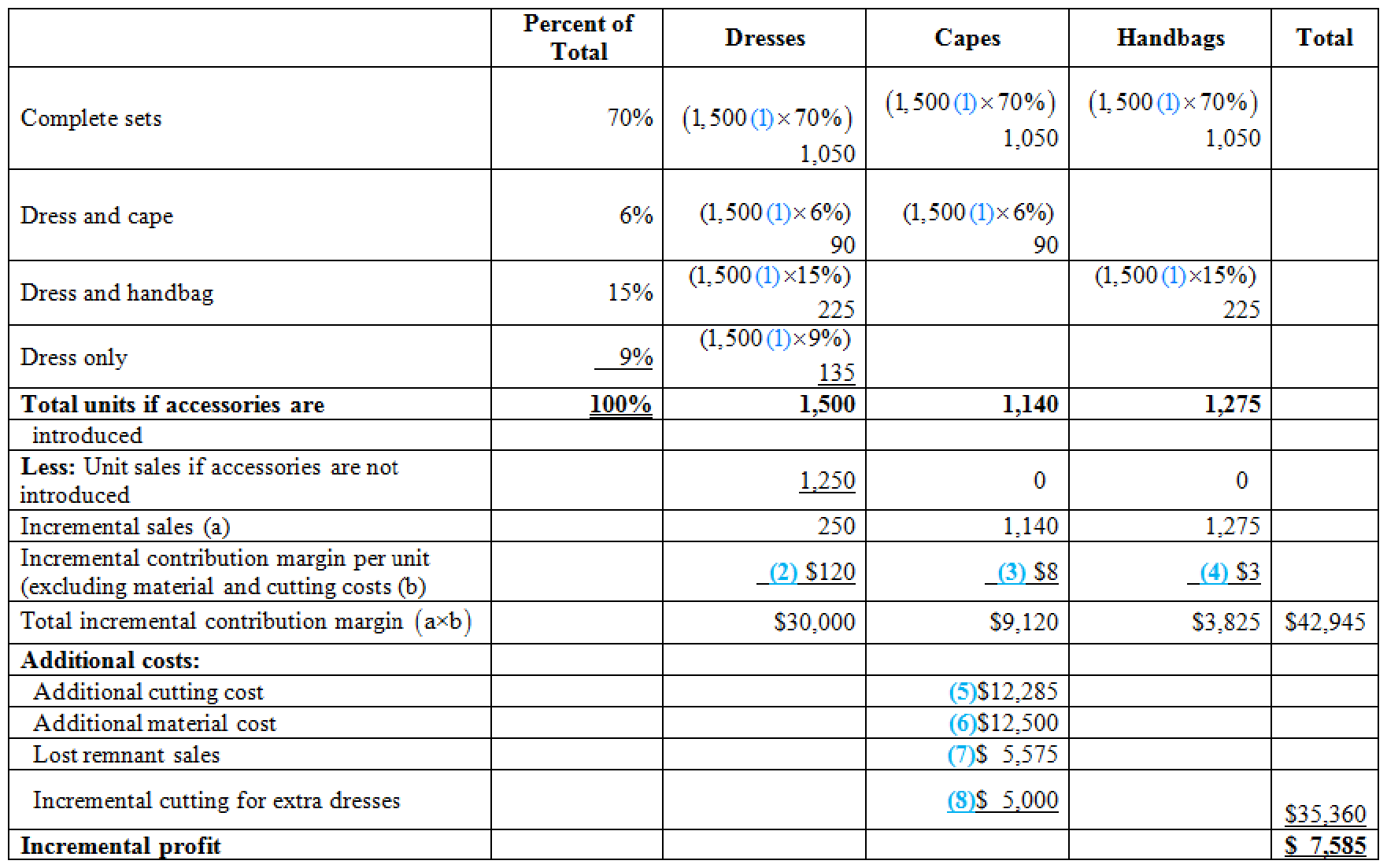

Compute incremental profit:

Figure (1)

Therefore, the incremental profit is $7,585.

Working notes:

(1)Calculate the increase in sale of dress:

(2)Calculate incremental contribution margin for dress:

(3)Calculate incremental contribution margin for capes:

(4) Calculate incremental contribution margin for handbag:

(5)Calculate additional cutting cost:

Note:

(6)Calculate additional material cost:

(7)Calculate lost remnant sales:

Note: 135dresses =

(8)Calculate incremental cutting cost for extra dresses:

2.

Identify the qualitative factors that affect the company’s management in its decision to manufacture caps and handbags to match dresses.

2.

Explanation of Solution

Qualitative factors that influence the management team of the company for the decision of manufacture matching capes and handbags include the following:

- Accurateness of

forecasted increase in dress sales. - Rivalry from other manufacturers of women’s apparel.

- Accurateness of forecasted product mix.

- Image of a company manufacturing dress in competition with a more extensive supplier of women’s apparel.

- To check if there is enough capacity (facilities, labor, storage, etc.).

Want to see more full solutions like this?

Chapter 14 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- cost accountingarrow_forwardSummit Holdings has $280,000 in accounts receivable that will be collected within 70 days. The company needs cash urgently and decides to factor them, receiving $260,000. Skyline Factoring Company, which took the receivables, collected $275,000 after 85 days. Find the rate of return on this investment for Skyline.arrow_forwardwhat are the variable expenses per unit?arrow_forward

- general accountingarrow_forwardBright Electronics has a Computer Division with the following financial details: • Sales: $250,000 • Cost of Goods Sold: $120,000 Operating Expenses: $50,000 Average Invested Assets: $1,200,000 ⚫ Hurdle Rate: 12%arrow_forwardA business has a dividend payout ratio of 0.6, an expected growth rate of 4% per year, and investors require a 9% return on their investment. What should be the price-earnings ratio? a. 10x b. 12x c. 15x d. 6xarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning