Measures of liquidity, solvency, and profitability

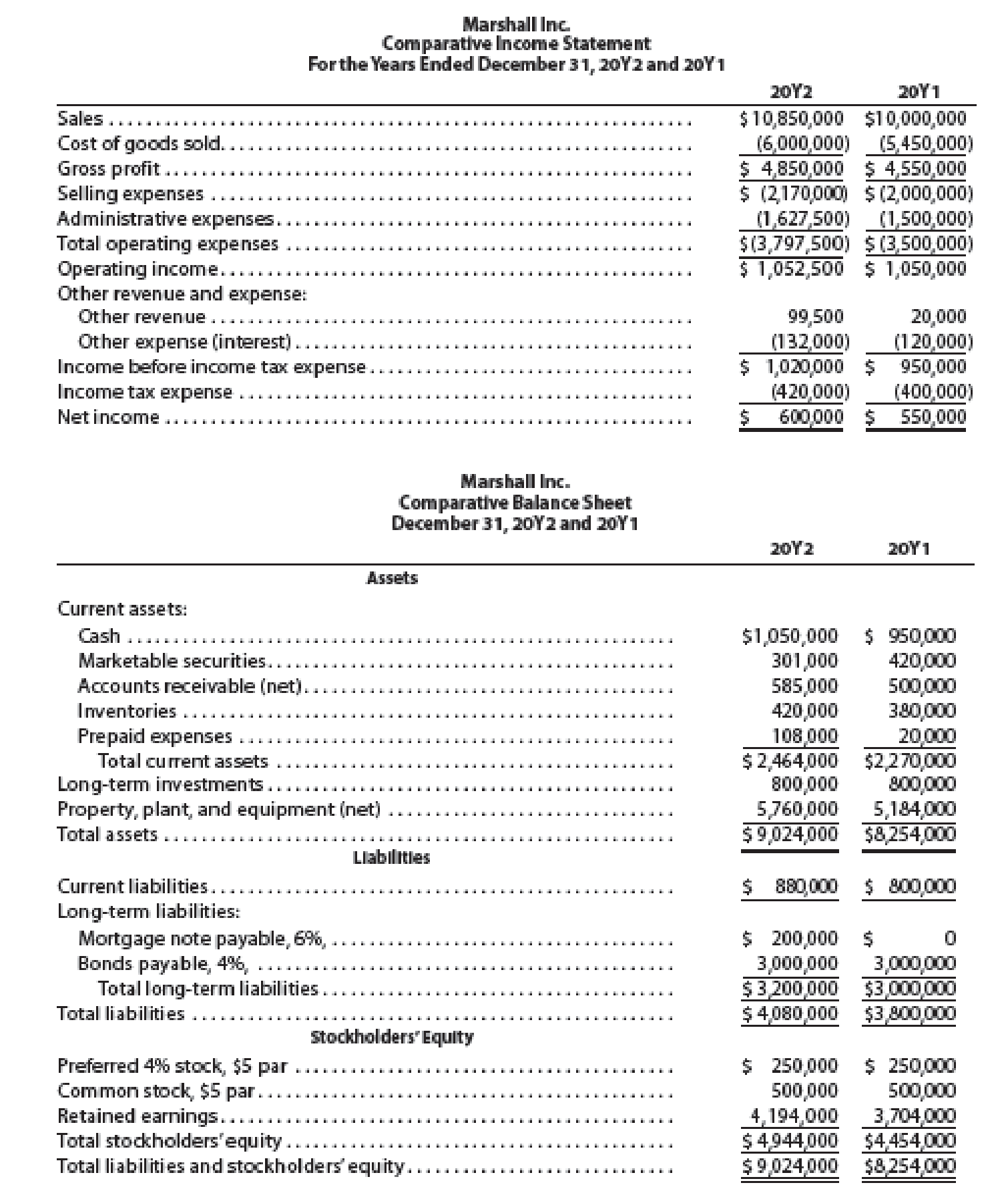

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2.

Instructions

Determine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts):

- 1.

Working capital - 2.

Current ratio - 3. Quick ratio

- 4.

Accounts receivable turnover - 5. Number of days’ sales in receivables

- 6. Inventory turnover

- 7. Number of days’ sales in inventory

- 8. Ratio of fixed assets to long-term liabilities

- 9. Ratio of liabilities to stockholders’ equity

- 10. Times interest earned

- 11. Asset turnover

- 12. Return on total assets

- 13. Return on stockholders’ equity

- 14. Return on common stockholders’ equity

- 15. Earnings per share on common stock

- 16. Price-earnings ratio

- 17. Dividends per share of common stock

- 18. Dividend yield

1 (1)

Determine the working capital.

Explanation of Solution

Financial Ratios: Financial ratios are the metrics used to evaluate the capabilities, profitability, and overall performance of a company.

.Working capital

Working capital = Current assets – Current liabilities = $2,464,000 – $880,000= $1,584,000

Working capital is determined as the difference between current assets and current liabilities.

Formula:

Working capital = Current assets – Current liabilities

1(2)

Determine the current ratio of M Incorporation.

Explanation of Solution

Current ratio

Current ratio=Current assetsCurrent liabilities=$2,464,000$880,000=2.8

Current ratio is used to determine the relationship between current assets and current liabilities. The ideal current ratio is 2:1. Current assets include cash and cash equivalents, short-term investments, net, accounts and notes receivables, net, inventories, and prepaid expenses and other current assets. Current liabilities include short-term obligations and accounts payable.

Formula:

Current ratio=Current assetsCurrent liabilities

1 (3)

Determine the quick ratio of M Incorporation.

Explanation of Solution

.Quick ratio

Quick ratio =Quick assets Current liabilities=$1,936,000$880,000=2.2

Acid-Test Ratio is the ratio denotes that this ratio is a more rigorous test of solvency than the current ratio. It is determined by dividing quick assets and current liabilities. The acceptable acid-test ratio is 0.90 to 1.00. It is referred as quick ratio. Use the following formula to determine the acid-test ratio:

Acid Ratio=Quick assetsCurrent liabilities

1 (4)

Determine accounts receivable turnover for M Incorporation.

Explanation of Solution

Accounts receivable turnover

Accounts receivables turnover ratio}=Net credit salesAverage accounts receivables=$10,850,000$542,500=20.0

Accounts receivables turnover ratio is mainly used to evaluate the collection process efficiency. It helps the company to know the number of times the accounts receivable is collected in a particular time period. Main purpose of accounts receivable turnover ratio is to manage the working capital of the company. This ratio is determined by dividing credit sales and sales return.

Formula:

Accounts receivables turnover ratio}=Net credit salesAverage accounts receivables

Average accounts receivable is determined as follows:

Average accounts receivables }= (Opening accounts receivables + Closing accounts receivables )2=$585,000+$500,0002=$542,500

1(5)

Determine number of days’ sales in receivables of M Incorporation.

Explanation of Solution

Number of days’ sales in receivables

Number of days’ sales in receivable }=Average accounts receivable Average daily sales=$542,50029,726.02=18.3 days

Number of days’ sales in receivables is used to determine the number of days a particular company takes to collect accounts receivables.

Formula:

Number of days’ sales in receivable =Average accounts receivable Average daily sales

Average daily sales are determined by dividing sales by 365 days.

Average daily sales = Sales365 days=$10,850,000365 days=$29,726.02

1 (6)

Determine inventory turnover ratio for M Incorporation.

Explanation of Solution

Inventory turnover ratio =Cost of goods soldAverage inventory=$6,000,000$400,000=15.0 times

Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period.

Formula:

Inventory turnover=Cost of goods soldAverage inventory

Average inventory is determined as below:

Average inventory = (Opening inventory + Closing inventory )2=$420,000+$380,0002=$400,000

1(7)

Determine number of days’ sales in inventory ratio of M Incorporation.

Explanation of Solution

Number of days sales in inventory ratio

Number of days’ sales in inventory }=Average inventory Average daily cost of goods sold=$400,000$16,438.35=24.3 days

Number of days’ sales in inventory is determined as the number of days a particular company takes to make sales of the inventory available with them.

Formula:

Number of days’ sales in invenotry=Average inventory Average daily cost of goods sold

Average daily cost of goods sold are determined by dividing cost of goods sold by 365 days. Thus, average daily cost of goods sold are determined as follows:

Average daily cost of goods sold= Cost of goods sold365 days=$6,000,000365 days=$16,438.35

1 (8)

Determine ratio of fixed assets to long-term liabilities.

Explanation of Solution

Ratio of fixed assets to long-term liabilities=Fixed assets Long-term liabilities =$5,760,000$3,200,000=1.8

Ratio of fixed assets to long-term liabilities is determined by dividing fixed assets and long-term liabilities.

Formula:

Ratio of fixed assets to long-term liabilities=Fixed assets Long-term liabilities

1 (9)

Determine ratio of liabilities to stockholders’ equity.

Explanation of Solution

Ratio of liabilities to stockholders’ equity

Ratio of liabilities to stockholders' equity }=Total liabilitiesStockholders' equity=$4,080,000$4,944,000=0.8

Ratio of liabilities to stockholders’ equity is determined by dividing liabilities and stockholders’ equity.

Formula:

Ratio of liabilities to stockholders' equity=Total liabilitiesStockholders' equity

1 (10)

Determine times interest earned ratio.

Explanation of Solution

Times interest earned ratio

Times-interest-earned ratio }=Income before income tax+Interest expenseInterest expense=$1,020,000+$132,000$132,000=8.5%

Times interest earned ratio quantifies the number of times the earnings before interest and taxes can pay the interest expense. First, determine the sum of income before income tax and interest expense. Then, divide the sum by interest expense.

Formula:

Times-interest-earned ratio }=Income before income tax+Interest expenseInterest expense

1 (11)

Determine asset turnover ratio.

Explanation of Solution

Asset turnover ratio

Asset turnover ratio =SalesAverage total assets=$10,850,000$8,639,000=1.3

Asset turnover ratio is used to determine the asset’s efficiency towards sales.

Formula: Asset turnover =Net revenueAverage total assets

Working notes for average total assets are as follows:

Average total assets =Beginning total assets + Ending total assets 2=$9,024,000+$8,254,0002=$8,639,000

1 (12)

Determine return on total assets.

Explanation of Solution

Return on total assets

Return on total assets=Net income + Interest expenseAverage total assets=$600,000+$132,000$8,639,000=8.5%

Return on assets determines the particular company’s overall earning power. It is determined by dividing sum of net income and interest expense and average total assets.

Formula:

Rate of return on assets=Net income + Interest expenseAverage total assets

1 (13)

Determine return on stockholders’ equity.

Explanation of Solution

Return on stockholders’ equity

Return on stockholders' equity}= Net income Average stockholder’s equity= $600,000$4,699,000=12.8%

Rate of return on stockholders’ equity is used to determine the relationship between the net income and the average equity that are invested in the company.

Formula: Rate of return on stockholders' equtiy = Net incomeAverage stockholder’s equity

Average stockholders’ equity is determined as follows:

Average stockholders' equity =(Beginning stockholders' equity + Ending stockholders' equity 2)=$4,944,000+$4,454,0002=$4,699,000

1 (14)

Determine return on common stockholders’ equity.

Explanation of Solution

Return on common stockholders’ equity

Return on common stockholders' equity}= Net income – Preferred dividends Average stockholder’s equity= $600,000–$10,000$4,699,000=13.3%

Rate of return on stockholders’ equity is used to determine the relationship between the net income and the average common equity that are invested in the company.

Formula:

Rate of return on common stockholders' equtiy = Net income – Preferred dividends Average common stockholder’s equity

Average common stockholders’ equity is determined as follows:

Average stockholders' equity =(Beginning common stockholders' equity + Ending common stockholders' equity 2)=$4,694,000+$4,204,0002=$4,449,000

1(15)

Determine earnings per share on common stock.

Explanation of Solution

Earnings per share on common stock

Earnings per share=(Net income – PreferreddividendsWeighted-average common shares outstanding)=$600,000−$10,000100,000=$5.90

A portion of profit that an individual earns from each share is referred to earnings per share.

Formula:

Earnings per share}=Net income −Preferred dividendsWeighted average number of common shares outstanding

1 (16)

Determine price earnings ratio.

Explanation of Solution

Price earnings ratio

Price earnings ratio =Market price per shareEarning per share=$82.60$5.90=14.0 times

Price/earnings ratio is used to determine the profitability of a company. This ratio is abbreviated as P/E.

Formula:

Price/earnings ratio= Market price per share of common stockEarnings per share

17.

Determine dividend per share of common stock.

Explanation of Solution

Dividend per share of common stock

Dividend per share of common stock}= Dividend per Common stockShares of common stock × 100=$100,000100,000 shares=$1.00

Dividend per share of commons stock is determined by dividing dividend per common stock and shares of common stock.

Formula:

Dividend per share of common stock}= Dividend per Common stockShares of common stock × 100

18.

Determine dividend yield ratio.

Explanation of Solution

Dividend yield ratio

Dividend yield = Annual dividend per ShareMarket price per Share × 100=$1.00$82.60=1.2%

Dividend yield ratio is determined to evaluate the relationship between the annual dividend per share and the market price per share.

Formula:

Dividend yield = Annual dividend per ShareMarket price per Share × 100

Thus, summary table of determined ratios are below:

| S.No | Particulars | Ratios |

| 1. | Working capital | $1,584,000 |

| 2. | Current ratio | 2.8 |

| 3. | Acid test ratio | 2.2 |

| 4. | Accounts receivable turnover ratio | 20.0 |

| 5. | Number of days’ sales in receivables | 18.3 |

| 6. | Inventory turnover ratio | 15.0 |

| 7. | Number of days sales in inventory | 24.3 |

| 8. | Ratio of fixed assets to long-term liabilities | 1.8 |

| 9. | Ratio of liabilities to stockholders’ equity | 0.8 |

| 10. | Times interest earned ratio | 8.7 |

| 11. | Asset turnover ratio | 1.3 |

| 12. | Return on total assets | 8.5% |

| 13. | Return on stockholders’ equity | 12.8% |

| 14. | Return on common stockholders’ equity | 13.3% |

| 15. | Earnings per share | $5.90 |

| 16. | Price earnings ratio | 14.0 |

| 17. | Dividend per share of common stock | $1.00 |

| 18. | Dividend yield | 1.2% |

Want to see more full solutions like this?

Chapter 14 Solutions

Financial And Managerial Accounting

- Ans plzarrow_forwardToodles Inc. had sales of $1,840,000. Cost of goods sold,administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2,173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capitalarrow_forward

- Answer the questions in the attached imagearrow_forwardAuditor should assess the likelihood of --------- when identifying potential criteria for the audit. material misstatement wrong answerarrow_forwardWhen information comes to the auditors' attention indicating that ----- may have occured, auditors should evaluate whether the possible effect is significant within the context of the audit objectives.arrow_forward

- Need help with this question solution general accountingarrow_forwardSelect the correct answerarrow_forwardWhat is a good response to this post? Hello everyone,The theory of facework is a beneficial instrument for preserving self-image and fostering mutual respect during exchanges. According to Nguyen-Phuong-Mai, Terlouw, and Pilot (2014), facework is the strategic approach individuals employ to validate their own identity while simultaneously considering the requirements of others. The necessity of these strategies has been evident to me during my nine years as a rideshare driver. I endeavor to understand the context and intentions of each passenger by dedicating sufficient time to attentive listening before disclosing undue personal information. This empathetic and respectful approach safeguards my identity and fosters trust, reducing the probability of rambling and mitigating the potential harm of receiving a poor rating.My experience in the restaurant industry, particularly at venues such as Tavern on the Green in New York City, has emphasized the significance of effective facework.…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT