Concept explainers

Part I a.

Identify the number of years that are covered in each of the primary comparative financial statements. State whether all of the statements were audited and state the name of the auditors. State the auditors’ conclusions concerning these statements.

Part I a.

Explanation of Solution

- The years covered in the primary comparative financial statements of Incorporation HD consist of the following:

- Comparative

balance sheets are presented for two years: 2015 (Year ending January 31, 2016) and 2014 (Year ending February 1, 2015). - Three years of comparative statements of earnings are presented for the years: 2015 (Year ending January 31, 2016) and 2014 (Year ending February 1, 2015), and 2013 (Year ending February 2, 2014).

- Three years of statements of

cash flows are presented for the years: 2015 (Year ending January 31, 2016) and 2014 (Year ending February 1, 2015), and 2013 (Year ending February 2, 2014). - All the financial statements of Incorporation HD are audited by the independent auditors – LLP KPMG.

- The auditors issued an unqualified audit report, concluding that the financial statements are prepared in accordance with generally accepted accounting principles and the financial position, results of operation and cash flows for each year are presented fairly.

Part I b.

Identify the part in which details about changes in the amount of

Part I b.

Explanation of Solution

Statement of changes in

Incorporation HD reports the Consolidated Statement of Stockholders' Equity that includes the statement of retained earnings. The 4th column of numbers of left shows the changes in retained earnings for the three year period.

The descriptive captions to the left, combined with the numbers in the retained earnings column, make up the information that would otherwise have constituted a separate statement of retained earnings.

Part I c.

Identify whether the company’s annual net cash flows have been positive or negative from (1) operating activities, (2) investing activities, and (3) financing activities over the three years and identify whether the company’s cash balance increased or decreased during each of these three years

Part I c.

Explanation of Solution

Statement of cash flows: Statement of cash flows reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Cash flows from operating activities: These refer to the cash received or cash paid in day-to-day operating activities of a company.

Cash flows from financing activities: This section of cash flows statement provides information about the

Cash flows from investing activities: This section of cash flows statement provides information concerning about the purchase and sale of capital assets by the company.

The statement of cash flows of Incorporation HD over the three years reveals the following:

| Particulars | Amount |

| The cash flow from operating activities have been positive for all three years: $9,373 million, $8,242 million, and $7,628 million in 2015, 2014, and 2013, respectively. |

| The cash flows from investing activities were negative all three years ($2,982 million) in 2015, ($1,271 million) in 2014, and ($1,507 million) in 2013 respectively. |

| The cash flows from financing activities were negative for each of the three years ($5,787 million) in 2015, ($7,071 million) in 2014, and ($6,652 million in 2013) |

Table (1)

The cash balance of Incorporation HD increased $604 million in 2015 and decreased $100 million and $531 million in 2014 and 2013, respectively.

Part II a.

Compute the following for the fiscal years ending January 31, 2016, and February 1, 2015

1.

2. Quick ratio.

3. Amount of

4 Percentage change in working capital from the prior year.

5. Percentage change in cash and cash equivalents from the prior year.

Part II a.

Explanation of Solution

Current ratio: Current ratio is one of the liquidity ratios, which measures the capacity of the company to meet its short-term obligations using its current assets. Current ratio is calculated by using the formula:

Quick ratio: The financial ratio which evaluates the ability of a company to pay off the instant debt obligations is referred to as quick ratio. Quick assets are cash, marketable securities, and accounts receivables. This ratio assesses the short-term liquidity of a company. Quick ratio is calculated by using the formula:

Working capital: The measure which evaluates the ability of a company to pay off the short-term debt obligations, by computing the excess of current assets over current liabilities is referred to as working capital. Working capital is calculated by using the formula:

Percentage change: In percentage change the amount of each item of the current period’s financial statement is compared with the previous period’s financial statement. The amount of each item increased or decreased in the current financial statement, and its respective percentage can be computed by taking the previous period statement as the base. Percentage change is calculated by using the formula:

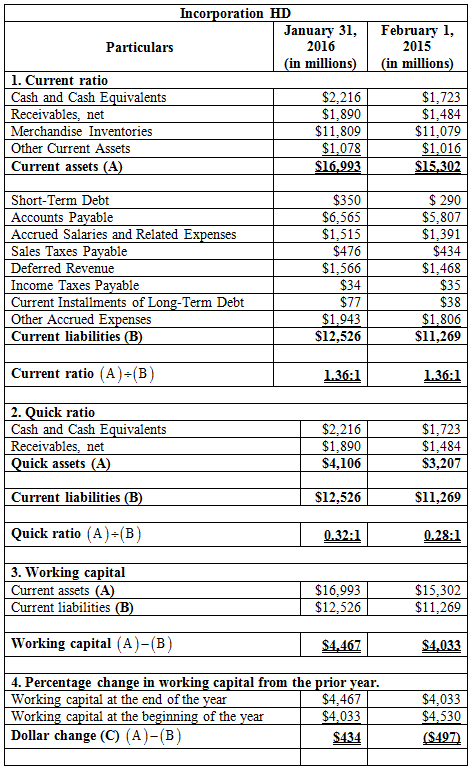

The ratios of Incorporation HD are computed as follows:

Table (2)

Part II b.

Explain whether the company’s liquidity have increased or decreased during the most recent fiscal year on the basis of your analysis in part a.

Part II b.

Explanation of Solution

From table (1), the schedule of changes in the company’s liquidity is as follows:

| Ratios | January 31, 2016 | February 01, 2015 | Changes |

| Current ratio | 1.36 | 1.36 | No changes |

| Quick ratio | 0.32 | 0.28 | Increased |

| Working capital | $434 | ($497) | Increased |

| Percentage change in working capital | 10.76% | (11%) | Increased |

| Percentage change in cash | 28.61% | (10.67%) | Increased |

Table (3)

Overall, the liquidity position of Incorporation HD has improved during the year.

Part II c.

Identify other major considerations that should be analyzed before taking decisions, apart from the ability of Incorporation HD to pay for its purchases.

Part II c.

Explanation of Solution

The Consolidated Statements of Stockholders' Equity of Incorporation HD reveals that the company has an aggressive policy of purchasing the treasury stock. Cash of $7,000 million, $7,000 million, and $8,500 million were used in 2015, 2014, and 2013 respectively for the purpose of purchasing the treasury stock. Over the years the company has consistently paid dividends of $3,031 million in 2015, $2,530 million in 2014, and $2,243 million in 2013 to the stockholders. The payment of dividend and the purchase of treasury stock have significantly affected the company's liquidity.

Part II d.

Write a memorandum explaining the reasons for assigning the possible credit rating to Incorporation HD

Part II d.

Explanation of Solution

Memo

From

XYZ

To

XY,

Chief Financial Officer,

Incorporation HD

December 5, 2018

Sub: Analysis of the liquidity measure.

As per Table (1), the current ratio and quick ratio of Incorporation HD are below the thumb of rules, but the company appears to be in a strong financial situation. So, Incorporation HD is assigned “A outstanding” credit rating. The capital expenditures, payment of dividend and the repurchase of common stock have caused the liquidity measures to be low.

I surely believe that the analyses are sufficient for explanation. Please revert back for any further clarifications.

Regards,

XYZ

Part III a.

Compute the following for the fiscal years ending January 31, 2016, and February 1, 2015

1. Percentage change in net sales (relative to the prior year).

2. Percentage change in net earnings.

3. Gross profit rate.

4. Net income as a percentage of sales.

5. Return on average total assets.

6. Return on average total equity.

Part III a.

Explanation of Solution

Percentage change: In percentage change the amount of each item of the current period’s financial statement is compared with the previous period’s financial statement. The amount of each item increased or decreased in the current financial statement, and its respective percentage can be computed by taking the previous period statement as the base. Percentage change is calculated by using the formula:

Gross Profit rate: The financial ratio which estimates the portion of gross profit retained from net sales revenue in terms of percentage is known as gross margin or gross profit margin. Gross profit is the difference between net sales revenue and cost of goods sold.

Formula to calculate the gross profit rate:

Net income as a percentage of net sales: The percentage of net profit generated by every dollar of net sales is referred to as net income as a percentage of net sales. This ratio is also known as net profit margin or net margin. The formula to calculate the net income as a percentage of net sales is as follows:

Return on average total assets: This financial ratio evaluates the efficiency of management in utilizing the assets to generate operating income. This tool is used to measure the profitability of a company. The formula to calculate the return on equity is as follows

Return on average total equity: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on equity is as follows:

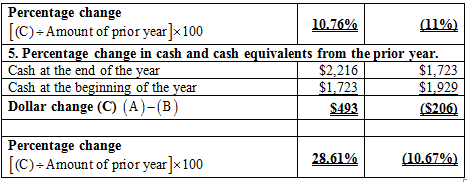

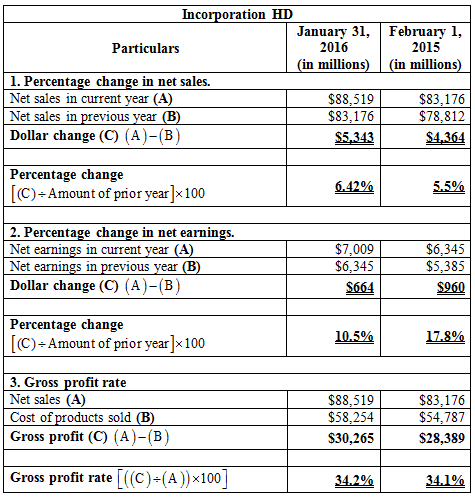

The ratios of Incorporation HD are computed as follows:

Table (4)

Part III b.

Explain the conclusion(s) concerning trends in the profitability of Incorporation HD during the period.

Part III b.

Explanation of Solution

From table (4), the schedule of changes in the company’s liquidity is as follows:

| Ratios | January 31, 2016 | February 01, 2015 | Changes |

| 1. Percentage change in net sales (relative to the prior year). | 6.42% | 5.5% | Increased |

| 2. Percentage change in net earnings. | 10.5% | 17.8% | Decreased |

| 3. Gross profit rate. | 34.2% | 34.1% | Increased |

| 4. Net income as a percentage of sales | 7.9% | 7.6% | Increased |

| 5. Return on average total assets. | 28.5% | 26.0% | Increased |

| 6. Return on average total equity. | 89.6% | 58.0% | Increased |

Table (5)

Overall, the profitability position of Incorporation HD has increased in 2016 as compared with the year 2015. The return on equity and net income as a percentage of net sales has increased significantly in 2016. The return on assets and the gross profit rate has slightly increased in 2016.

Want to see more full solutions like this?

Chapter 14 Solutions

Gen Combo Looseleaf Financial And Managerial Accounting; Connect Access Card

- On March 1, 20X1, your company,which uses Units-of-Production (UOP) Depreciation, purchases a machine for $300,000.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardI am searching for the right answer to this financial accounting question using proper techniques.arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardi will give unhelpful.blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education