Concept explainers

Issue of bond at premium:

When the coupon rate or contract rate of a bond is higher than the market interest rate, the bond is being issued at premium. If the bond is issued at premium, the selling price of the bond will be higher than the face value of the bond.

Under straight line amortization method, a specific amount of premium is amortized each period till its maturity period. The period ending amortization amount is computed by dividing the total premium by the number of periods in maturity of the bonds payable.

To determine:

1. Preparation of

2. Computation of (a) the cash payment, (b) the straight-line premium amortization, and (c) the bond interest expense

3. Determine to total bond interest expense to be recognized over the life of the bonds.

4. Prepare the first two years of an amortization table using straight-line method.

5. Prepare the journal entries to record the first two interest payments.

Answer to Problem 3APSA

Solution:

1.

| Date | Accounts | Debit | Credit |

| 2015 | |||

| Jan. 1 | Cash | $4,895,980 | |

| Bonds Payable | $4,000,000 | ||

| Premium on Bonds Payable | $895,980 |

2.

| Semiannual Period | Amount |

| Cash Payment | $120,000 |

| Straight-line discount amortization | $29,866 |

| Bond Interest Expense | $149,866 |

3.

The total bond interest expense to be recognized over the bond’s life is $2,704,020.

4.

| Period Ending | Unamortized Premium | Carrying Value |

| 01/1/2015 | $895,980 | $4,895,980 |

| 06/30/2015 | $866,114 | $4,866,114 |

| 12/31/2015 | $836,248 | $4,836,248 |

| 06/30/2016 | $806,382 | $4,806,382 |

| 12/31/2016 | $776,516 | $4,776,516 |

5.

| Date | General Journal | Debit | Credit |

| 2015 | |||

| Jun. 30 | Interest Expense | $90,134 | |

| Premium on Bonds Payable | $29,866 | ||

| Cash | $120,000 | ||

| Dec. 31 | Interest Expense | $90,134 | |

| Premium on Bonds Payable | $29,866 | ||

| Cash | $120,000 |

Explanation of Solution

Explanation:

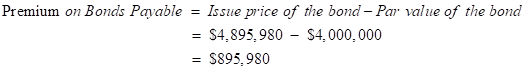

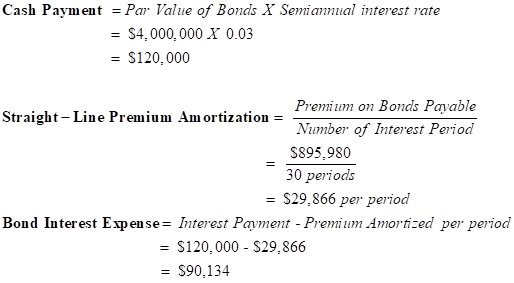

1. Computation of discount on bonds payable

2. Computation of cash payment, straight-line discount amortization, and the bond interest expense

3.

| Computation of total interest expense | |

| Amount to be repaid at maturity: | |

| Total Interest Payment | $3,600,000 |

| Par | $4,000,000 |

| Total amount to be repaid | $7,600,000 |

| Less : Selling Price of the Bonds | $4,895,980 |

| Total Bond Interest Expense | $2,704,020 |

4. The premium amortization amount of $29,866 deducted from both the unamortized premium column and carrying value of the bonds payable for every semiannual period.

5. Under straight line premium amortization, the same amount of interest expense, discount amortized and interest payment is recorded till the maturity of the bonds.

Conclusion:

The discount amortization for every semiannual period is $29,866 and carrying value of the bonds payable for the year ended December 31, 2016 is $4,776,516.

Want to see more full solutions like this?

Chapter 14 Solutions

Connect 2-Semester Access Card for Fundamental Accounting Principles

- 18 Stranger Things Inc. (STI) had 80,000 ordinary shares outstanding on January 1, 2026. Transactions throughout 2026 affecting its shareholdings follow. • February 1: STI issued 200,000, $10, cumulative 10% preferred shares.• March 1: STI issued 40,000 ordinary shares.• April l: STI declared and issued an 8% stock dividend on the ordinary shares.• July 1: STI repurchased and cancelled 30,000 ordinary shares.• October 1: STI declared and issued a 3-for-l stock split on the ordinary shares.• December 31: STI declared $99,600 in dividends on the ordinary shares.• Net income for the year ended December 31, 2026, was $600,000. Its tax rate was 40%.Required1. What was weighted average number of ordinary shares outstanding in 2026?2. What was basic EPS in 2026?arrow_forward16 Which of the following best describes a "defined benefit plan"? Question 16 options: A pension plan that specifies how much funds the employee needs to contribute. A plan that requires the employer to contribute $10 per hour worked by an employee. A plan that specifies how much in pension payments employees will receive in their retirement. High returns in the pension plan result in higher benefit payments to the employees in the future.arrow_forwardPlease provide problem with accounting questionarrow_forward

- 3 Which statement is correct about financial leverage? Question 3 options: Leverage can increase an investor's returns but also increases the risk of loss. Leverage decreases the debt level relative to a company's equity base. Leverage can decrease an investor's returns and also decrease the risk of loss. Leverage decreases the payments that a company makes on an ongoing basis.arrow_forwardThe comparative balance sheets and an income statement for Raceway Corporation follow. Balance Sheets As of December 31 Year 2 Year 1 Assets Cash $ 6,300 $ 48,400 Accounts receivable 10,200 7,260 Inventory 45,200 56,000 Prepaid rent 700 2,140 Equipment 140,000 144,000 Accumulated depreciation (73,400) (118,000) Land 116,000 50,000 Total assets $ 245,000 $ 189,800 Liabilities Accounts payable (inventory) $ 37,200 $ 40,000 Salaries payable 12,200 10,600 Stockholders’ equity Common stock, $50 par value 150,000 120,000 Retained earnings 45,600 19,200 Total liabilities and stockholders’ equity $ 245,000 $ 189,800 Income Statement For the Year Ended December 31, Year 2 Sales $ 480,000 Cost of goods sold (264,000) Gross profit 216,000 Operating expenses Depreciation expense (11,400) Rent expense (7,000) Salaries expense (95,200) Other operating expenses (76,000) Net income $ 26,400 Other Information Purchased…arrow_forwardPlease help holy tamale I have been staring at this for hours.arrow_forward

- Could you explain the steps for solving this financial accounting question accurately?arrow_forwardI need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education