Compare Current Cost to Historical Cost

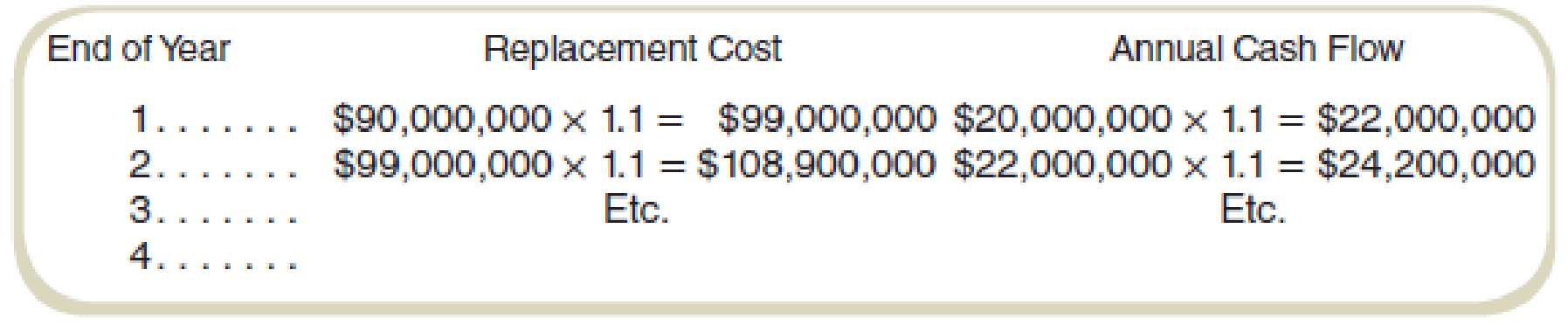

Refer to the information in Exercise 14-36. In computing

Note that “accumulated” depreciation is 10 percent of the gross book value of depreciable assets after one year, 20 percent after two years, and so forth.

Required

- a. Compute ROI using historical cost, net book value.

- b. Compute ROI using historical cost, gross book value.

- c. Compute ROI using current cost, net book value.

- d. Compute ROI using current cost, gross book value.

a.

Compute ROI by using historical cost, net book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 16.05%, 21.11%, 27.97%, and 37.56%.

Explanation of Solution

Net book value:

Net book value refers to the value of the asset after the adjustment of the depreciation. The value of the asset is calculated by deducting the cumulative depreciation from the book value of the asset.

Calculate the ROI using historical cost, net book value:

| Year |

Investment(3) (a) |

Operating profit (1) (b) |

ROI |

| 1 | $81,000,000 | $13,000,000 | 16.05% |

| 2 | $72,000,000 | $15,200,000 | 21.11% |

| 3 | $63,000,000 | $17,620,000 | 27.97% |

| 4 | $54,000,000 | $20,282,000 | 37.56% |

Table: (1)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 16.05%, 21.11%, 27.97%, and 37.56%.

Working note 1:

Calculate the operating profit over the life of the asset:

| Year |

Gross cash flow (a) |

Net cash flow |

Depreciation (1) (c) |

Operating profit |

| 1 | $20,000,000 | $22,000,000 | $9,000,000 | $13,000,000 |

| 2 | $22,000,000 | $24,200,000 | $9,000,000 | $15,200,000 |

| 3 | $24,200,000 | $26,620,000 | $9,000,000 | $17,620,000 |

| 4 | $26,620,000 | $29,282,000 | $9,000,000 | $20,282,000 |

Table: (2)

Working note 2:

Calculate the depreciation:

Working note 3:

Calculate the investment base over the life of the asset:

| Year |

Gross asset value (a) |

Annual depreciation (b) |

Depreciation |

Net asset value |

| 1 | $90,000,000 | 10% | $9,000,000 | $81,000,000 |

| 2 | $90,000,000 | 20% | $18,000,000 | $72,000,000 |

| 3 | $90,000,000 | 30% | $27,000,000 | $63,000,000 |

| 4 | $90,000,000 | 40% | $36,000,000 | $54,000,000 |

Table: (3)

The depreciation has been calculated on the historical cost in this method.

b.

Compute ROI using historical cost, gross book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 14.44%, 16.89%, 19.58%, and 22.54%.

Explanation of Solution

Gross book value:

Gross book value is the value of the asset without the adjustment of the depreciation. The asset is recorded on the book value or the cost value.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (a) |

Operating profit (1) (b) |

ROI |

| 1 | $90,000,000 | $13,000,000 | 14.44% |

| 2 | $90,000,000 | $15,200,000 | 16.89% |

| 3 | $90,000,000 | $17,620,000 | 19.58% |

| 4 | $90,000,000 | $20,282,000 | 22.54% |

Table: (4)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 14.44%, 16.89%, 19.58%, and 22.54%.

c.

Compute ROI by using current cost, net book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 13.58%, 15.28%, 17.46%, and 20.37%.

Explanation of Solution

Current cost:

Current cost is the current market value of the asset. The depreciation is calculated on the current value of the asset rather than the historical cost of the asset.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (7) (a) |

Operating profit (4) (b) |

ROI |

| 1 | $89,100,000 | $12,100,000 | 13.58% |

| 2 | $87,120,000 | $13,310,000 | 15.28% |

| 3 | $83,853,000 | $14,641,000 | 17.46% |

| 4 | $79,061,400 | $16,105,100 | 20.37% |

Table: (5)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 13.58%, 15.28%, 17.46%, and 20.37%.

Working note 4:

Calculate the operating profit over the life of the asset:

| Year |

Gross cash flow (a) |

Net cash flow |

Depreciation (5) (c) |

Operating profit |

| 1 | $20,000,000 | $22,000,000 | $9,900,000 | $12,100,000 |

| 2 | $22,000,000 | $24,200,000 | $10,890,000 | $13,310,000 |

| 3 | $24,200,000 | $26,620,000 | $11,979,000 | $14,641,000 |

| 4 | $26,620,000 | $29,282,000 | $13,176,900 | $16,105,100 |

Table: (2)

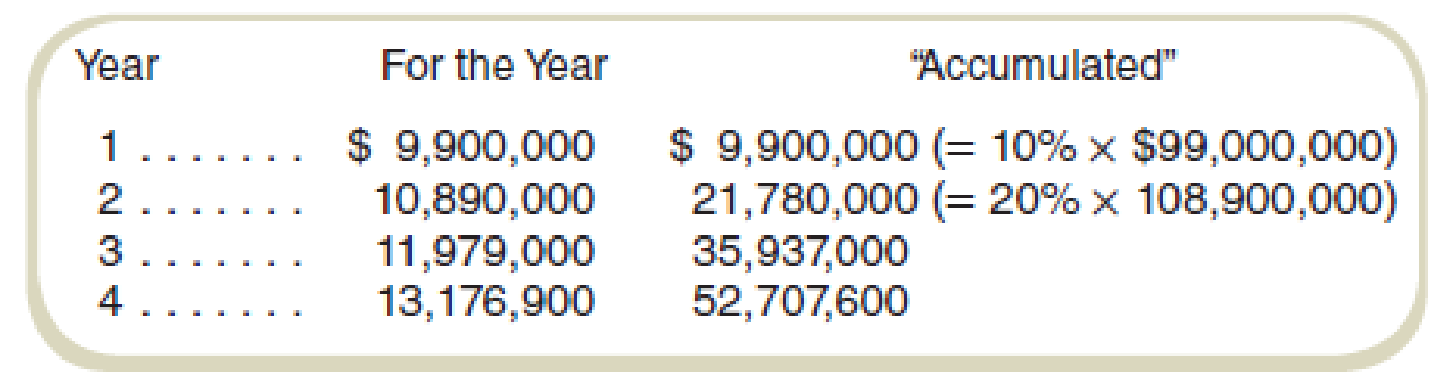

Working note 5:

Calculate the depreciation over the life of the asset:

| Year |

Asset value (a) |

Annual Increment (b) |

The gross value of the asset |

Yearly depreciation |

Total depreciation |

| 1 | $36,000,000 | 10% | $39,600,000 | $9,900,000 | $9,900,000 |

| 2 | $39,600,000 | 10% | $43,560,000 | $10,890,000 | $21,780,000 |

| 3 | $43,560,000 | 10% | $47,916,000 | $11,979,000 | $35,937,000 |

| 4 | $47,916,000 | 10% | $52,707,600 | $13,176,900 | $52,707,600 |

Table: (6)

The closing gross value of each year will be the opening asset value of the next year.

Working note 6:

Calculate the asset value for the first year:

Working note 7:

Calculate the investment base over the life of the asset:

| Year |

Gross asset value (a) |

Depreciation (5) (b) |

Net asset value |

| 1 | $9,900,000 | $9,900,000 | $89,100,000 |

| 2 | $10,890,000 | $21,780,000 | $87,120,000 |

| 3 | $11,979,000 | $35,937,000 | $83,853,000 |

| 4 | $13,176,900 | $52,707,600 | $79,061,400 |

Table: (7)

d.

Compute ROI using current cost, gross book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 12.22% each year.

Explanation of Solution

Gross book value:

Gross book value is the value of the asset without the adjustment of the depreciation. The asset is recorded on the book value or the cost value.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (a) |

Operating profit (4) (b) |

ROI |

| 1 | $99,000,000 | $12,100,000 | 12.22% |

| 2 | $108,900,000 | $13,310,000 | 12.22% |

| 3 | $119,790,000 | $14,641,000 | 12.22% |

| 4 | $131,769,000 | $16,105,100 | 12.22% |

Table: (8)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 12.22% each year.

Want to see more full solutions like this?

Chapter 14 Solutions

Fundamentals of Cost Accounting

- Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardNavarro Enterprises has a beginning retained earnings balance of $78,000. Net income for the year is $22,000, and cash dividends paid during the year amount to $12,500. What will be the ending retained earnings balance? a. $78,000 b. $87,500 c. $100,000 d. $65,500arrow_forwardGeneral accountingarrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you explain the correct approach to solve this financial accounting question?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT