Concept explainers

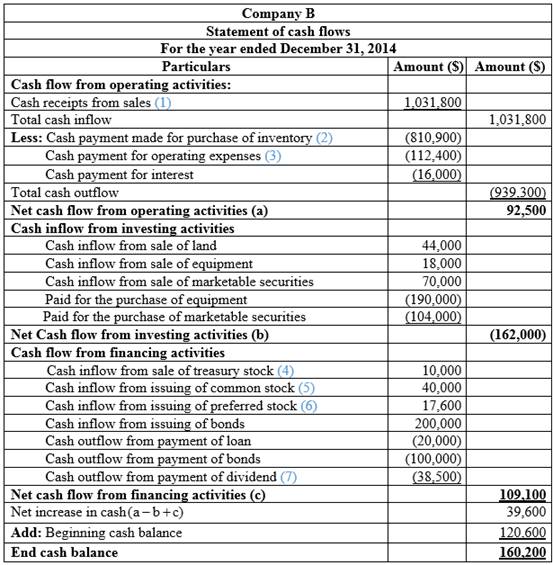

The operating activity, investing activity, and financing activity.

Explanation of Solution

The calculation of

Table 1

Working note:

The calculation of total cash received from sales:

Hence, the cash received from sales is $1,031,800.

…… (1)

The calculation of inventory purchased:

Hence, the inventory purchased is $810,900.

…… (2)

The calculation of operating expenses:

Hence, the operating expenses is $112,400.

…… (3)

The calculation of

Hence, the treasury stock is $10,000.

…… (4)

The calculation of common stock:

Hence, the common stock is $40,000.

…… (5)

The calculation of

Hence, the preferred stock is $17,600.

…… (6)

The calculation of paid dividend:

Hence, the paid dividend is $38,500.

…… (7)

a

The cost per share of the treasury stock

a

Explanation of Solution

The calculation of cost per share of the treasury stock is as follows:

Hence, the cost per share is $100.

…… (1)

b

The issue price per share of the preferred stock.

b

Explanation of Solution

The issue price of the preferred stock is $88 (2) per share.

Working note:

The calculation of number of preferred stocks is as follows:

Hence, the number of preferred stocks is 200.

The calculation of excess of par is as follows:

Hence, the excess of par is $17,600.

The calculation of issue price of preferred stock is as follows:

Hence, the issue price of preferred stocks is $88 per share.

…… (2)

c

The book value of equipment sold

c

Explanation of Solution

The book value of equipment sold is $10,000 (3).

Working note:

The calculation of book value of equipment sold is as follows:

Hence, the book value of equipment sold is $10,000.

…… (3)

Want to see more full solutions like this?

Chapter 14 Solutions

Fundamental Managerial Accounting Concepts

- Please provide the answer to this general accounting question using the right approach.arrow_forwardCreditors Sales Revenue 22,500 1,143,700 Land at cost 550,000 Building at cost 570,000 Furniture and fittings at cost 85,000 Bank 14,000 Provision for Depreciation Buildings 120,000 Furniture and fittings 15,000 Discounts 5,700 5,800 Retained Earnings at 1 Oct 2022 14,800 Provision for bad debts 2,200 Goodwill 400,000 Cash 16,400 Inventory at 1 Oct 2022 48,000 Rent Received(from Breezy Ltd) 27,000 Rent 7,900 Wages and Salaries 122,000 Insurance 16,300 Carriage Inwards 2,300 Returns 8,500 12,000 Commission received 5,200 8% Mortgage 100,000 Other Operating Expenses 2,500 Debtors 45,000 Purchases 340,000 Debenture Interest 1,200 Mortgage Interest 4,600 Bad debt 4,700 7% Debentures 150,000 4% Preference Shares @ $0.5 130,000 Ordinary Shares @ $0.75 375,000 General Reserves 127,000 Interim ordinary dividends paid 4,500 2,249,400 2,249,400arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education