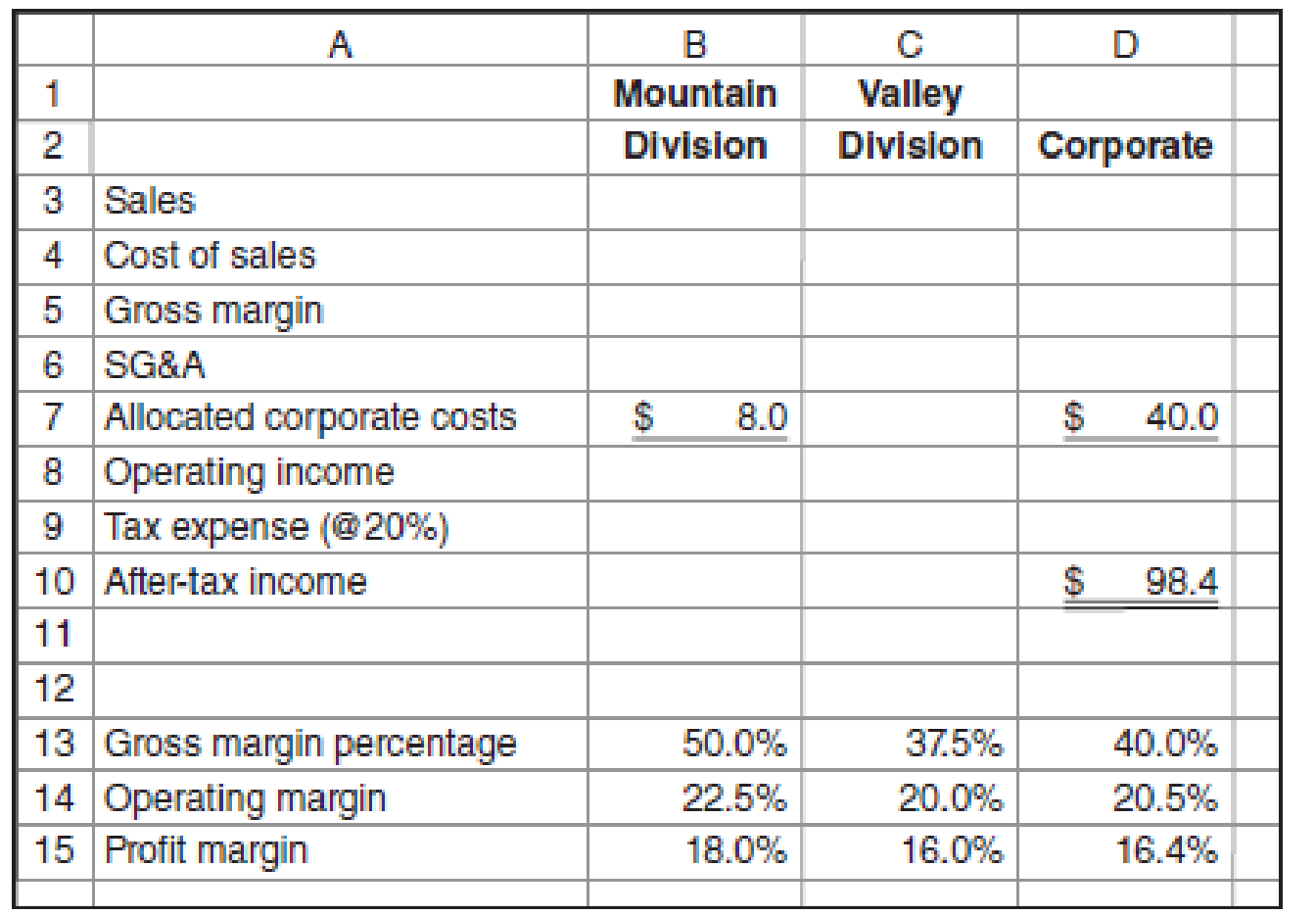

Computing Divisional Income: Incomplete Information and Financial Ratios

As a part of an employment interview, you are given the partial income statement and selected financial ratios shown for Sneaky Pete’s, a chain of western stores. Sneaky Pete’s is organized into two divisions: Mountain and Valley. You are told that corporate

Required

- a. Complete the income statements for both divisions and the corporation as a whole.

- b. What recommendation(s) would you make about computing divisional income for divisional performance measurement at Sneaky Pete’s?

a.

Complete the income statements for both divisions along with the corporation as a whole.

Explanation of Solution

Divisional income statement:

The divisional income statement shows the income of various divisions of the business. It calculates the operating profit of the division by subtracting the expenses of the business from the sales of the division.

Calculate the divisional income statement for mountain division, valley division and corporate:

|

Company S Divisional Income Statement | |||

| Particulars | Mountain division | Valley division | Corporate |

| Sales | $120.00(6) | $480.00(7) | $600.00(1) |

| Cost of sales | $60.00(10) | $300.00(10) | $360.00(4) |

| Gross margin | $60.00(8) | $180.00(8) | $240.00(3) |

| SG&A | $25.00(9) | $52.00(5) | $77.00(5) |

| Allocated corporate costs | $8.00 | $32.00(11) | $40.00 |

| Operating income(a) | $27.00(8) | $96.00(8) | $123.00(2) |

| Tax expenses | $5.40 | $19.20 | $24.60 |

| After tax profit | $21.60 | $76.80 | $98.40 |

Table: (1)

Working note 1:

Calculate the overall corporate sales:

Working note 2:

Calculate the operating income:

Working note 3:

Calculate the gross margin:

Working note 4:

Calculate the cost of sales:

Working note 5:

Calculate the SG&A:

Working note 6:

Calculate the sales for mountain division:

The allocated corporate costs are allocated on the basis of sales. The sales level is $600 on the costs of $40, and it will be computed as follows for the costs of $8:

Working note 7:

Calculate the sales for valley division:

Working note 8:

Calculate the gross and operating income for both the divisions:

| Particulars |

Sales (a) |

Gross margin (b) |

Operating margin (c) |

Gross margin |

Operating profit |

| Mountain division | $120 | 50% | 23% | $60 | $27 |

| Valley division | $480 | 38% | 20% | $180 | $96 |

Table: (2)

Working note 9:

Calculate the SG&A:

Working note 10:

Calculate the cost of sales:

| Particulars | Sales | Gross margin | Cost of sales |

| Mountain division | 120 | 50% | $60 |

| Valley division | 480 | 38% | $298 |

Table: (3)

Working note 11:

Calculate the allocated corporate costs:

b.

Provide recommendations to Company S.

Explanation of Solution

Recommendations to company S:

Company S should not allocate the corporate cost to the divisions. It is not a division specific cost so it should not be allocated on the basis of the revenue of the unit.

Thus, Company S should not allocate the corporate cost to the mountain division and valley division.

Want to see more full solutions like this?

Chapter 14 Solutions

FUNDAMENTALS OF COST ACCOUNTING BUNDLE

- Please don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forwardQuick answerarrow_forward

- Financial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forwardPaterson Manufacturing uses both standards and budgets. For the year, estimated production of Product Z is 620,000 units. The total estimated cost for materials and labor are $1,512,000 and $1,984,000, respectively. Compute the estimates for: (a) a standard cost per unit (b) a budgeted cost for total production (Round standard costs to 2 decimal places, e.g., $1.25.)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning