a)

Prepare all necessary journal entries to record the given transactions.

a)

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare all necessary journal entries to record the given transactions:

| Date | Accounts title and Explanation | Debit ($) | Credit ($) |

| 1 | Rent expense | $35,000 | |

| Contributions-without donor restrictions | $35,000 | ||

| (To record the rent expenses paid for the net assets) | |||

| 2 | Cash | $335,000 | |

| Contributions receivable | $100,000 | ||

| Contributions-without donor restrictions | $185,000 | ||

| Contributions with donor restrictions — program | $250,000 | ||

| (To record the cash receipt and contribution receivables) | |||

| 3. | Salaries & benefits expense | $224,560 | |

| Cash | $208,560 | ||

| Salaries & benefits payable | 16,000 | ||

| (To record the salaries and benefits expenses) | |||

| 4 | Contributions receivable | $100,000 | |

| Contributions with donor restrictions—time | $94,260 | ||

| Discount on contributions receivable | $5,740 | ||

| (To record the contribution receivable) | |||

| 5. | Equipment & furniture | $21,600 | |

| Cash | $12,000 | ||

| Contributions without donor restrictions | $9,600 | ||

| (To record the purchase of furniture and equipment) | |||

| 6 | Telephone expense | $5,200 | |

| Printing & postage expense | $12,000 | ||

| Utilities expense | $8,300 | ||

| Supplies expense | $4,300 | ||

| Cash | $26,200 | ||

| Accounts payable | $3,600 | ||

| (To record the expenses partly paid and partly payable) | |||

| 7 | For this transaction no | ||

| 8 | Provision for uncollectible pledges | $10,000 | |

| Allowance for uncollectible pledges -Unrestricted | $10,000 | ||

| (To record the provision for uncollectible pledges) | |||

| $3,360 | |||

| Allowance for depreciation - equipment & furniture | $3,360 | ||

| (To record the depreciation expense) | |||

| 9 | Public health education program | $105,952 | |

| Community service program | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| Salaries & benefits expense | $224,560 | ||

| Rent expense | $35,000 | ||

| Telephone expense | $5,200 | ||

| Printing & postage expense | $12,000 | ||

| Utilities | $8,300 | ||

| Supplies expense | $4,300 | ||

| Provision for uncollectible accounts | $10,000 | ||

| Depreciation expense | $3,360 | ||

| (To record the | |||

| 10 | Net assets released satisfaction of purpose restriction - with donor restrictions | $105,952 | |

| Net assets released-satisfaction of purpose restriction-without donor restrictions | $105,952 | ||

| (To record the release of net assets) | |||

| 11 | Contributions—without donor restrictions (transactions 1, 2 and 5) | $229,600 | |

| Net assets without donor restrictions | $73,120 | ||

| Public health education | $105,952 | ||

| Community service | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| (To record the closing entry for contributions- without donor restrictions) | |||

| Contributions-with donor restrictions- program | $250,000 | ||

| Contributions-with donor restrictions- time (transactions 2 &4) | $94,260 | ||

| Net assets with donor restrictions | $344,260 | ||

| (To record the closing entry for the contributions – with donor restrictions | |||

| Net assets with donor restrictions | $105,952 | ||

| Net assets released—satisfaction of purpose restriction—with donor restrictions | $105,952 | ||

| (To record the closing entry for the net assets with donor restrictions) | |||

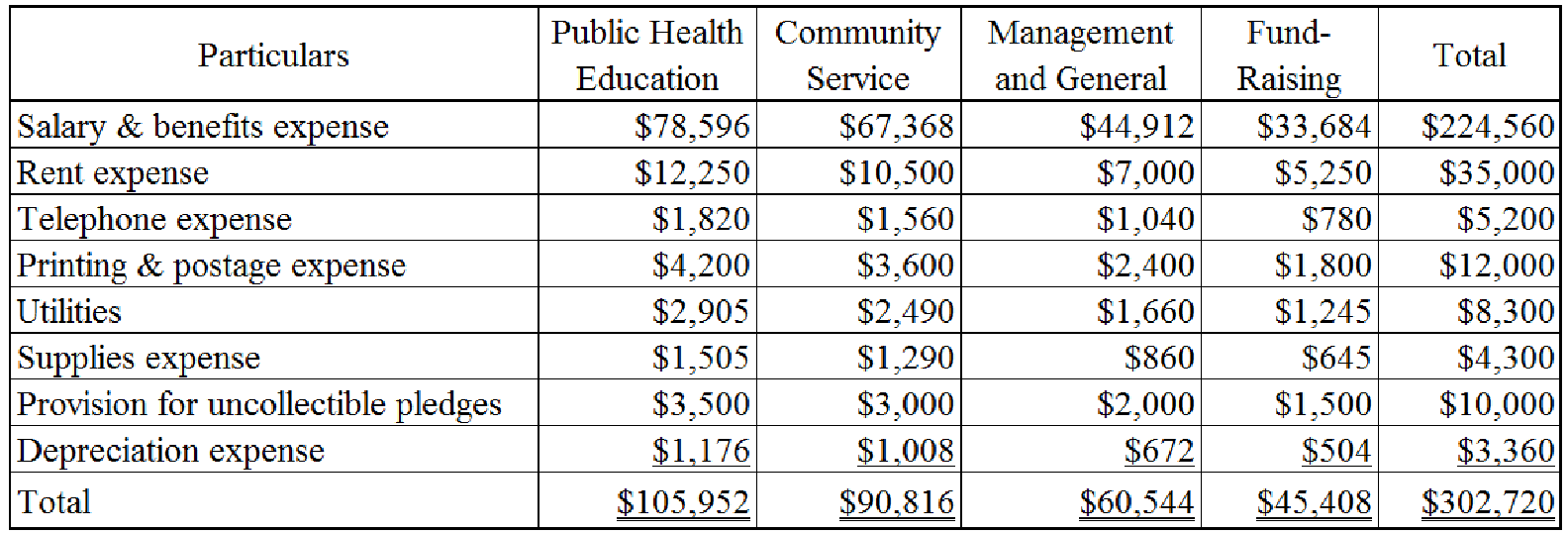

Table (1)

Notes to the above table:

- Compute the resource allocation based on the available information (transaction 9):

Table (2)

b.

Prepare the statement of activity for the year ended December 31, 2020.

b.

Explanation of Solution

Prepare the statement of activity for the year ended December 31, 2020:

| Entity I | |||

| Statement of activities | |||

| For the year ended December 31, 2020 | |||

| Particulars | Without donor restrictions | With donor restrictions | total |

| Revenue and other Support: | |||

| Contributions-net assets released from restriction | $ 229,600 | $ 344,260 | $ 573,860 |

| Satisfaction of purpose | $105,952 | ($105,952) | |

| Total revenue & other support (A) | $335,552 | $238,308 | $573,860 |

| Expenses: | |||

| Public health education | $105,952 | 105,952 | |

| Community services | $90,816 | 90,816 | |

| Management & general | $60,544 | 60,544 | |

| Fund-raising | $45,408 | 45,408 | |

| Total expenses (B) | $302,720 | 302,720 | |

| Increase in net assets (A) – (B) | $32,832 | $238,308 | $271,140 |

| Beginning net assets | 0 | 0 | 0 |

| Ending net assets | $ 32,832 | $ 238,308 | $ 271,140 |

Table (3)

Therefore, the total ending net assets are $271,140.

c)

Prepare a

c)

Explanation of Solution

Statement of financial position: It is an itemized list of total assets and “liabilities and net assets.” The assets are classified into current and noncurrent assets. The liabilities are also classified into current and noncurrent liabilities. The assets should be equal to the liabilities and net assets.

Prepare a statement of financial position for the year ended December 31, 2020:

| Entity I | |

| Statement of Financial Positions | |

| For the year ended December 31, 2020 | |

| Assets | Amount ($) |

| Cash | $88,240 |

| Contributions receivable (less allowance for uncollectible accounts of $10,000 and discount on contributions receivable of $5,740) | $184,260 |

| Equipment and furniture (less allowance for accumulated depreciation of $3,360) |

$18,240 |

| Total Assets | $290,740 |

| Liabilities: | |

| Accounts payable | $3,600 |

| Salaries & benefits payable | $16,000 |

| Total liabilities | $19,600 |

| Net Assets: | |

| Without donor restrictions | $32,832 |

| With donor restrictions | $238,308 |

| Total net assets | $271,140 |

| Total liabilities and net assets | $290,740 |

Table (4)

d)

Prepare a statement of

d)

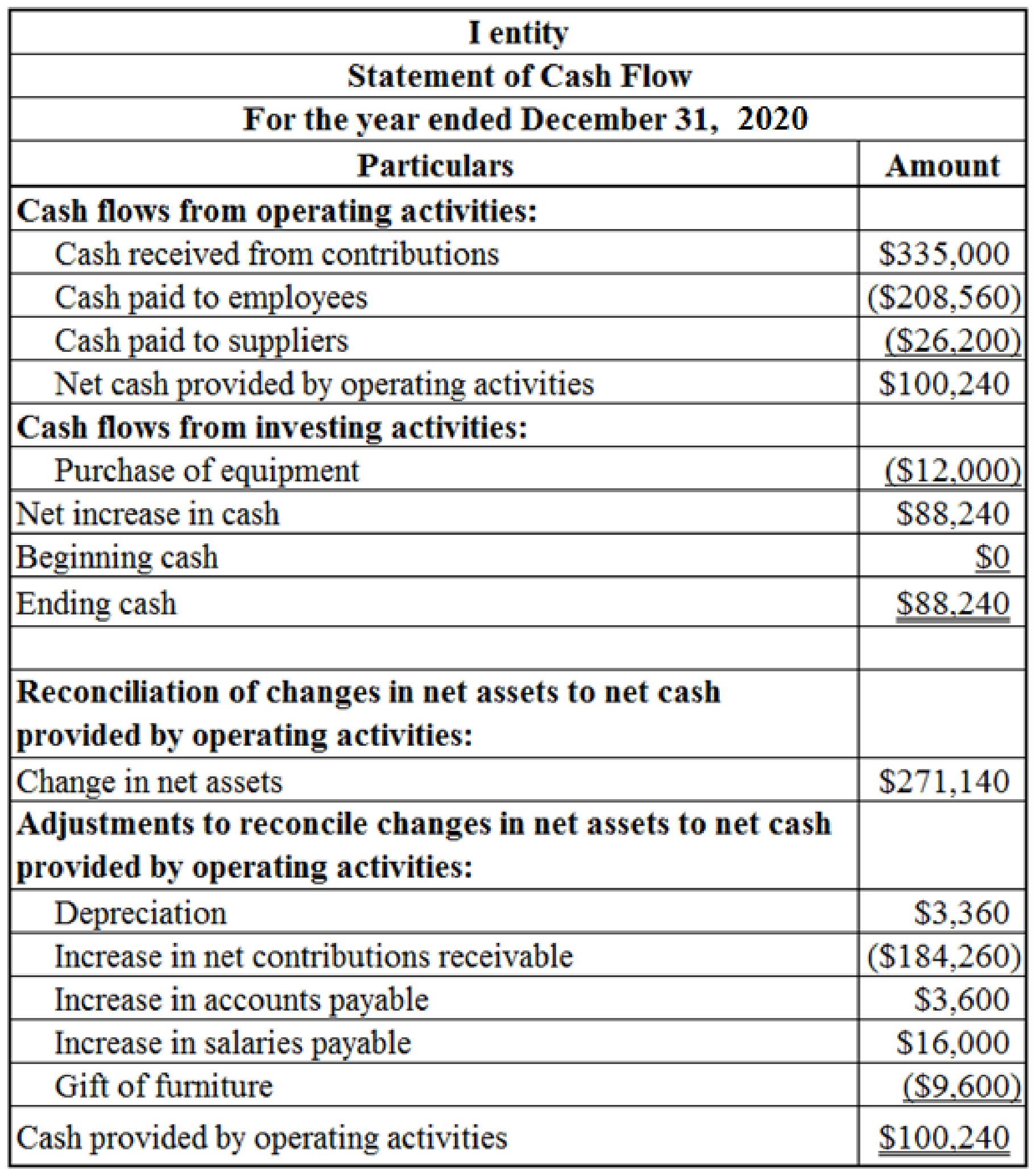

Explanation of Solution

Prepare a statement of cash flow for the year ended December 31, 2020:

Table (5)

e)

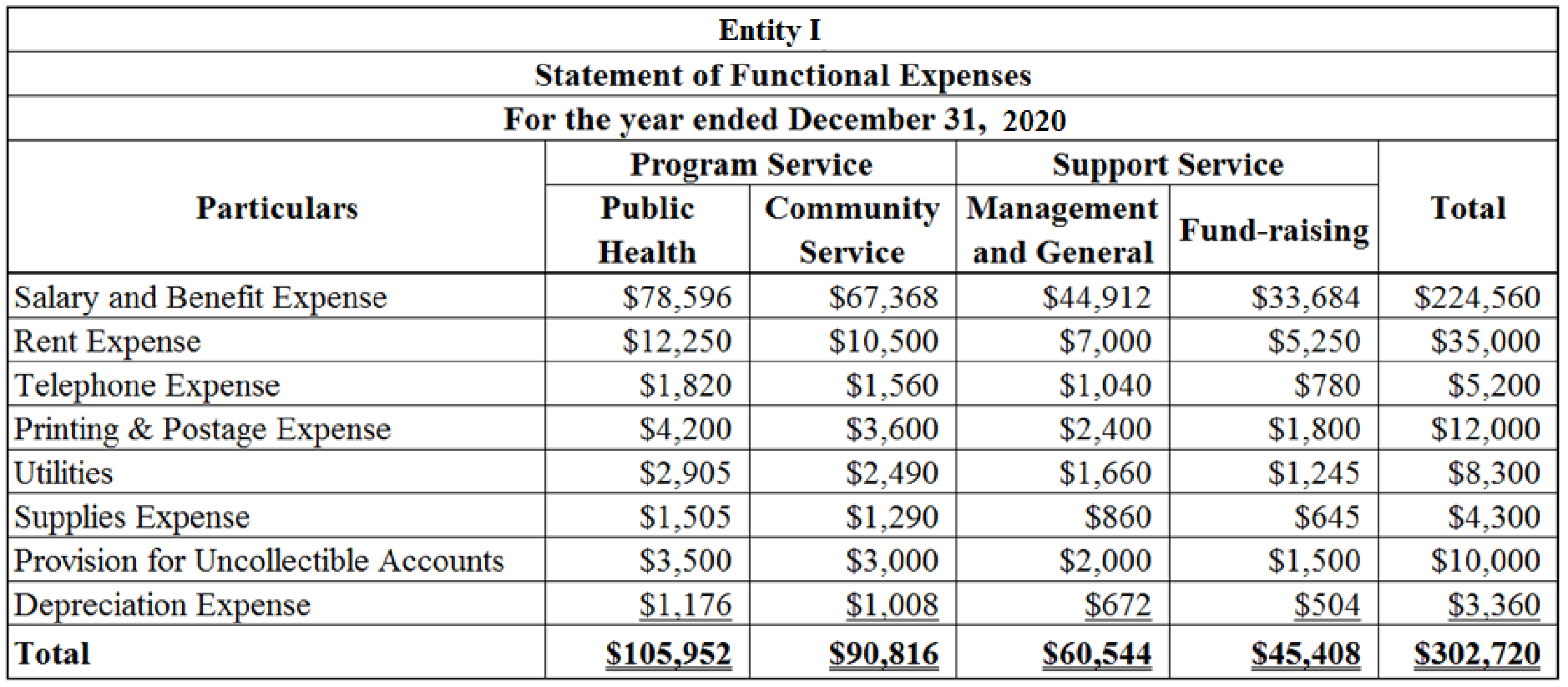

Prepare the schedule of expenses by nature and function for the year ended December 31, 2020.

e)

Explanation of Solution

Prepare the schedule of expenses by nature and function for the year ended December 31, 2020:

Table (6)

Want to see more full solutions like this?

Chapter 14 Solutions

ACCOUNTING F/GOV.+NON...(LL)

- Provide Answerarrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardComet Industries reported FIFO ending inventory of $138,200 and a beginning inventory of $130,600 for 2023. Inventory purchases for 2023 were $278,500, and the change in the LIFO reserve for 2023 was an increase in the LIFO reserve of $1,050. Calculate the value of COGS under LIFO for Comet Industries in 2023.arrow_forward

- What is the primary purpose of the trial balance?A) To prepare financial statementsB) To detect errors in journal entriesC) To ensure debits equal creditsD) To calculate net incomestep by steparrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Which principle dictates that expenses should be recognized in the same period as the revenues they help to generate?A) Revenue Recognition PrincipleB) Matching PrincipleC) Conservatism PrincipleD) Cost Principlearrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forward

- What is the primary purpose of the trial balance?A) To prepare financial statementsB) To detect errors in journal entriesC) To ensure debits equal creditsD) To calculate net income need help!arrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward