a)

Determine the percentage increase in sales and prepare the pro forma income statement.

a)

Explanation of Solution

The formula to calculate the percentage of increase in sales:

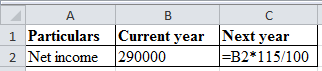

Compute net income:

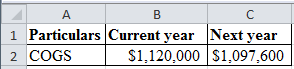

Excel workings:

Table (1)

Excel spread sheet:

Table (2)

Compute the sales value:

Consider sales as X:

Hence, sales are $1,817,500.

Compute selling and administration expenses:

Hence, the selling and administration expenses are $211,750.

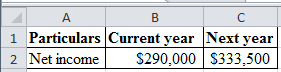

Prepare a pro forma income statement:

Table (3)

Hence, the net income is $333,500.

Compute the percentage of increase in sales:

Hence, the percentage of increase in sales is 13.59%.

b)

Prepare the pro forma income statement and the other ideas to reach the Company T’s goal.

Given information:

Discount rate of 2% on COGS

b)

Explanation of Solution

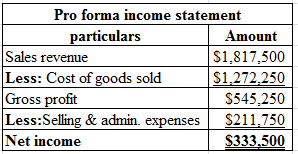

Compute the COGS:

Excel workings:

Table (4)

Excel spread sheet:

Table (5)

Hence, the COGS are $1,097,600.

Compute the selling and administration expenses:

Consider selling and administration expenses as X:

Hence, selling and administration expenses are $168,900.

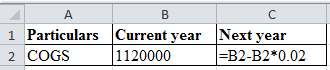

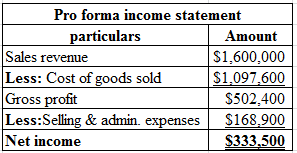

Prepare a pro forma income statement:

Excel spreadsheet:

Table (6)

Hence, the net income is $333,500.

The management cuts the selling and administrative expenses by the amount of $21,100 that is

c)

Whether the company can reach the goal of Company T

c)

Explanation of Solution

Compute projected sales:

Hence, the projected sales are $1,840,000.

Compute the projected cost of goods sold:

Hence, the projected cost of goods sold is $1,288,000.

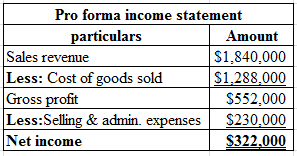

Prepare a pro forma income statement:

Excel spreadsheet:

Table (7)

Hence, the net income is $322,000.

The company cannot reach the goal as the desired profit is less than the actual that is $322,000 is less than the $333,500.

Want to see more full solutions like this?

Chapter 14 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardUniversal Computing Solutions (UCS) sells laptops for $1,800 each and also provides a 2-year warranty, which requires the company to perform periodic services and replace defective parts. During 2024, the company sold 750 laptops. Based on past experience, the company has estimated the total 2-year warranty costs per laptop as $45 for parts and $75 for labor. (Assume sales all occur on December 31, 2024.) In 2025, UCS incurred actual warranty costs relative to 2024 laptop sales of $12,000 for parts and $25,000 for labor. Under the expense warranty treatment (accrual method), what is the balance under current liabilities in the 2024 balance sheet? a. $90,000 b. $120,000 c. $100,000 d. $85,000arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education