Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 14, Problem 1E

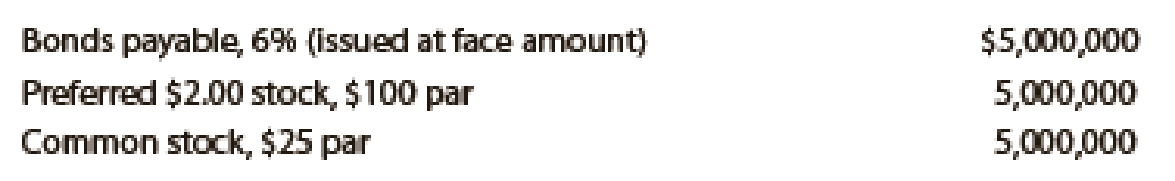

Domanico Co., which produces and sells biking equipment, is financed as follows:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $600,000, (b) $800,000, and (c) $1,200,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting problem using appropriate accounting principles?

Please provide the correct answer to this general accounting problem using accurate calculations.

Can you explain the correct approach to solve this general accounting question?

Chapter 14 Solutions

Financial Accounting

Ch. 14 - Describe the two distinct obligations incurred by...Ch. 14 - Explain the meaning of each of the following terms...Ch. 14 - If you asked your broker to buy you a 12% bond...Ch. 14 - A corporation issues 26,000,000 of 9% bonds to...Ch. 14 - If bonds issued by a corporation are sold at a...Ch. 14 - Prob. 6DQCh. 14 - Bonds Payable has a balance of 5,000,000, and...Ch. 14 - What is a mortgage note?Ch. 14 - Fleeson Company needs additional funds to purchase...Ch. 14 - In what section of the balance sheet would a bond...

Ch. 14 - Prob. 1PEACh. 14 - Brower Co. is considering the following...Ch. 14 - On January 1, the first day of the fiscal year, a...Ch. 14 - On January 1, the first day of the fiscal year, a...Ch. 14 - On the first day of the fiscal year, a company...Ch. 14 - On the first day of the fiscal year, a company...Ch. 14 - Prob. 4PEACh. 14 - Prob. 4PEBCh. 14 - On the first day of the fiscal year, a company...Ch. 14 - On the first day of the fiscal year, a company...Ch. 14 - Prob. 6PEACh. 14 - Prob. 6PEBCh. 14 - A 1,500,000 bond issue on which there is an...Ch. 14 - Prob. 7PEBCh. 14 - On the first day of the fiscal year, a company...Ch. 14 - On the first day of the fiscal year, a company...Ch. 14 - Berry Company reported the following on the...Ch. 14 - Averill Products Inc. reported the following on...Ch. 14 - Domanico Co., which produces and sells biking...Ch. 14 - Prob. 2ECh. 14 - Prob. 3ECh. 14 - Prob. 4ECh. 14 - Thomson Co. produces and distributes...Ch. 14 - On the first day of its fiscal year, Chin Company...Ch. 14 - Prob. 7ECh. 14 - Adele Corp., a wholesaler of music equipment,...Ch. 14 - Emil Corp. produces and sells wind-energy-driven...Ch. 14 - On the first day of the fiscal year, Shiller...Ch. 14 - On January 1, Year 1, Luzak Company issued a...Ch. 14 - On January 1, Year 1, Bryson Company obtained a...Ch. 14 - Prob. 13ECh. 14 - The following data were taken from recent annual...Ch. 14 - Loomis, Inc. reported the following on the...Ch. 14 - Prob. 16ECh. 14 - Tommy John is going to receive 1,000,000 in three...Ch. 14 - Prob. 18ECh. 14 - Prob. 19ECh. 14 - Prob. 20ECh. 14 - Prob. 21ECh. 14 - Prob. 22ECh. 14 - Prob. 23ECh. 14 - Prob. 24ECh. 14 - Prob. 25ECh. 14 - Boyd Co. produces and sells aviation equipment. On...Ch. 14 - Prob. 1PACh. 14 - On July 1, Year 1, Danzer Industries Inc. issued...Ch. 14 - Campbell Inc. produces and sells outdoor...Ch. 14 - The following transactions were completed by...Ch. 14 - On July 1, Year 1, Danzer Industries Inc. issued...Ch. 14 - Campbell, Inc. produces and sells outdoor...Ch. 14 - Prob. 1PBCh. 14 - On July 1, Year 1, Livingston Corporation, a...Ch. 14 - Rodgers Corporation produces and sells football...Ch. 14 - The following transactions were completed by...Ch. 14 - On July 1, Year 1, Livingston Corporation, a...Ch. 14 - Rodgers Corporation produces and sells football...Ch. 14 - CEG Capital Inc. is a large holding company that...Ch. 14 - Prob. 3CPCh. 14 - Prob. 4CPCh. 14 - Xentec Inc. has decided to expand its operations...Ch. 14 - You hold a 25% common stock interest in YouOwnIt,...Ch. 14 - The following financial data (in thousands) were...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forward

- Can you explain the process for solving this General accounting question accurately?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license