Common-Size Statements and Financial Ratios for a Loan Application

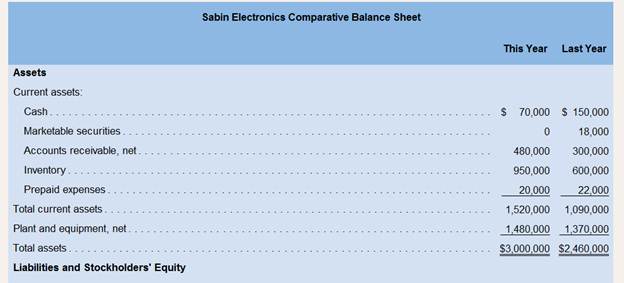

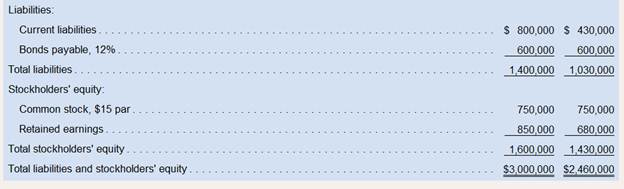

Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $500,000 long-term loan from Gulfport State Bank. $100,000 of which will be used to bolster the Cash account and $400,000 of which will be used to modernize equipment. The company's financial statements for the two most recent years follow:

During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 2/10, n/30. All sales are on account.

Required:

1. To assist in approaching the bank about the loan. Paul has asked you to compute the following ratios for both this year and last year:

a. The amount of

b. The

c. The acid-test ratio.

d. The average collection period. (The

e. The average sale period. (The inventory at the beginning of last year totaled $500,000.)

f The operating cycle.

g. The total asset turnover. (The total assets at the beginning of last year were $2,420,000.)

h. The debt-to-equity ratio.

i. The times interest earned ratio.

j. The equity multiplier. (The total

2. For both this year and last year:

a. Present the

b. Present the income statement in common-size format down through net income.

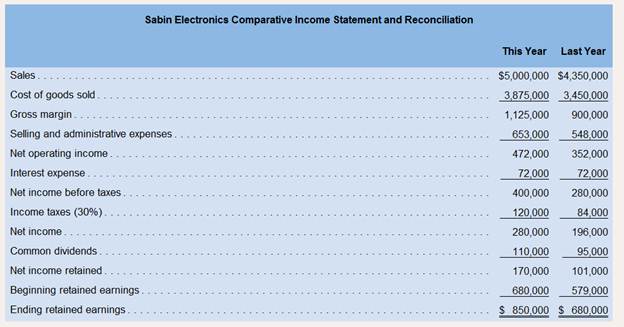

3. Paul Sabin has also gathered the following financial data and ratios that are typical of companies in the electronics industry:

Comment on the results of your analysis in (1) and (2) above and compare Sabin Electronics' performance to the benchmarks from the electronics industry. Do you think that the company is likely to get its loan application approved?

Financial Ratio Analysis:

The process of evaluating the financial ratios is known as financial ratio analysis

1.

Compute the following ratios for both this year and last year.

a. Working Capital

b. Current Ratio

c. Acid-Test Ratio

d. Average Collection Period

e. Average Sale Period

f. Operating Cycle

g. Total Asset Turnover

h. Debt-to-Equity Ratio

i. Times Interest Earned Ratio

j. Equity Multiplier

2.

Prepare balance sheet and income statement in common-size format for both this year and last year.

3.

Comment on the results of your analysis in (1) and (2) above and compare Sabin Electronics’ performance to the benchmarks from the electronics industry. Do you think that the company is likely to get its loan application approved?

Answer to Problem 18P

Solution:

1.

| Ratios | This Year | Last Year |

| Working Capital | $720,000 | $660,000 |

| Current Ratio | 1.90 | 2.53 |

| Acid-Test Ratio | 0.69 | 1.09 |

| Average Collection Period | 28 days | 23 days |

| Average Sale Period | 73 days | 58 days |

| Average Payable Period | 58 days | 45 days |

| Operating Cycle | 43 days | 36 days |

| Total Asset Turnover | 1.83 | 1.78 |

| Debt-to-Equity Ratio | 0.88 | 0.72 |

| Times Interest Earned Ratio | 6.56 | 4.89 |

| Equity Multiplier | 1.80 | 1.71 |

2.

| SABIN ELECTRONICS

Common Size Balance Sheet | ||||

| This Year | Percent | Last Year | Percent | |

| Assets | ||||

| Current assets: | ||||

| Cash | $70,000 | 2.3% | $150,000 | 6.1% |

| Marketable securities | 0 | 0.0% | 18,000 | 0.7% |

| Accounts receivable, net | 480,000 | 16.0% | 300,000 | 12.2% |

| Inventory | 950,000 | 31.7% | 600,000 | 24.4% |

| Prepaid expenses | 20,000 | 0.7% | 22,000 | 0.9% |

| Total current assets | 1,520,000 | 50.7% | 1,090,000 | 44.3% |

| Plant and equipment, net | 1,480,000 | 49.3% | 1,370,000 | 55.7% |

| Total Assets | $3,000,000 | 100% | $2,460,000 | 100% |

| Liabilities and Stockholders’ Equity | ||||

| Liabilities: | ||||

| Current liabilities | $800,000 | 26.7% | $430,000 | 17.5% |

| Bonds payable, 12% | 600,000 | 20% | 600,000 | 24.4% |

| Total Liabilities | 1,400,000 | 46.7% | 1,030,000 | 41.9% |

| Stockholders’ equity | ||||

| Common stock, $15 par | 750,000 | 25% | 750,000 | 30.5% |

| Retained Earnings | 850,000 | 28.3% | 680,000 | 27.6% |

| Total Stockholders’ Equity | 1,600,000 | 53.3% | 1,430,000 | 58.1% |

| Total liabilities and stockholders’ equity | $3,00,000 | 100% | $2,460,000 | 100% |

| SABIN ELECTRONICS

Common Size Income Statement | ||||

| This Year | Percent | Last Year | Percent | |

| Sales | $5,000,000 | 100% | $4,350,000 | 100% |

| Cost of goods sold | 3,875,000 | 77.5% | 3,450,000 | 79.3% |

| Gross margin | 1,125,000 | 22.5% | 900,000 | 20.7% |

| Selling and administrative expenses | 653,000 | 13.1% | 548,000 | 12.6% |

| Net operating income | 472,000 | 9.4% | 352,000 | 8.1% |

| Interest expense | 72,000 | 1.4% | 72,000 | 1.7% |

| Net income before taxes | 400,000 | 8% | 280,000 | 6.4% |

| Income taxes (30%) | 120,000 | 2.4% | 84,000 | 1.9% |

| Net Income | 280,000 | 5.6% | 196,000 | 4.5% |

3.

Considering the financial data and ratios of companies in the electronics industry, Sabin Electronics is likely to get its loan approved because the low debt equity ratio and improving times interest earned ratio which are good signs for the bank. In addition to that, the company is planning to invest 80% of the loan amount into modernizing the equipment which increase the productivity and ultimately resulting in higher profitability.

Explanation of Solution

1.

| a. Computation of Working Capital | ||||

| This Year | Last Year | |||

| Current Assets | $1,520,000 | $1,090,000 | ||

| Less: Current Liabilities | $800,000 | $430,000 | ||

| Working Capital | $720,000 | $660,000 | ||

With 80% of loan amount being invested in modernizing the equipment, the sales and net income of the company is likely to improve with productivity. The current ratio and acid-test ratio and other relevant ratios will probably improve with this investment. Considering all these factors, the bank is likely to approve the loan of the company.

Want to see more full solutions like this?

Chapter 14 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT