Interpretation of Financial Ratios

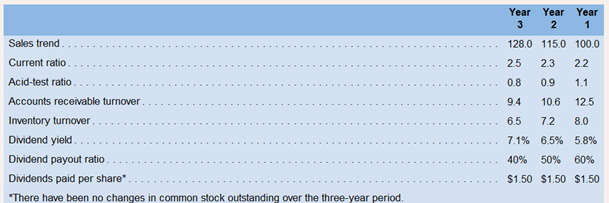

Pecunious Products, Inc.'s financial results for the past three years are summarized below:

Your boss has asked you to review these results and then answer the following questions:

a. Is it becoming easier for the company to pay its bills as they come due?

b. Are customers paying their accounts at least as fast now as they were in Year 1?

c. Is the total of the

d. Is the level of inventory increasing, decreasing, or remaining constant?

e. Is the market price of the company's stock going up or down?

f. Is the earnings per share increasing or decreasing?

g. Is the price-earning ratio going up or down?

Required:

Provide answers to each of the questions raised by your boss.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

INTRO MGRL ACCT LL W CONNECT

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College