Concept explainers

Customer profitability and ethics. KC Corporation manufactures an air-freshening device called GoodAir, which it sells to six merchandising firms. The list price of a GoodAir is $30, and the full

KC Corporation makes products based on anticipated demand. KC carries an inventory of GoodAir, so rush orders do not result in any extra manufacturing costs over and above the $18 per unit. KC ships finished product to the customer at no additional charge for either regular or expedited delivery. KC incurs significantly higher costs for expedited deliveries than for regular deliveries. Customers occasionally return shipments to KC, and the company subtracts these returns from gross revenue. The customers are not charged a restocking fee for returns.

Budgeted (expected) customer-level cost driver rates are:

| Order taking (excluding sales commission) | $15 per order |

| Product handling | $1 per unit |

| Delivery | $1.20 per mile driven |

| Expedited (rush) delivery | $175 per shipment |

| Restocking | $50 per returned shipment |

| Visits to customers | $125 per customer |

Because salespeople are paid $10 per order, they often break up large orders into multiple smaller orders. This practice reduces the actual order-taking cost by $7 per smaller order (from $15 per order to $8 per order) because the smaller orders are all written at the same time. This lower cost rate is not included in budgeted rates because salespeople create smaller orders without telling management or the accounting department. All other actual costs are the same as budgeted costs.

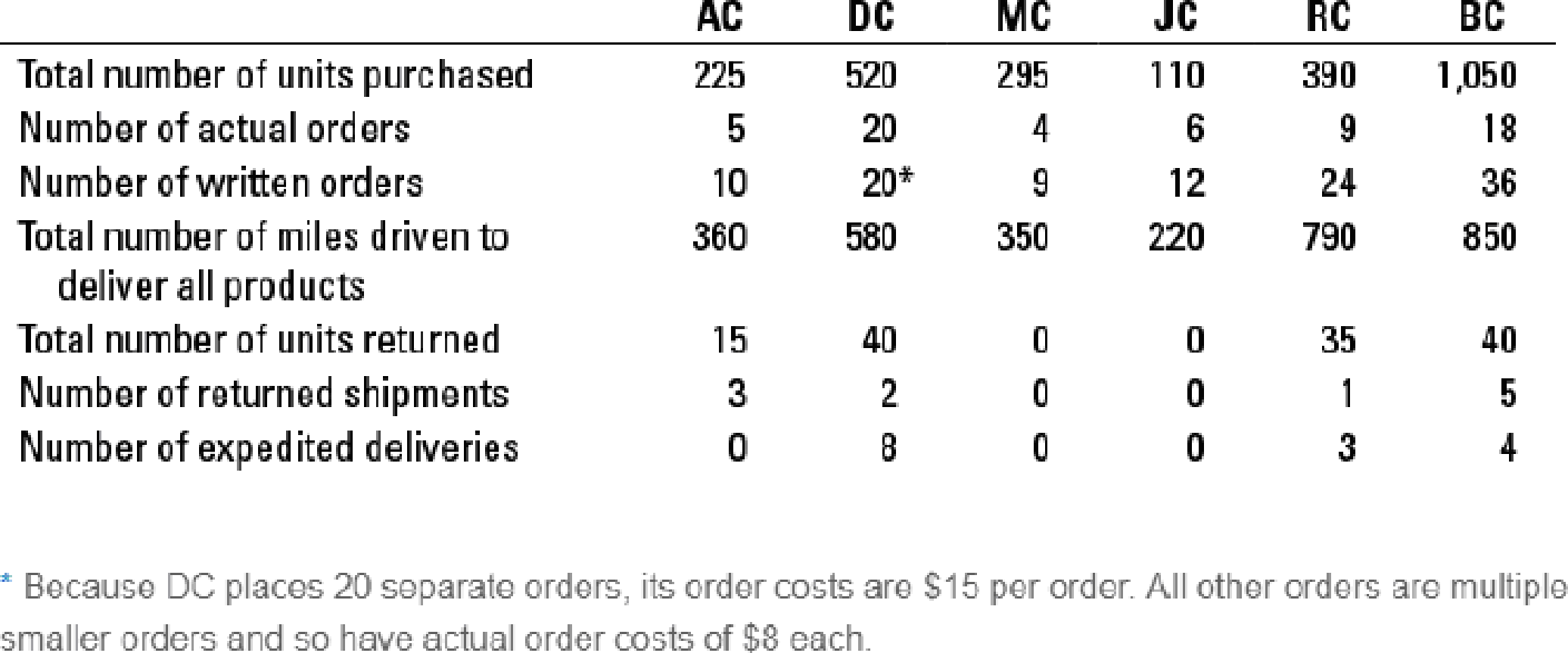

Information about KC’s clients follows:

- 1. Classify each of the customer-level operating costs as a customer output unit–level, customer batch-level, or customer-sustaining cost.

Required

- 2. Using the preceding information, calculate the expected customer-level operating income for the six customers of KC Corporation. Use the number of written orders at $15 each to calculate expected order costs.

- 3. Recalculate the customer-level operating income using the number of written orders but at their actual $8 cost per order instead of $15 (except for DC, whose actual cost is $15 per order). How will KC Corporation evaluate customer-level operating cost performance this period?

- 4. Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don’t forget to also adjust sales commissions.

- 5. How is the behavior of the salespeople affecting the profit of KC Corporation? Is their behavior ethical? What could KC Corporation do to change the behavior of the salespeople?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

EBK COST ACCOUNTING

- Lakshmi Investment Group has total sales of $1,250,000, costs of $520,000, depreciation expense of $85,000, and an interest expense of $65,000. The company has a tax rate of 25%. What is Lakshmi Investment Group's net income?arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardI need correct answer without ai I will unhelpful. If blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Solve this financial accounting problemarrow_forwardThe adjusting entry for depreciation includes:A. Debit Asset, Credit Depreciation ExpenseB. Debit Depreciation Expense, Credit Accumulated DepreciationC. Debit Accumulated Depreciation, Credit AssetD. Debit Cash, Credit Assetarrow_forwardTutor, can you please help me solve this general accounting problemarrow_forward

- Which document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memo Correct solutionarrow_forwardWhich document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memoneedarrow_forwardWhich document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memoarrow_forward

- Accrued expenses are recorded:A. When paid in advanceB. When the cash is paidC. When incurred, before paymentD. Only at year-endPlz coarrow_forwardAccrued expenses are recorded:A. When paid in advanceB. When the cash is paidC. When incurred, before paymentD. Only at year-endcorrearrow_forwardAccrued expenses are recorded:A. When paid in advanceB. When the cash is paidC. When incurred, before paymentD. Only at year-endarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning