Concept explainers

Exercise 7-10A Preparing inventory purchases budgets with different assumptions

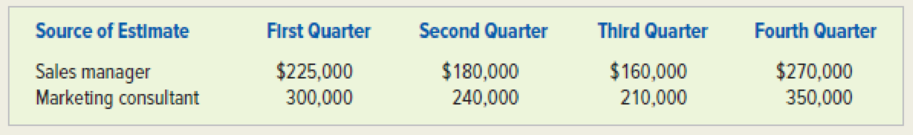

Executive officers of Stoneham Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two difference sources:

Stoneham’s past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to maintain 10 percent of the next quarter’s expected cost of goods sold as the current quarter’s ending inventory. This year’s ending inventory is $15,000. Next year’s ending inventory is budgeted to be $18,000.

Required

a. Prepare an inventory purchases budget using the sales manager’s estimate.

b. Prepare an inventory purchases budget using the marketing consultant’s estimate.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- What is the impact of inventory valuation method (FIFO vs. LIFO) on net income during inflation?no aiarrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- What are index funds, and why are they popular among long-term investors in finance? need helparrow_forwardJoe and Ethan form JH Corporation. Joe transfers equipment (basis of $210,000 and fair market value of $180,000) while Ethan transfers land (basis of $15,000 and fair market value of $150,000) and $30,000 of cash. Each receives 50% of JH’s stock. As a result of these transfers: a. Joe has a recognized loss of $30,000, and Ethan has a recognized gain of $135,000. b. Neither Joe nor Ethan has any recognized gain or loss.c. Joe has no recognized loss, but Ethan has a recognized gain of $30,000. d. JH Corporation will have a basis in the land of $45,000.e. None of the above.arrow_forwardWhat is the impact of inventory valuation method (FIFO vs. LIFO) on net income during inflation?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub