Concept explainers

Exercise 7-10A Preparing inventory purchases budgets with different assumptions

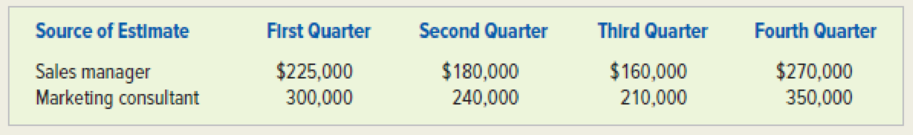

Executive officers of Stoneham Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two difference sources:

Stoneham’s past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to maintain 10 percent of the next quarter’s expected cost of goods sold as the current quarter’s ending inventory. This year’s ending inventory is $15,000. Next year’s ending inventory is budgeted to be $18,000.

Required

a. Prepare an inventory purchases budget using the sales manager’s estimate.

b. Prepare an inventory purchases budget using the marketing consultant’s estimate.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Survey Of Accounting

- Direct materials:24 Direct labor:16arrow_forwardXavier Manufacturing has a contribution margin ratio of 25%. The company's break-even point is 120,000 units, and the selling price of its only product is $4.80 per unit. What are the company's fixed expenses?need answerarrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardProvide correct solution and accounting questionarrow_forwardGalaxy Enterprises reports its accounts receivable on the balance sheet. The gross receivable balance is $75,000, and the allowance for uncollectible accounts is estimated at 12% of gross receivables. At what amount will accounts receivable be reported on the balance sheet?arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Hollister Athletic Equipment had a balance in the Accounts Receivable account of $780,000 at the beginning of the year and a balance of $820,000 at the end of the year. Net credit sales during the year amounted to $6,570,000.arrow_forwardUnder Variable costing, total period costs are:arrow_forward4 POINTSarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub