Concept explainers

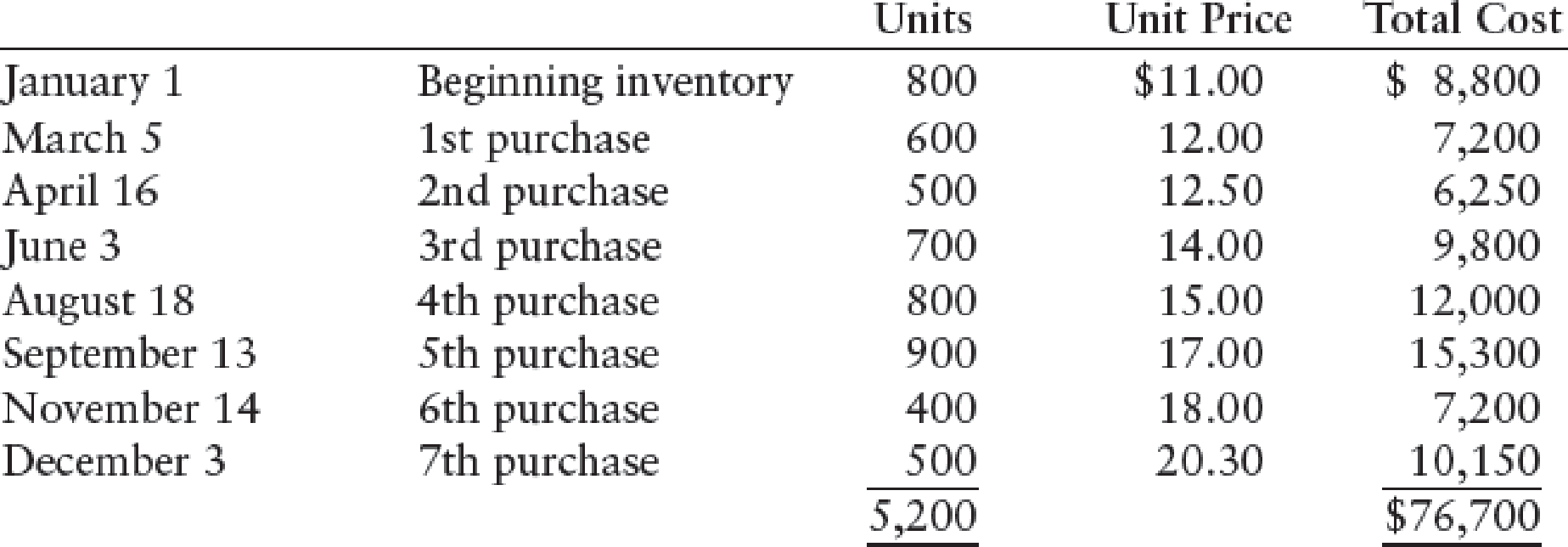

COST ALLOCATION AND LOWER-OF-COST-OR-MARKET Hall Company’s beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows:

There are 1,100 units of inventory on hand on December 31.

REQUIRED

- 1. Calculate the total amount to be assigned to the ending inventory and cost of goods sold on December 31 under each of the following methods:

- (a) FIFO

- (b) LIFO

- (c) Weighted-average (round calculations to two decimal places)

- 2. Assume that the market price per unit (cost to replace) of Hall’s inventory on December 31 was $16. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods:

- (a) FIFO lower-of-cost-or-market

- (b) Weighted-average lower-of-cost-or-market

- 3. Prepare required entries to apply:

- (a) FIFO lower-of-cost-or-market

- (b) Weighted-average lower-of-cost-or-market

1.

(a)

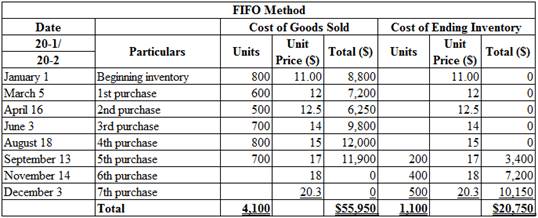

Calculate the total amount of cost of goods sold and cost of ending inventory on September 30, 20-2 under FIFO method.

Explanation of Solution

First-in-First-Out (FIFO): In First-in-First-Out method, the first purchased items are sold first. The value of the ending inventory consists of the recently purchased items.

Calculate the total amount of cost of goods sold and cost of ending inventory on September 30, 20-2 under FIFO method:

Table (1)

Therefore, the cost of sold and cost of ending inventory under FIFO (Periodic inventory system) is $55,950 and $20,750.

2.

(b)

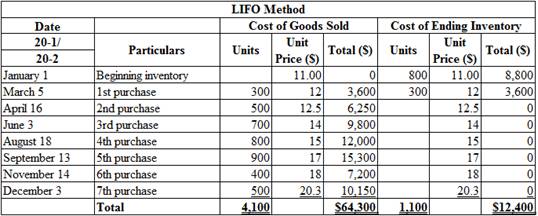

Calculate the total amount of cost of goods sold and cost of ending inventory on September 30, 20-2 under LIFO method.

Explanation of Solution

Last-in-First-Out (LIFO): In Last-in-First-Out method, the last purchased items are sold first. The value of the closing stock consists of the initially purchased items.

Calculate the total amount of cost of goods sold and cost of ending inventory on September 30, 20-2 under LIFO method:

Table (2)

Therefore, the cost of sold and cost of ending inventory under LIFO (Periodic inventory system) is $64,300 and $12,400.

3.

(c)

Calculate the total amount of cost of goods sold and cost of ending inventory on September 30, 20-2 under weighted average cost method.

Explanation of Solution

Weighted-average cost method: Under average cost method inventories are priced at the average of all available inventories. Average cost is the quotient of total cost of goods available for sale and total units available for sale.

Calculate the total amount of cost of goods sold and cost of ending inventory on September 30, 20-2 under weighted average cost method:

Step 1: Calculate the weighted-average cost.

Step 2: Calculate the amount of ending inventory.

Step 3: Calculate the amount of cost of goods sold.

Therefore, the cost of sold and cost of ending inventory under weighted average cost method (Periodic inventory system) is $60,475 and $16,225.

2.

(a)

Calculate the cost of ending inventory under FIFO method (Lower of cost or market).

Explanation of Solution

Lower-of-cost-or-market: The lower-of-cost-or-market (LCM) is a method which requires the reporting of the ending merchandise inventory in the financial statement of a company, at its current market value or at is historical cost price, whichever is less.

First-in-First-Out (FIFO): In First-in-First-Out method, the first purchased items are sold first. The value of the ending inventory consists of the recently purchased items.

Calculate the cost of ending inventory under FIFO (Lower of cost or market):

|

Particulars |

FIFO Cost (A) |

Market Cost (B) |

LCM Valuation (C = A or B ) Whichever is lesser |

| Ending inventory under FIFO | $20,750 | $17,600 | $17,600 |

Table (2)

Working note:

Calculate the market cost.

Therefore, the cost of ending inventory under FIFO method (Lower of cost or market) is $17,600.

2.

(b)

Calculate the cost of ending inventory under weighted average cost method (Lower of cost or market).

Explanation of Solution

Weighted-average cost method: Under average cost method inventories are priced at the average of all available inventories. Average cost is the quotient of total cost of goods available for sale and total units available for sale.

Calculate the cost of ending inventory under weighted average cost (Lower of cost or market):

|

Particulars |

Weighted Average Cost (A) |

Market Cost (B) |

LCM Valuation (C = A or B ) Whichever is lesser |

| Ending inventory under weighted average cost | $16,225 | $17,600 | $16,225 |

Table (3)

Working note:

Calculate the market cost.

Therefore, the cost of ending inventory under weighted average cost method (Lower of cost or market) is $16,225.

3.

(a)

Show the journal entry would be made under lower-of-cost-or-market.

Explanation of Solution

Lower-of-cost-or-market: The lower-of-cost-or-market (LCM) is a method which requires the reporting of the ending merchandise inventory in the financial statement of a company, at its current market value or at is historical cost price, whichever is less.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Show the journal entry would be made under lower-of-cost-or-market:

| Section | Particulars | Debit ($) | Credit ($) |

| (a) | Loss on write-down of inventory | 3,150 | |

| Merchandise inventory | 3,150 | ||

| (To record the loss on inventory) |

Table (2)

Working note:

Calculate the amount of loss on inventory.

3.

(b)

Show the journal entry would be made under lower-of-cost-or-market.

Explanation of Solution

No entry required for part b.

Want to see more full solutions like this?

Chapter 13 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- General accountingarrow_forwardFinancial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forward

- Paterson Manufacturing uses both standards and budgets. For the year, estimated production of Product Z is 620,000 units. The total estimated cost for materials and labor are $1,512,000 and $1,984,000, respectively. Compute the estimates for: (a) a standard cost per unit (b) a budgeted cost for total production (Round standard costs to 2 decimal places, e.g., $1.25.)arrow_forwardQuestion: Gujri Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax. The entry in the general journal will include a credit to Sales for a) $2,250.00 b) $2,092.50 c) $2,452.50. choose the correct optionarrow_forwardPlease help mearrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,