Concept explainers

a)

To determine: Cash flows at year 0.

a)

Explanation of Solution

Calculation of cash flows at year 0:

Therefore, the year 0 cash flow is -$89,000

b)

To determine: Net operating cash flows for 3 years.

b)

Explanation of Solution

Calculation of

Cost of the machine is $85,000 ($70,000+$15,000)

Calculation of operating cash flows:

Therefore, the net operating cash flow at year 1 is $26,332.4

Therefore, the net operating cash flow at year 2 is $30,113.2

Therefore, the net operating cash flow at year 2 is $20,035.6

c)

To determine: Additional year-3 cash flow required.

c)

Explanation of Solution

Book value is $6,298.50

Calculation of profit on sale:

Therefore, profit on sale is $23,701.50

Calculation of taxes on salvage value:

Therefore, taxes on salvage value is $20,519.40

Calculation of additional cash flow at year 3:

Therefore, additional cash flow required is $24,519.40

d)

To determine: Whether the firm should accept the project or not.

d)

Explanation of Solution

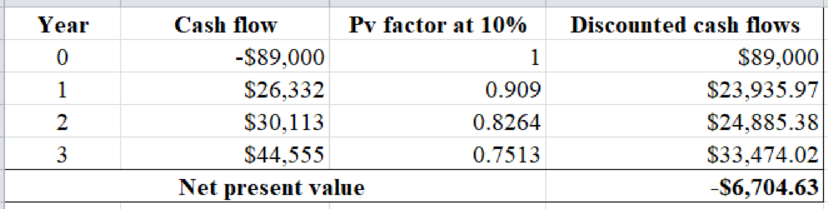

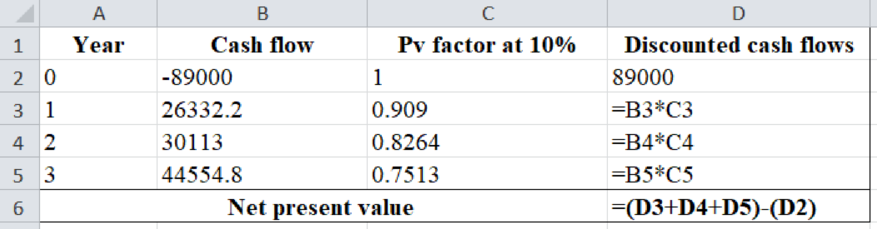

Calculation of NPV:

Excel workings:

Excel spread sheet:

Therefore, the

Want to see more full solutions like this?

Chapter 13 Solutions

INTERMEDIATE FINAN.MGMT.(LL)-W/MINDTAP

- I am looking for help with this financial accounting questionarrow_forwardPlease provide the correct answer to this financial accounting questionarrow_forward(Calculating annuity payments) The Aggarwal Corporation needs to save $8 million to retire a(n) $8 million mortgage that matures in 17 years. To retire this mortgage, the company plans to put a fixed amount into an account at the end of each year for 17 years. The Aggarwal Corporation expects to earn 12 percent annually on the money in this account. What equal annual contribution must the firm make to this account to accumulate the $8 million by the end of 17 years? The equal annual contribution Aggarwal must make to this account is (round your answer to the nearest cent) $arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning