Concept explainers

a)

To determine: Cash flows at year 0.

a)

Explanation of Solution

Calculation of cash flows at year 0:

Therefore, the year 0 cash flow is -$89,000

b)

To determine: Net operating cash flows for 3 years.

b)

Explanation of Solution

Calculation of

Cost of the machine is $85,000 ($70,000+$15,000)

Calculation of operating cash flows:

Therefore, the net operating cash flow at year 1 is $26,332.4

Therefore, the net operating cash flow at year 2 is $30,113.2

Therefore, the net operating cash flow at year 2 is $20,035.6

c)

To determine: Additional year-3 cash flow required.

c)

Explanation of Solution

Book value is $6,298.50

Calculation of profit on sale:

Therefore, profit on sale is $23,701.50

Calculation of taxes on salvage value:

Therefore, taxes on salvage value is $20,519.40

Calculation of additional cash flow at year 3:

Therefore, additional cash flow required is $24,519.40

d)

To determine: Whether the firm should accept the project or not.

d)

Explanation of Solution

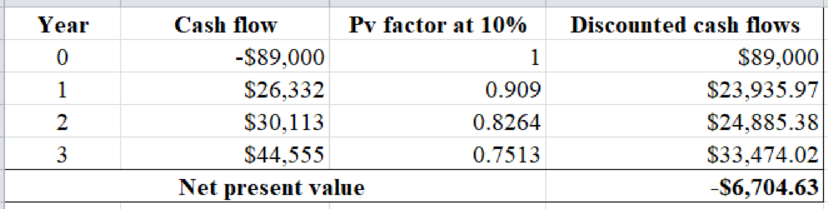

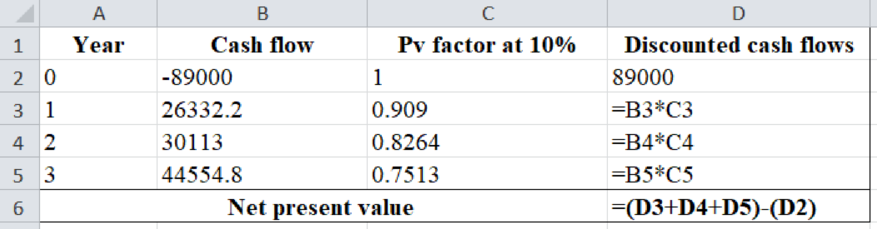

Calculation of NPV:

Excel workings:

Excel spread sheet:

Therefore, the

Want to see more full solutions like this?

Chapter 13 Solutions

Bundle: Intermediate Financial Management, 13th + MindTap Finance, 1 term (6 months) Printed Access Card

- critically discuss the hockey stick model of a start-up financing. In your response, explain the model and discibe its three main stages, highlighting the key characteristics of each stage in terms of growth, risk, and funding expectations.arrow_forwardSolve this problem please .arrow_forwardSolve this finance question.arrow_forward

- solve this question.Pat and Chris have identical interest-bearing bank accounts that pay them $15 interest per year. Pat leaves the $15 in the account each year, while Chris takes the $15 home to a jar and never spends any of it. After five years, who has more money?arrow_forwardWhat is corporate finance? explain all thingsarrow_forwardSolve this finance problem.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT