Concept explainers

a)

To determine: Cash flows at year 0.

a)

Explanation of Solution

Calculation of cash flows at year 0:

Therefore, the year 0 cash flow is -$89,000

b)

To determine: Net operating cash flows for 3 years.

b)

Explanation of Solution

Calculation of

Cost of the machine is $85,000 ($70,000+$15,000)

Calculation of operating cash flows:

Therefore, the net operating cash flow at year 1 is $26,332.4

Therefore, the net operating cash flow at year 2 is $30,113.2

Therefore, the net operating cash flow at year 2 is $20,035.6

c)

To determine: Additional year-3 cash flow required.

c)

Explanation of Solution

Book value is $6,298.50

Calculation of profit on sale:

Therefore, profit on sale is $23,701.50

Calculation of taxes on salvage value:

Therefore, taxes on salvage value is $20,519.40

Calculation of additional cash flow at year 3:

Therefore, additional cash flow required is $24,519.40

d)

To determine: Whether the firm should accept the project or not.

d)

Explanation of Solution

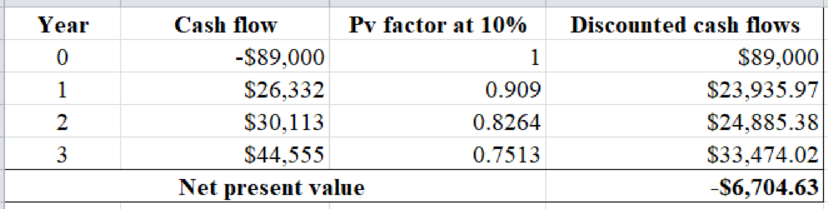

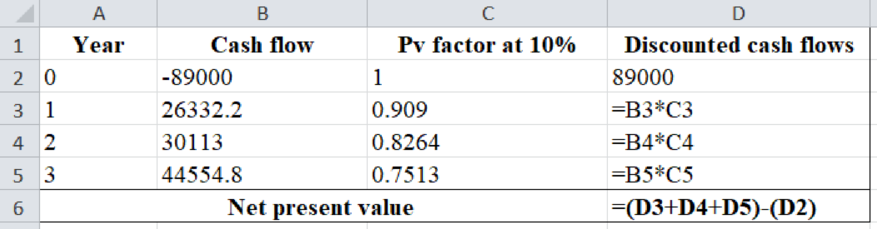

Calculation of NPV:

Excel workings:

Excel spread sheet:

Therefore, the

Want to see more full solutions like this?

Chapter 13 Solutions

INTERMEDIATE FINANCIAL MANAGEMENT

- Which of the following is not an investment grade credit rating?* BB+ BBB+ BBB BBB-arrow_forwardCompany A has a capital structure of $80M debt and $20M equity. This year, the company reported a net income of $17M. What is Company A's return on equity?* 117.6% 21.3% 85.0% 28.3%arrow_forward12. Which of the following is the formula to calculate cost of capital?* Total assets/Net debt x Cost of debt + Total assets/Equity x Cost of equity Net debt/Equity x Cost of debt + Equity/Net debt x Cost of equity Net debt x Cost of debt + Equity x Cost of equity Net debt/Total assets x Cost of debt + Equity/Total assets x Cost of equity .arrow_forward

- no ai .What is the enterprise value of a business?* The market value of equity of the business The book value of equity of the business The entire value of the business without giving consideration to its capital structure The entire value of the business considering its capital structurearrow_forward10. The concept of time value of money is that* The cash flows that occur earlier are more valuable than cash flows that occur later The cash flows that occur earlier are less valuable than cash flows that occur later The longer the time cash flows are invested, the more valuable they are in the future The future value of cash flows are always higher than the present value of the cash flows .arrow_forward9. Which of the following is true when a bond is trading at a discount?* Coupon Rate > Current Yield > Yield to Maturity Coupon Rate < Current Yield < Yield to Maturity Coupon Rate = Current Yield = Yield to Maturity Coupon Rate < Current Yield = Yield to Maturity.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT