Loose Leaf For Introduction To Managerial Accounting

8th Edition

ISBN: 9781260190175

Author: Brewer Professor, Peter C.; Garrison, Ray H; Noreen, Eric

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 6E

Prepare a Statement of

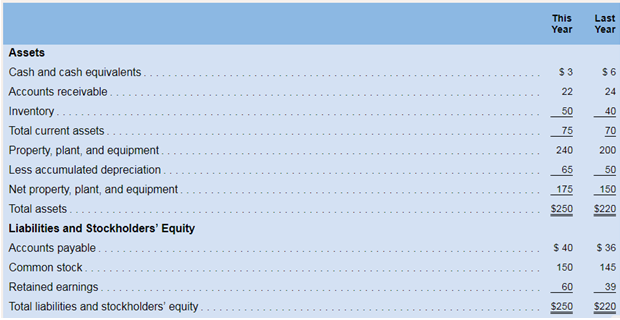

Comparative financial statement data for Carmono Company follow:

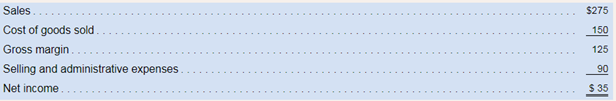

For this year the company reported net income as follows:

This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year.

Required:

1. Using the indirect method, prepare a statement of cash flows for this year.

2. Compute Carmono's free cash flow for this year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 13 Solutions

Loose Leaf For Introduction To Managerial Accounting

Ch. 13.A - Prob. 1ECh. 13.A - Prob. 2ECh. 13.A - Prob. 3ECh. 13.A - Prob. 4ECh. 13.A - Prob. 5PCh. 13.A - Prob. 6PCh. 13.A - Prob. 7PCh. 13 - Prob. 1QCh. 13 - Prob. 2QCh. 13 - Prob. 3Q

Ch. 13 - What general guidelines can you provide for...Ch. 13 - Prob. 5QCh. 13 - Prob. 6QCh. 13 - Prob. 7QCh. 13 - Prob. 8QCh. 13 - A business executive once stated, “Depreciation is...Ch. 13 - If the Accounts Receivable balance increases...Ch. 13 - Would a sale of equipment for cash be considered a...Ch. 13 - Prob. 12QCh. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 2F15Ch. 13 - Prob. 3F15Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 5F15Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 8F15Ch. 13 - Prob. 9F15Ch. 13 - Prob. 10F15Ch. 13 - Prob. 11F15Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Ravenna Company is a merchandiser that uses the...Ch. 13 - Prob. 14F15Ch. 13 - Prob. 15F15Ch. 13 - Prob. 1ECh. 13 - Net Cash Provided by Operating Activities For the...Ch. 13 - Prob. 3ECh. 13 - Prob. 4ECh. 13 - Net Cash Provided by Operating Activities Changes...Ch. 13 - Prepare a Statement of Cash Flows; Free Cash Flow...Ch. 13 - Prob. 7PCh. 13 - Prob. 8PCh. 13 - Prob. 9PCh. 13 - Prepare a Statement of Cash Flows; Free Cash...Ch. 13 - Prob. 11PCh. 13 - Prepare a Statement of Cash Flows A comparative...Ch. 13 - Prob. 13PCh. 13 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License