Concept explainers

House prices This chapter has considered many aspects of

- a. Construct a

scatterplot matrix. Identify the plots that pertain to selling price as a response variable. Interpret and explain how the highly discrete nature of x2 and x3 affects the plots. - b. Fit the model. Write down the prediction equation and interpret the coefficient of size of home by its effect when x2 and x3 are fixed.

- c. Show how to calculate R2 from SS values in the ANOVA table. Interpret its value in the context of these variables.

- d. Find and interpret the

multiple correlation . - e. Show all steps of the F test that selling price is independent of these predictors. Explain how to obtain the F statistic from the mean squares in the ANOVA table.

- f. Report the t statistic for testing H0: β2 = 0. Report the P-value for Ha: β2 < 0 and interpret. Why do you think this effect is not significant? Does this imply that the number of bedrooms is not associated with selling price?

- g. Construct and examine the histogram of the residuals for the multiple regression model. What does this describe, and what does it suggest?

- h. Construct and examine the plot of the residuals plotted against size of home. What does this describe, and what does it suggest?

a.

Draw a scatterplot matrix.

Identify the plots that identify selling price as a response variable.

Interpret and explain the manner in which the highly discrete nature of

Answer to Problem 60CP

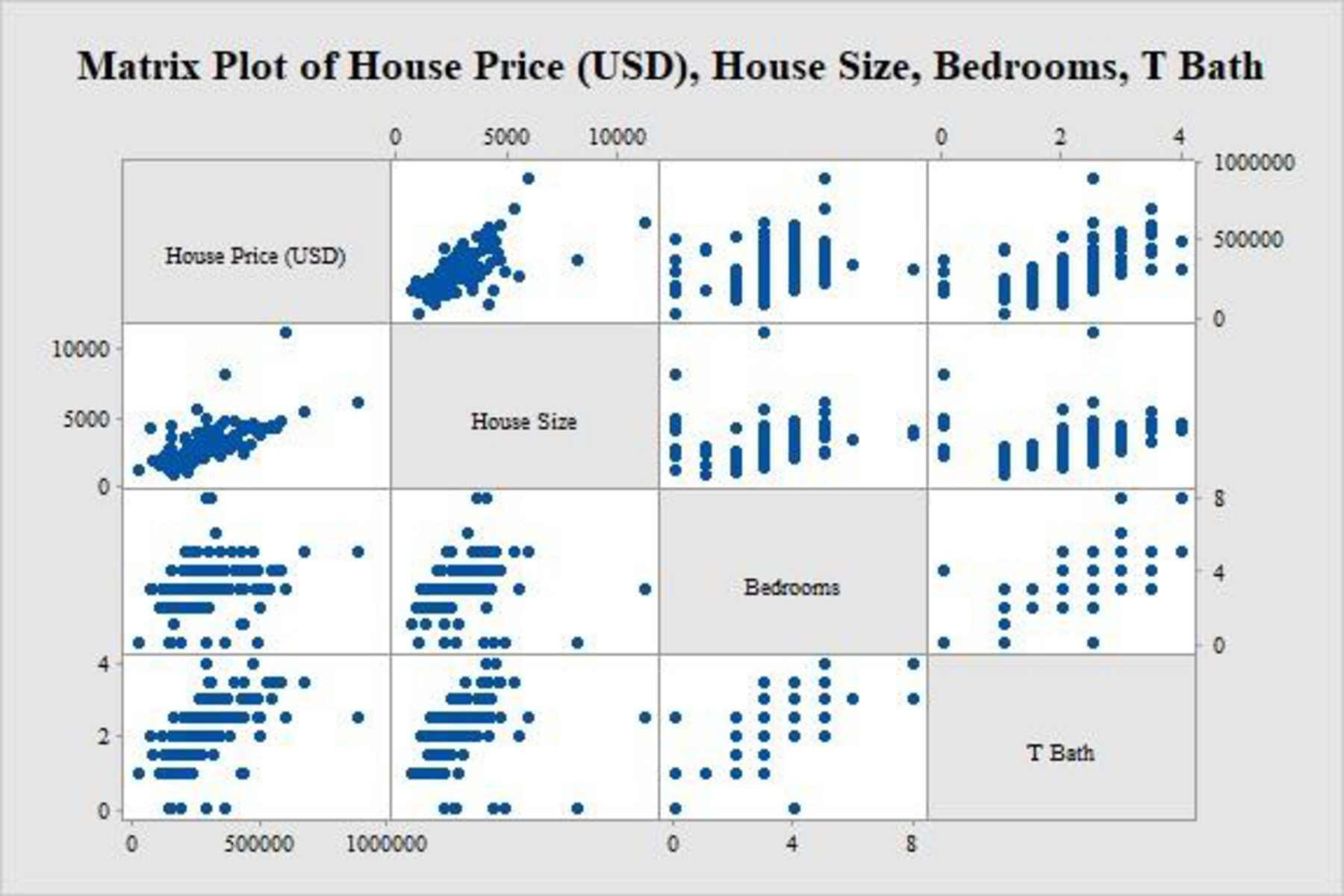

The scatterplot matrix is as follows:

Explanation of Solution

Calculation:

The data relate the selling price of home to the size of the home, the number of bedrooms, and the number of bathrooms.

Denote the response variable and selling price of home as y, the predictor and size of home as

Scatterplot matrix:

Software procedure:

Step by step procedure to draw the scatterplot matrix using the MINITAB software:

- Choose Graph > Matrix Plots > Simple > OK.

- Enter the columns of House Price (USD), House Size, Bedrooms, and T Bath under Graph variables.

- Click OK in all dialogue boxes.

Thus, the scatterplot matrix is obtained.

Interpretation:

The plots in the top row of the scatterplot matrix have the house prices along the vertical axis and the other variables in the corresponding horizontal axes. Now, it is customary to plot the response variable along the vertical axis and the predictor variable along the horizontal axis.

Thus, the plots across the top row pertain to selling price as a response variable.

The number of bedrooms and the number of bathrooms are highly discrete, which can only take limited number of values. Each of these discrete values has many observations and it is reflected in the above graph. Since these variables are discrete, the regression or prediction procedure for continuous predictors may not be well-defined.

b.

Fit a model and give the prediction equation.

Interpret the effect of coefficient of size of home when

Answer to Problem 60CP

The prediction equation is as follows:

Explanation of Solution

Calculation:

Regression equation:

Software procedure:

Step by step procedure to obtain the regression equation using the MINITAB software:

- Choose Stat > Regression > Regression > Fit Regression Model.

- Enter the column of y under House Price(USD).

- Enter the columns of House size, Bedrooms, and T Bath under Continuous predictors.

- Choose Results and select Analysis of variance, Model summary, Coefficients, Regression Equation.

- Click OK in all dialogue boxes.

Output obtained using MINITAB is given below:

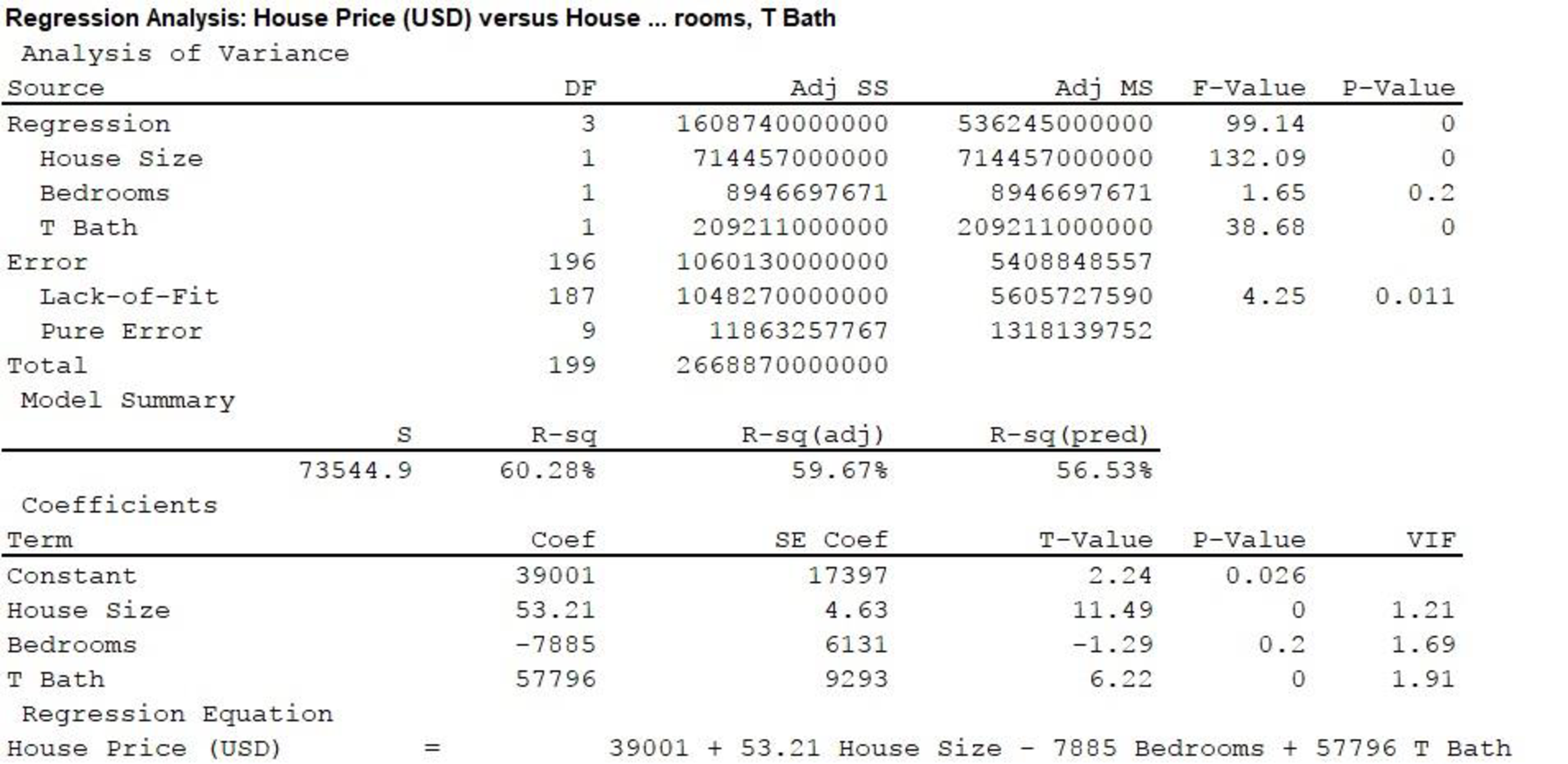

From Regression equation is MINTAB output and the prediction equation is as follows:

Significance of the slope:

In a multiple regression equation, the slope corresponding to a particular explanatory variable signifies the effect of that explanatory variable on the response variable while keeping the other explanatory variables at a fixed level. The slope gives the amount of change in the response variable for unit increase in the explanatory variable. A positive slope implies that the response variable increases when the explanatory variable increases, whereas a negative slope implies that the response variable decreases when the explanatory variable increases.

From the MINITAB output, the slope corresponding to House size is 53.21, which is positive.

It is clear that a unit increase in the House size increases the selling price of a house by $53.21 using the explanation regarding the significance of slope.

c.

Explain the procedure to calculate

Answer to Problem 60CP

The value of

Explanation of Solution

Calculation:

The statistic

The statistic

The numerator gives the regression sum of squares, which is

From Part b., the column “Adj SS” of the “Analysis of Variance” section provides the sum of squares for the test. The sum of square (SS) value is 1,608,740,000,000 corresponding to the Source “Regression” and the SS value is 2,668,870,000,000 corresponding to “Total”.

The value of

Thus, the value of

Interpretation:

In this case, the value of

d.

Calculate and interpret the multiple correlation.

Answer to Problem 60CP

The multiple correlation is 0.78.

Explanation of Solution

Calculation:

It is known that

From Part c., the value of

Thus, the multiple correlation, R is the positive square root of

Thus, the multiple correlation is 0.78.

Interpretation:

The multiple correlation coefficient is the correlation coefficient between the observed response variable, y and the predicted value of the response variable,

The value of multiple correlation is 0.78, which is quite close to 1. Thus, there is quite strong relationship between the observed selling prices and selling prices using the given prediction model.

e.

Show all steps of the F test for predicting the selling price.

Explain the procedure to obtain the F statistic from mean squares in the ANOVA table.

Explanation of Solution

Calculation:

Step 1: Assumptions:

The multiple regression holds for the selling price of houses. There is a normal distribution for y with the same standard deviation at each combination of values of the predictors in the model. The data is collected randomly.

Step 2: Hypotheses:

Assume that

Null hypothesis:

That is, house-selling price does not depend on size of home, number of bedrooms, and number of bathrooms.

Alternative hypothesis:

That is, house-selling price depends on size of home, number of bedrooms, and number of bathrooms.

Step 3: Test statistic:

The formula for F test statistic is as follows:

From Part b., the column “F-value” of the “Analysis of Variance” section provides the F-test statistic values. Corresponding to the Source “Regression”, The F-value is 99.14.

Thus, F-test statistic is 99.14.

Step 4: P-value:

From Part b., the column “P-value” of the “Analysis of Variance” section provides the P-values for the test. Corresponding to the Source “Regression”, the P-value is 0.

Step 5: Conclusion:

Decision rule:

If

Here, P-value is less than the most commonly used levels of significance like 0.05, 0.01, and 0.10.

Therefore, reject the null hypothesis.

Thus, there is strong evidence that at least one of House size, number of bedrooms, and number of bathrooms is useful for predicting the House price.

f.

Find the t test statistic for the given hypotheses.

Find the P-value for the given alternative hypothesis.

Explain the reason that the effect of number of bedrooms is not significant.

Check whether it is implied that the number of bedrooms is not associated with the selling price of the house.

Answer to Problem 60CP

The value of t-test statistic is –1.29.

The P-value is 0.1.

Explanation of Solution

Calculation:

It is assumed that

The given hypotheses are as follows:

Null hypothesis:

That is, the selling price of house does not depend on the number of bedrooms.

Alternative hypothesis:

That is, house selling price decreases with the number of bedrooms.

The formula for t-test statistic is as follows:

Here “

From Part b., the column “T-value” of the “Coefficients” section provides the T-test statistic values. The T-value corresponding to “Bedrooms” is –1.29.

Thus, the value of t-test statistic is –1.29.

P-value:

From Part b., the P-value is 0.2

The P-value for two-tailed test with critical value

The P-value for left-tailed test with critical value

Hence, for the left-tailed test, the P-value is calculated from the P-value of the two-tailed test as follows:

Thus, P-value is 0.1.

Decision rule:

If

Here, P-value is greater than the most commonly used levels of significance like 0.05, 0.01.

Therefore, fail to reject the null hypothesis.

Thus, there is no evidence that the selling price of house depends on the number of bedrooms at levels of significance 0.05 and 0.01.

Here, P-value is equal with the level of significance 0.10.

Therefore, reject the null hypothesis.

Thus, there is enough evidence that the selling price of house depends on the number of bedrooms at level of significance 0.10.

The effect of number of bedrooms is not significant on house price because the other explanatory variables have an effect on the house selling price. If it is used independently, the effect may be significant.

Thus, it cannot be said that the number of bedrooms is not associated with the selling price.

g.

Draw the histogram of the residuals and examine it.

State the conclusions from the graph.

Answer to Problem 60CP

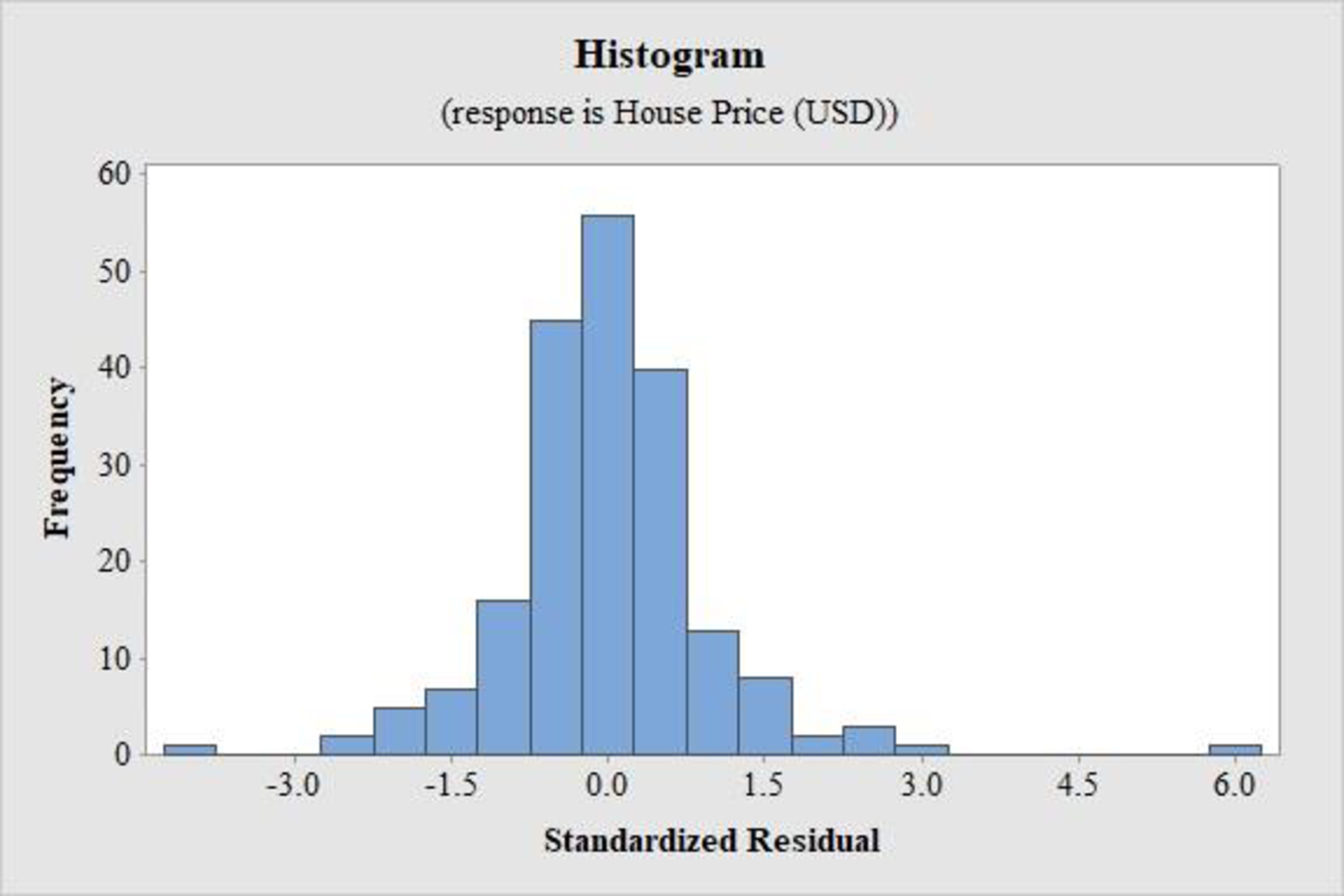

The histogram for the residuals is as follows:

Explanation of Solution

Calculation:

Histogram of standardized residuals:

Software procedure:

Step by step procedure to obtain the histogram of the standardized residuals using the MINITAB software:

- Choose Stat > Regression > Regression > Fit Regression Model.

- Enter the column of y under House Price(USD).

- Enter the columns of House size, Bedrooms, and T Bath under Continuous predictors.

- Choose Results and select Analysis of variance, Model summary, Coefficients, Regression Equation.

- Choose Graphs.

- Choose Standardized under Residuals for plots and select Histogram for residuals.

- Click OK in all dialogue boxes.

Thus, the histogram of the residuals is obtained.

Interpretation:

The histogram of the standardized residuals in this case is approximately bell-shaped. However, there is one outlier to the left and one extreme outlier to the right.

Thus, the graph indicates that the distribution of the conditional distribution of y at given values of the explanatory variables is approximately normal.

h.

Draw the plot of the residuals against size of home and examine it.

State the conclusions from the graph.

Answer to Problem 60CP

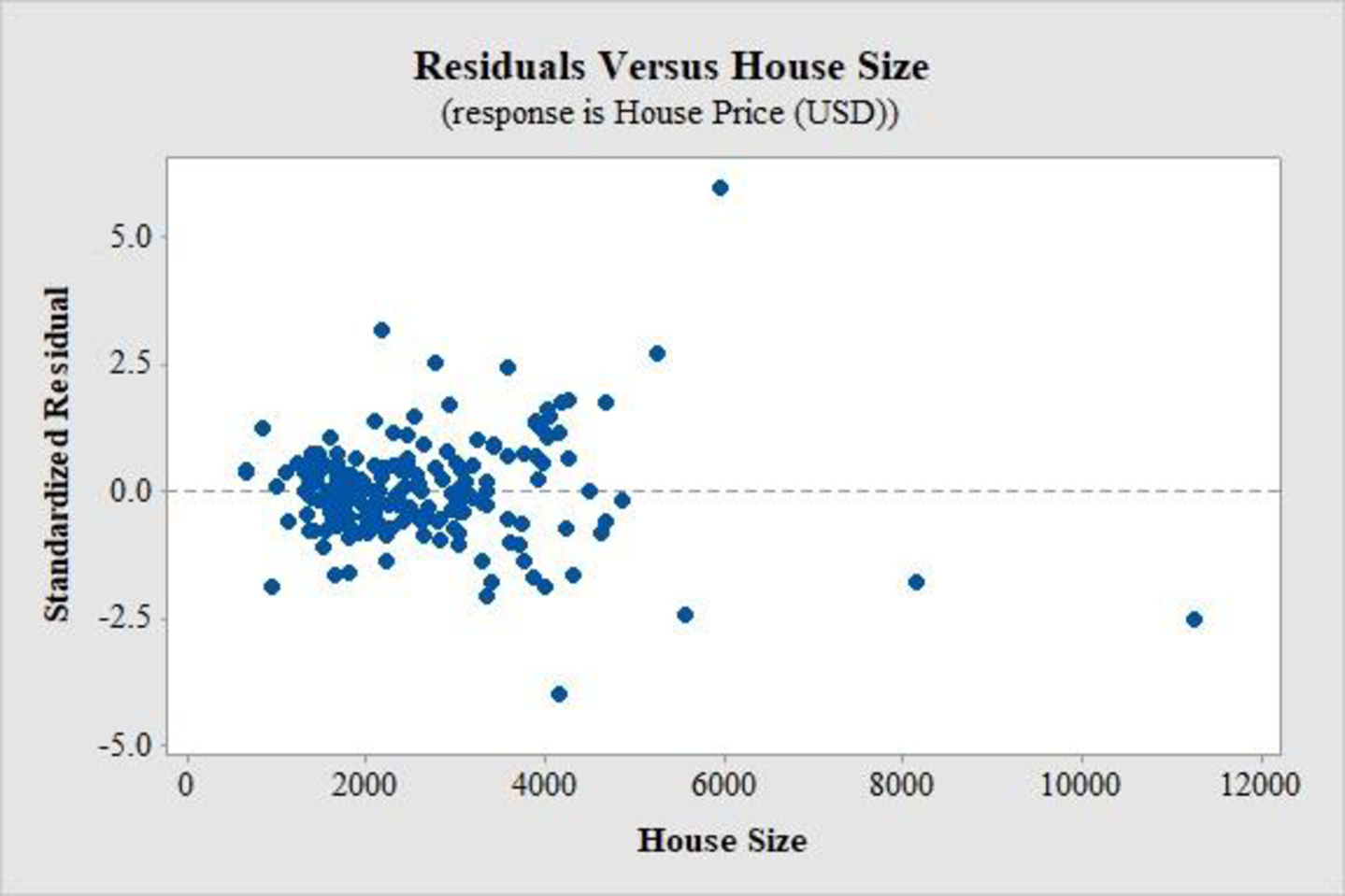

The plot for the residuals is as follows:

Explanation of Solution

Calculation:

Plot of residuals against size of home:

Software procedure:

Step by step procedure to obtain the histogram of the standardized residuals using the MINITAB software:

- Choose Stat > Regression > Regression > Fit Regression Model.

- Enter the column of y under House Price(USD).

- Enter the columns of House size, Bedrooms, and T Bath under Continuous predictors.

- Choose Results and select Analysis of variance, Model summary, Coefficients, Regression Equation.

- Choose Graphs.

- Choose Standardized under Residuals for plots.

- Under Residuals versus the variable, enter the column of House Size.

- Click OK in all dialogue boxes.

Thus, the plot of the residuals is obtained.

Interpretation:

The plot of the standardized residuals in this case is quite well-scattered and does not show any specific pattern. However, there is one value of the standardized residuals that is extremely high as compared to the others and one value that is fairly low. Moreover, the plot seems to become more scattered with an increase in house sizes.

Thus, the plot of residuals indicates that the relationship between the selling price and house sizes is quite straight, although a slightly greater deviation from the linearity occurs when house size increases.

Want to see more full solutions like this?

Chapter 13 Solutions

EBK STATISTICS

Additional Math Textbook Solutions

Basic Business Statistics, Student Value Edition

Algebra and Trigonometry (6th Edition)

Elementary Statistics

Introductory Statistics

Elementary Statistics: Picturing the World (7th Edition)

- 1 No. 2 3 4 Binomial Prob. X n P Answer 5 6 4 7 8 9 10 12345678 8 3 4 2 2552 10 0.7 0.233 0.3 0.132 7 0.6 0.290 20 0.02 0.053 150 1000 0.15 0.035 8 7 10 0.7 0.383 11 9 3 5 0.3 0.132 12 10 4 7 0.6 0.290 13 Poisson Probability 14 X lambda Answer 18 4 19 20 21 22 23 9 15 16 17 3 1234567829 3 2 0.180 2 1.5 0.251 12 10 0.095 5 3 0.101 7 4 0.060 3 2 0.180 2 1.5 0.251 24 10 12 10 0.095arrow_forwardstep by step on Microssoft on how to put this in excel and the answers please Find binomial probability if: x = 8, n = 10, p = 0.7 x= 3, n=5, p = 0.3 x = 4, n=7, p = 0.6 Quality Control: A factory produces light bulbs with a 2% defect rate. If a random sample of 20 bulbs is tested, what is the probability that exactly 2 bulbs are defective? (hint: p=2% or 0.02; x =2, n=20; use the same logic for the following problems) Marketing Campaign: A marketing company sends out 1,000 promotional emails. The probability of any email being opened is 0.15. What is the probability that exactly 150 emails will be opened? (hint: total emails or n=1000, x =150) Customer Satisfaction: A survey shows that 70% of customers are satisfied with a new product. Out of 10 randomly selected customers, what is the probability that at least 8 are satisfied? (hint: One of the keyword in this question is “at least 8”, it is not “exactly 8”, the correct formula for this should be = 1- (binom.dist(7, 10, 0.7,…arrow_forwardKate, Luke, Mary and Nancy are sharing a cake. The cake had previously been divided into four slices (s1, s2, s3 and s4). What is an example of fair division of the cake S1 S2 S3 S4 Kate $4.00 $6.00 $6.00 $4.00 Luke $5.30 $5.00 $5.25 $5.45 Mary $4.25 $4.50 $3.50 $3.75 Nancy $6.00 $4.00 $4.00 $6.00arrow_forward

- Faye cuts the sandwich in two fair shares to her. What is the first half s1arrow_forwardQuestion 2. An American option on a stock has payoff given by F = f(St) when it is exercised at time t. We know that the function f is convex. A person claims that because of convexity, it is optimal to exercise at expiration T. Do you agree with them?arrow_forwardQuestion 4. We consider a CRR model with So == 5 and up and down factors u = 1.03 and d = 0.96. We consider the interest rate r = 4% (over one period). Is this a suitable CRR model? (Explain your answer.)arrow_forward

- Question 3. We want to price a put option with strike price K and expiration T. Two financial advisors estimate the parameters with two different statistical methods: they obtain the same return rate μ, the same volatility σ, but the first advisor has interest r₁ and the second advisor has interest rate r2 (r1>r2). They both use a CRR model with the same number of periods to price the option. Which advisor will get the larger price? (Explain your answer.)arrow_forwardQuestion 5. We consider a put option with strike price K and expiration T. This option is priced using a 1-period CRR model. We consider r > 0, and σ > 0 very large. What is the approximate price of the option? In other words, what is the limit of the price of the option as σ∞. (Briefly justify your answer.)arrow_forwardQuestion 6. You collect daily data for the stock of a company Z over the past 4 months (i.e. 80 days) and calculate the log-returns (yk)/(-1. You want to build a CRR model for the evolution of the stock. The expected value and standard deviation of the log-returns are y = 0.06 and Sy 0.1. The money market interest rate is r = 0.04. Determine the risk-neutral probability of the model.arrow_forward

- Several markets (Japan, Switzerland) introduced negative interest rates on their money market. In this problem, we will consider an annual interest rate r < 0. We consider a stock modeled by an N-period CRR model where each period is 1 year (At = 1) and the up and down factors are u and d. (a) We consider an American put option with strike price K and expiration T. Prove that if <0, the optimal strategy is to wait until expiration T to exercise.arrow_forwardWe consider an N-period CRR model where each period is 1 year (At = 1), the up factor is u = 0.1, the down factor is d = e−0.3 and r = 0. We remind you that in the CRR model, the stock price at time tn is modeled (under P) by Sta = So exp (μtn + σ√AtZn), where (Zn) is a simple symmetric random walk. (a) Find the parameters μ and σ for the CRR model described above. (b) Find P Ste So 55/50 € > 1). StN (c) Find lim P 804-N (d) Determine q. (You can use e- 1 x.) Ste (e) Find Q So (f) Find lim Q 004-N StN Soarrow_forwardIn this problem, we consider a 3-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year. The interest rate is r = 0%. 16 22 28 12 16 12 8 4 2 time Figure 1: Stock evolution for Problem 1. (a) A colleague notices that in the model above, a movement up-down leads to the same value as a movement down-up. He concludes that the model is a CRR model. Is your colleague correct? (Explain your answer.) (b) We consider a European put with strike price K = 10 and expiration T = 3 years. Find the price of this option at time 0. Provide the replicating portfolio for the first period. (c) In addition to the call above, we also consider a European call with strike price K = 10 and expiration T = 3 years. Which one has the highest price? (It is not necessary to provide the price of the call.) (d) We now assume a yearly interest rate r = 25%. We consider a Bermudan put option with strike price K = 10. It works like a standard put, but you can exercise it…arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning