Concept explainers

Budgeted Purchases and

Mast Corporation seeks your assistance in developing cash and other budget information for May, June, and July. At April 30, the company had cash of $11,000,

- Each month’s sales are billed on the last day of the month.

- Customers are allowed a 2 percent discount if payment is made within 10 days after the billing date. Receivables are recorded in the accounts at their gross amounts (not net of discounts).

- The billings are collected as follows: 70 percent within the discount period, 15 percent by the end of the month, and 12 percent by the end of the following month. Three percent is uncollectible.

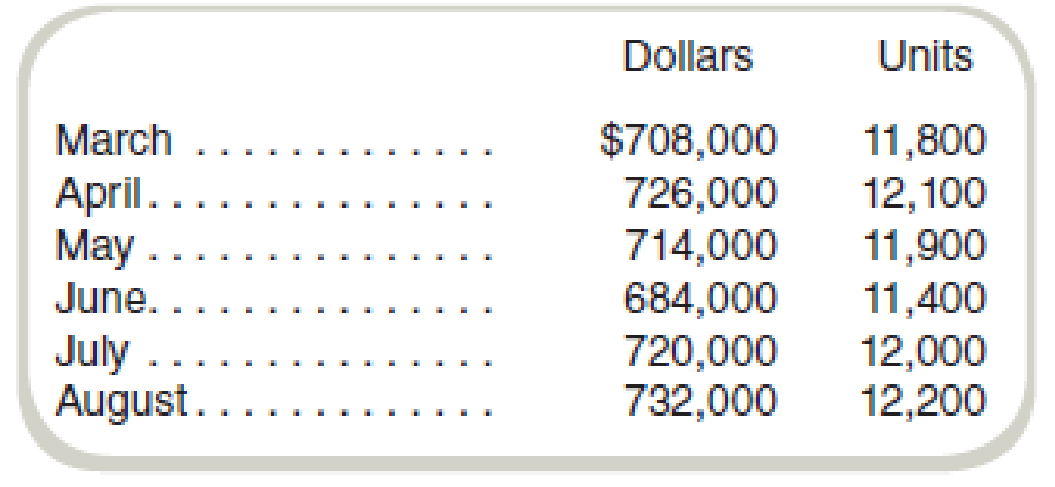

Purchase data are as follows:

- Of all purchases of merchandise and selling, general, and administrative expenses, 60 percent is paid in the month purchased and the remainder in the following month.

- The number of units in each month’s ending inventory equals 120 percent of the next month’s units of sales.

- The cost of each unit of inventory is $10.

- Selling, general, and administrative expenses, of which $4,000 is

depreciation , equal 15 percent of the current month’s sales. - Actual and projected sales follow:

Required

Compute the following:

- a. Budgeted purchases in dollars for May.

- b. Budgeted purchases in dollars for June.

- c. Budgeted cash collections during May.

- d. Budgeted cash disbursements during June.

- e. The budgeted number of units of inventory to be purchased during July.

a.

Calculate the Budgeted purchases in dollars for May.

Answer to Problem 58P

The budgeted purchase for May is $113,000.

Explanation of Solution

Budgeted purchase:

The budgeted purchase is the total amount of goods purchased in the budgeted to attain the targeted or estimated sales.

Calculate the budgeted purchase for May ($):

Thus, the budgeted purchase for May is $113,000.

Working note 1:

Calculate the closing stock:

Working note 2:

Calculate the opening stock:

Working note 3:

Calculate the budgeted purchase for May (units):

b.

Calculate the Budgeted purchases in dollars for June.

Answer to Problem 58P

The budgeted purchase for June is $121,200.

Explanation of Solution

Budgeted purchase:

The budgeted purchase is the total amount of goods purchased in the budgeted to attain the targeted or estimated sales.

Calculate the budgeted purchase for June ($):

Thus, the budgeted purchase for May is $121,200.

Working note 4:

Calculate the closing stock:

Working note 5:

Calculate the opening stock:

Working note 6:

Calculate the budgeted purchase for May (units):

c.

Calculate the Budgeted cash collection during May.

Answer to Problem 58P

The budgeted cash collection during May is $691,896.

Explanation of Solution

Budgeted cash collection:

Budgeted cash collection is the amount of total cash inflow in the budgeted period. Only the cash revenues and incomes are considered in the calculation.

Calculate the budgeted cash collection:

Cash collection will be made for April (70% and 15%) and May (12%) because sales of each month are billed on the last day of the month.

The billings have been collected as follows: 70 percent within the discount period (April), 15 percent by the end of the month (April), and 12 percent by the end of the following month (May). Three percent is uncollectible.

Customers are allowed a discount of 2% for making the payment within 10 after the billing date.

| Particulars | Sales |

70% (a) | 15% | 12% | 2% discount | Total cash collection |

| April | $726,000 | $508,200 | - | - | $10,164 | $498,036 |

| April | $726,000 | - | $108,900 | - | - | $108,900 |

| May | $708,000 | - | - | $84,960 | - | $84,960 |

| Total cash collection | $691,896 |

Table: (1)

Thus, the total cash collection for May is $691,896.

d.

Calculate the Budgeted cash disbursement during June.

Answer to Problem 58P

The budgeted cash disbursement during June is $218,320.

Explanation of Solution

Budgeted cash disbursement:

Budgeted cash disbursement is the amount of total cash outflow in the budgeted period. Only the cash expenses are considered in the calculation.

Calculate the budgeted cash disbursement for June:

Calculate the selling general and administrative expenses:

May:

June:

Calculate the purchase payment:

May:

June:

Thus, the total cash disbursement for June is $218,320

e.

Calculate the Budgeted number of units of inventory to be purchased during July.

Answer to Problem 58P

The budgeted purchase for July is 12,240.

Explanation of Solution

Budgeted purchase:

The budgeted purchase is the total amount of goods purchased in the budgeted to attain the targeted or estimated sales

Calculate the budgeted purchase for July (units):

Thus, the budgeted purchase for July is 12,240.

Working note 7:

Calculate the closing stock:

Working note 8:

Calculate the opening stock:

Want to see more full solutions like this?

Chapter 13 Solutions

FUNDAME.OF COST ACCT. W/CONNECT

- Suppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardPlease fill all cells! I need helparrow_forwardHilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forward

- general accountingarrow_forwardThe following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forwardPLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forward

- Assume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forwardwhat is the investment turnover?arrow_forwardA California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forward

- PLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardprovide correct answer accounting questionarrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,