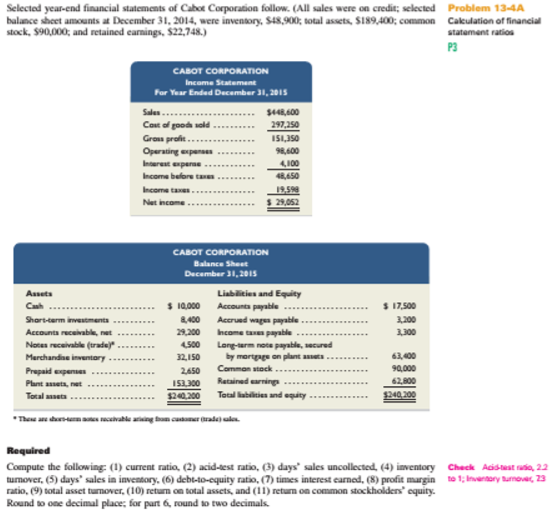

Selected year-end and financial statement of Cobalt Corporation follow. (All sales were on credit; Selected

Required

Compute the following; (1)

Round to one decimal places; for part 6, round to two decimals.

(1)

Introduction:

Liquidity or short-term ratios determines the ability of a firm to pay its current obligations. A good liquidity ration states that the company has liquid assets which can be easily convertible into cash. It includes current ratio, quick ratio etc.

To calculate:

Current ratio.

Answer to Problem 4PSA

Current ratio is 3.62:1

Explanation of Solution

= $86,900

= $24,000

= 3.62:1

(2)

Introduction:

Liquidity or short-term ratios determines the ability of a firm to pay its current obligations. A good liquidity ration states that the company has liquid assets which can be easily convertible into cash. It includes current ratio, quick ratio etc.

To calculate:

Acid-test ratio.

Answer to Problem 4PSA

Acid-test ratio is 2.2:1

Explanation of Solution

= 2.2:1

(3)

Introduction:

Days sales uncollected ratio helps the creditors and investors to measure the time in which company collects its account receivable.

To calculate:

Days sales uncollected.

Answer to Problem 4PSA

Days sales uncollected = 24 days

Explanation of Solution

= 24 days

(4)

Introduction:

Inventory turnover ratio measures how many times inventory is sold during a period.

To calculate:

Inventory turnover ratio.

Answer to Problem 4PSA

Inventory-turnover ratio is 7.3 times.

Explanation of Solution

= $40,525

= 7.3 times

(5)

Introduction:

Days sales in inventory calculates the time period which company takes to convert its inventory into sales.

To calculate:

Days sales in inventory.

Answer to Problem 4PSA

Days sales in inventory = 50 days

Explanation of Solution

= 50 days.

(6)

Introduction:

Debt-equity ratio measures the proportion of debt and equity in the capital structure.

To calculate:

Debt to equity ratio.

Answer to Problem 4PSA

Debt to equity ratio is 1.7:1

Explanation of Solution

= $87,400:

= $152,800

= 1.7:1

(7)

Introduction:

Time interest earned ratio measures the amount of income that will be required for for covering the interest expenses in the future.

To calculate:

Time interest earned.

Answer to Problem 4PSA

Time interest earned= 11.8

Explanation of Solution

= 11.8

(8)

Introduction:

Profit margin ratio is calculated by dividing net income by the net sales.

To calculate:

Profit margin ratio.

Answer to Problem 4PSA

Profit margin ratio is 6.4%

Explanation of Solution

= 6.4%

(9)

Introduction:

Asset turnover ratio calculates the ability of a company to generate sales with the total assets.

To calculate:

Asset-turnover ratio.

Answer to Problem 4PSA

Asset-turnover ratio = 1.8

Explanation of Solution

= 1.8:

(10)

Introduction:

Return on total asset is a ratio that calculated by dividing earning before income tax by total assets.

To calculate:

Return on total asset.

Answer to Problem 4PSA

Return on total asset is $0.18

Explanation of Solution

= $0.18

= $44,550

(11)

Introduction:

Return on common stockholder’s equity is calculated by dividing net income by shareholder’s equity. It helps in measuring the financial performance of a company.

To calculate:

Return on common stockholder’s equity.

Answer to Problem 4PSA

Return on common stockholder’s equity is $0.19

Explanation of Solution

= $0.19:

Want to see more full solutions like this?

Chapter 13 Solutions

Managerial Accounting

- Could you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardCaldwell Electronic Devices produces smartphone accessories. Estimated sales (in units) are 62,000 in July, 54,000 in August, and 49,500 in September. Each unit is priced at $35. Caldwell wants to have 45% of the following month's sales in ending inventory. That requirement was met on July 1. Each accessory requires 3 components and 8 feet of specialized cabling. Components cost $4 each, and cabling is $0.75 per foot. Caldwell wants to have 30% of the following month's production needs in ending raw materials inventory. On July 1, Caldwell had 45,000 components and 120,000 feet of cabling in inventory. What is Caldwell's expected sales revenue for August?arrow_forwardEinstein 2023 balance sheet showed net fixed assets of $3.1 million, while its 2022 balance sheet showed net fixed assets of $2.9 million. Its 2023 income statement reported a depreciation expense of $280,000. How much did Jason spend to acquire new fixed assets during 2023?arrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardJacobson Co. recently reported a net income of $7,840 and depreciation of $1,250. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets? provide answerarrow_forwardWhat is the value of valid returns of each averages $215?arrow_forward

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardPlease show me the correct approach to solving this financial accounting question with proper techniques.arrow_forward

- What was the amount of the net income for the year?arrow_forwardBased on potential sales of 800 units per year, a new product at Waverly Manufacturing has estimated traceable costs of $1,600,000. What is the target price to obtain a 25% profit margin on sales? A. $2,500.68 B. $2,400.21 C. $2,666.67 D. $1,950.55arrow_forwardHi expert please given correct answer with accountingarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning