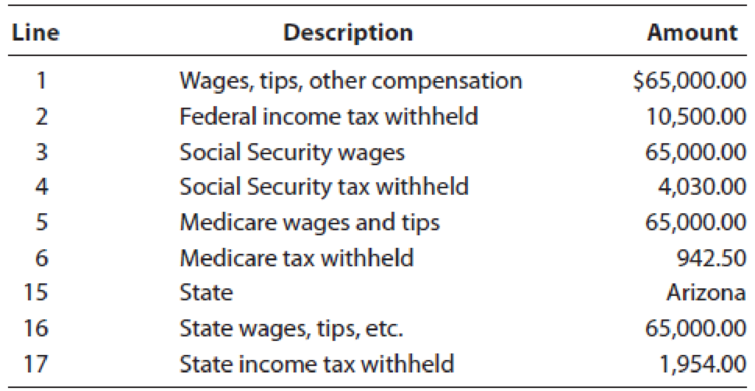

Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth’s birthday is July 4, 1972, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund. The following information is shown on Beth’s Wage and Tax Statement (Form W–2) for 2018.

The following information is shown on Beth’s Wage and Tax Statement (Form W–2) for 2018.

During the year, Beth received interest of $1,300 from Arizona Federal Savings and Loan and $400 from Arizona State Bank. Each financial institution reported the interest income on a Form 1099–INT. She received qualified dividends of $800 from Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation. Each corporation reported Beth’s dividend payments on a Form 1099–DIV.

Beth received a $1,100 income tax refund from the state of Arizona on April 29, 2018. On her 2017 Federal income tax return, she reported total itemized deductions of $8,200, which included $2,200 of state income tax withheld by her employer.

Fees earned from her part-time tax practice in 2018 totaled $3,800. She paid $600 to have the tax returns processed by a computerized tax return service.

On February 8, 2018, Beth bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2018, Beth sold the stock for $14 a share.

On January 2, 2018, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2018, for $55 a share. Both stock transactions were reported to Beth on Form 1099–B; basis was not reported to the IRS.

Beth bought a used sport utility vehicle for $6,000 on June 5, 2018. She purchased the vehicle from her brother-in-law, who was

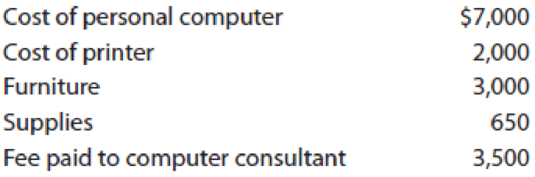

During the year, Beth records revenues of $16,000 from the sale of a software program she developed. Beth incurred the following expenses in connection with her software development business.

Beth elected to expense the maximum portion of the cost of the computer, printer, and furniture allowed under the provisions of § 179. These items were placed in service on January 15, 2018, and used 100% in her business.

Although her employer suggested that Beth attend a convention on current developments in corporate

During the year, Beth paid $300 for prescription medicines and $2,875 for doctor bills and hospital bills. Medical insurance premiums were paid for her by her employer. Beth paid real property taxes of $1,766 on her home. Interest on her home mortgage (Valley National Bank) was $3,845, and interest to credit card companies was $320. Beth contributed $2,080 to various qualifying charities during the year. Professional dues and subscriptions totaled $350.

Beth paid estimated taxes of $1,000.

Part 1—Tax Computation

Compute the net tax payable or refund due for Beth R. Jordan for 2018. If you use tax forms for your solution, you will need Form 1040 (and its Schedules 1, 4, 5, B, C, D, and SE) and Forms 4562 and 8949. Suggested software: ProConnect Tax Online

Part 2—Tax Planning

Beth is anticipating significant changes in her life in 2019, and she has asked you to estimate her taxable income and tax liability for 2019.

Beth just received word that she has been qualified to adopt a two-year-old daughter. Beth expects that the adoption will be finalized in 2019 and that she will incur approximately $2,000 of adoption expenses. In addition, she expects to incur approximately $3,500 of child and dependent care expenses relating to the care of her new daughter, which will enable her to keep her job at Mesa Manufacturing Company. However, with the additional demands on her time because of her daughter, she has decided to discontinue her two part-time jobs (i.e., the part-time tax practice and her software business), and she will cease making estimated income tax payments. Beth expects her interest income to increase from $1,700 to $2,050.

In your computations, assume that all other 2019 income and expenses will be the same as 2018 amounts.

Part 1

Determine the net income tax payable or refund due for Ms B for 2018.

Explanation of Solution

Determine the net income tax payable or refund due for Ms B for 2018.

| Calculation of Income Tax Payable (or Refund Due) | |||

| Description | Amount ($) | Amount ($) | |

| Gross Income: | |||

| Salary | $65,000 | ||

| Interest and Dividend Income | |||

| Interest on Savings | $1,300 | ||

| Interest from AS Bank | 400 | ||

| Dividends on B Stock | 800 | ||

| Dividends on G Stock | 750 | ||

| Dividends on O Stock | 650 | 3,900 | |

| State income tax refund | 1,100 | ||

| Business Income | 19,800 | Refer Note 1 | |

| Net Short-Term Capital Gain | 1,200 | Refer Note 2 | |

| Gross Income | 91,000 | ||

| Less: ‘For AGI Deduction’ | |||

| Business expenses | (16,750) | Refer Note 3 | |

| Self-employment tax deduction | (216) | Refer Note 4 | |

| Adjusted Gross Income (AGI) | 74,034 | ||

| Less: ‘From AGI Deduction’ | |||

| Itemized deductions ($9,645) or standard deduction ($12,000), whichever is greater | (12,000) | Refer Note 5 | |

| Deductions for qualified business income | (567) | Refer Note 6 | |

| Taxable Income | $61,467 | ||

| Tax Liability | $9,308 | Refer Note 7 | |

| Self-employment Tax | 431 | Refer Note 4 | |

| Total Tax Liability | $9,739 | ||

| Less: Tax withholdings by employer | (10,500) | ||

| Estimated taxes | (1,000) | ||

| Net tax payable (or refund due) for 2018 | $(1,761) | ||

Note (1): Compute business income amount.

| Details | Amount ($) |

| Revenue from part-time tax practice | $3,800 |

| Royalties received for software program | 16,000 |

| Total business income | $19,800 |

Note (2): Compute short-term capital gain (STCG).

Step 1: Compute cost of short-term capital investment as at purchase date.

| Security | Number of Shares | Cost Price | = | Cost of Investment | |

| Corporation G | 500 shares | $17.60 | = | $8,800 | |

| Sports Utility Vehicle | 6,000 | ||||

| Corporation B | 100 shares | 30 | = | 3,000 | |

| Total | $17,800 | ||||

Step 2: Compute the sale proceeds from short-term capital investment.

| Security | Number of Shares | Sale Price | = | Sale Proceeds | |

| Corporation G | 500 shares | $14 | = | $7,000 | |

| Sports Utility Vehicle | 6,500 | ||||

| Corporation B | 100 shares | 55 | = | 5,500 | |

| Total | $19,000 | ||||

Step 3: Prepare the schedule of cost and market of the investment portfolio.

| Security | Sale Proceeds | – | Cost of Investment | = | Gain (Loss) |

| Corporation G | $7,000 | – | $8,800 | = | $(1,800) |

| Sports Utility Vehicle | 6,500 | – | 6,000 | = | 500) |

| Corporation B | 5,500 | – | 3,000 | = | 2,500 |

| Total | $19,000 | – | $17,800 | = | $1,200 |

Note (3): Compute business expenses amount.

| Details | Amount ($) |

| Processing fee for part-time tax practice | $600 |

| Cost of personal computer | 7,000 |

| Cost of printer | 2,000 |

| Furniture cost | 3,000 |

| Supplies cost | 650 |

| Fee paid to computer consultant | 3,500 |

| Total business expenses | $16,750 |

Note (4): Compute self-employment deduction amount.

Step 1: Compute B’s earnings from self-employment.

| Details | Amount ($) |

| Business income | $19,800 |

| Business expenses | 16,750 |

| B’s earnings | $3,050 |

Step 2: Compute net self-employment income not subject to FICA tax.

Step 3: Compute excess of Social Security portion over FICA (Federal Insurance Contributions Act Taxes) wages.

| Details | Amount ($) |

| Social Security ceiling | $128,400 |

| Less: FICA wages | (65,000) |

| Net ceiling | $63,400 |

Step 4: Compute Social Security tax on lesser of Step 2 and Step 3.

Since value of Step 2 is lesser than value of Step 3, compute Social Security Tax on value of Step 2.

Step 5: Compute Medicare tax on lesser of Step 2 and Step 3.

Since value of Step 2 is lesser than value of Step 3, compute Medicare Tax on value of Step 2.

Step 6: Compute total self-employment tax.

| Details | Amount ($) |

| Social Security tax | $349 |

| Medicare tax | 82 |

| Self-employment tax | $431 |

Step 7: Compute self-employment tax deduction amount.

Note (5): Compute the itemized deductions.

| Description | Amount ($) |

| Medical expenses | $0 |

| Home mortgage interest | 3,845 |

| Real property taxes on home | 1,766 |

| Charitable contributions to church | 1,560 |

| Charitable contributions to U Way | 520 |

| Sales tax | 1,954 |

| Total itemized deductions | $9,645 |

Working Notes:

Compute medical expenses amount.

Note: Since the medical expenses do not exceed the 2% limit, they are not subject to deduction.

Compute charitable contributions to church amount.

Compute charitable contributions to U Way.

Note (6): Calculate deduction for qualified business income.

Note (7): Compute tax liability.

Step 1: Compute tax liability of qualified dividends.

Step 2: Compute tax liability on the remaining taxable income of $59,267 ($61,467 − $2,200).

Note: Refer to the Schedule X of 2018 Federal Tax Rate Schedule.

Step 3: Compute total tax liability.

Part 2

Determine the net income tax payable or refund due for Ms B for 2019, after the changes.

Explanation of Solution

Determine the net income tax payable or refund due for Ms B for 2019, after the changes.

| Calculation of Federal Income Tax Payable (or Refund Due) | |||

| Description | Amount ($) | Amount ($) | |

| Gross Income: | |||

| Salary | $65,000 | ||

| Interest and Dividend Income | |||

| Interest income | $2,050 | ||

| Dividends on B Stock | 800 | ||

| Dividends on G Stock | 750 | ||

| Dividends on O Stock | 650 | 4,250 | |

| State income tax refund | 1,100 | ||

| Net Short-Term Capital Gain | 1,200 | Refer Note 2 of Part 1 | |

| Gross Income | 71,550 | ||

| Less: ‘For AGI Deduction’ | (0) | ||

| Adjusted Gross Income (AGI) | 71,550 | ||

| Less: ‘From AGI Deduction’ | |||

| Itemized deductions (9,645) or standard deduction ($18,350) , whichever is greater | (18,350) | Refer Note 5 of Part 1 | |

| Taxable Income | $53,200 | ||

| Tax Liability | $5,908 | Refer Note 1 of Part 2 | |

| Less: Tax withholdings by employer | (10,500) | ||

| Child tax credit | (2,000) | ||

|

Credit for child and dependent care expenses($3,000 × 20%) | (600) | ||

| Adoption expenses credit | (2,000) | ||

| Net tax payable (or refund due) for 2019 | $(9,192) | ||

Note (1): Compute tax liability.

Step 1: Compute tax liability of qualified dividends.

Step 2: Compute tax liability on the remaining taxable income of $51,000 ($53,200 − $2,200).

Step 3: Compute total tax liability.

Want to see more full solutions like this?

Chapter 13 Solutions

Individual Income Taxes

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT