Sub part (a):

Consumption schedule and marginal propensity to consume.

Sub part (a):

Explanation of Solution

Table -1 shows the consumption schedule:

Table -1

|

| Consumption |

| 100 | 120 |

| 200 | 200 |

| 300 | 280 |

| 400 | 360 |

| 500 | 440 |

| 600 | 520 |

| 700 | 600 |

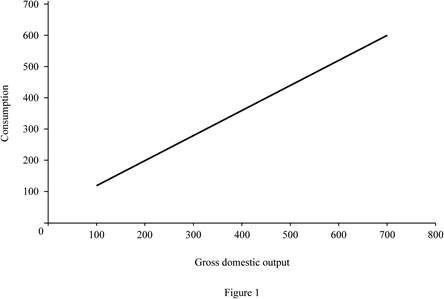

Figure 1 illustrates the level of consumption at different level of gross domestic product (GDP).

In Figure 1, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Size of marginal propensity to consume (MPC) can be calculated as follows.

The size of marginal propensity to consume is 0.8.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Sub part (b):

Disposable income, tax rate, consumption schedule, marginal propensity to consume and multiplier.

Sub part (b):

Explanation of Solution

Disposable income (DI) can be calculated by using the following formula.

Substitute the respective values in Equation (1) to calculate the disposable income at the level of GDP $100.

Disposable income at the level of GDP $100 is $90.

Tax rate can be calculated by using the following formula.

Substitute the respective values in Equation (2) to calculate the tax rate at the level of GDP $100.

Tax rate at the level of GDP is 10%.

New consumption level can be calculated by using the following formula.

Substitute the respective values in Equation (3) to calculate the disposable income at the level of GDP $100. Since, the tax payment is equal amount of decrease in consumption for all the levels of GDP. The decreasing consumption for increasing $10 is assumed to be $8.

New consumption is $112.

Table -2 shows the values of disposable income, new consumption level after tax and the tax rate that are obtained by using Equations (1), (2) and (3).

Table -2

| Gross domestic product | Tax | DI | New consumption | Tax rate |

| 100 | 10 | 90 | 112 | 10% |

| 200 | 10 | 190 | 192 | 5% |

| 300 | 10 | 290 | 272 | 3.33% |

| 400 | 10 | 390 | 352 | 2.5% |

| 500 | 10 | 490 | 432 | 2% |

| 600 | 10 | 590 | 512 | 1.67% |

| 700 | 10 | 690 | 592 | 1.43% |

Size of marginal propensity to consume (MPC) can be calculated as follows.

The size of marginal propensity to consume is 0.8.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption, at a constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save. Multiplier can be evaluated using the following formula:

Since the value of MPC remains the same for part (a) and part (b), there is no change in the value of multiplier. The value of multiplier is 5

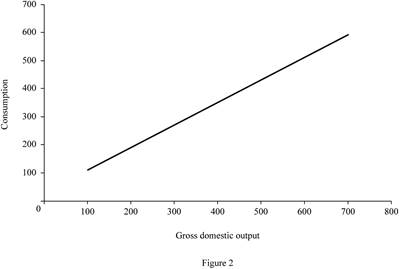

Figure -2 illustrates the level of consumption at different level of gross domestic product (GDP) for lump sum tax (Regressive tax).

In Figure -2, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Sub part (c):

Tax amount, consumption schedule, marginal propensity to consume and multiplier.

Sub part (c):

Explanation of Solution

Tax amount can be calculated by using the following formula.

Substitute the respective values in Equation (4) to calculate the tax amount at $100 GDP.

Tax amount is $10.

Table -3 shows the values of disposable income, new consumption level after tax and the tax rate that are obtained by using Equations (1), (2), (3) and (4). The change in tax amount is differing for different levels of GDP. The decreasing consumption for increasing each $10 is assumed to be $8 (Thus, if the tax payment is $30, then the consumption decreases by $24

Table -3

| Gross domestic product | Tax | DI | New consumption | Tax rate |

| 100 | 10 | 90 | 112 | 10% |

| 200 | 20 | 180 | 184 | 10% |

| 300 | 30 | 270 | 256 | 10% |

| 400 | 40 | 360 | 328 | 10% |

| 500 | 50 | 450 | 400 | 10% |

| 600 | 60 | 540 | 472 | 10% |

| 700 | 70 | 630 | 544 | 10% |

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption, at a constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save. Multiplier can be evaluated using the following formula:

Since the value of MPC different for part (a) and part (c), the value of multiplier for both the part is different. The value of multiplier is 3.57

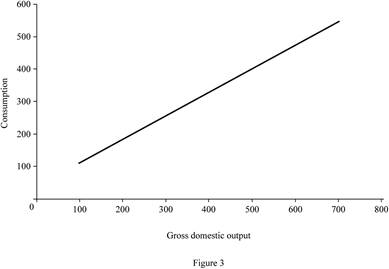

Figure -3 illustrates the level of consumption at different level of gross domestic product (GDP) for proportional tax.

In Figure -3, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Sub part (d):

consumption schedule, marginal propensity to consume and multiplier.

Sub part (d):

Explanation of Solution

Marginal propensity to consume can be calculated by using the following formula.

Substitute the respective values in Equation (5) to calculate the MPC at $100 GDP.

The value of MPC is 0.72.

Table -4 shows the values of disposable income, new consumption level after tax and the tax rate that are obtained by using Equations (1), (2), (3), (4) and (5). The change in tax amount is differing for different levels of GDP. The decreasing consumption for increasing each $10 is assumed to be $8 (Thus, if the tax payment is $20, then the consumption decreases by $16

Table -3

| Gross domestic product | Tax | DI | New consumption | Tax rate | MPC |

| 100 | 0 | 100 | 120 | 0% | |

| 200 | 10 | 190 | 192 | 5% | 0.8 |

| 300 | 30 | 270 | 256 | 10% | 0.64 |

| 400 | 60 | 340 | 312 | 15% | 0.56 |

| 500 | 100 | 400 | 360 | 20% | 0.48 |

| 600 | 150 | 450 | 400 | 25% | 0.4 |

| 700 | 210 | 490 | 432 | 30% | 0.32 |

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption, at a constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

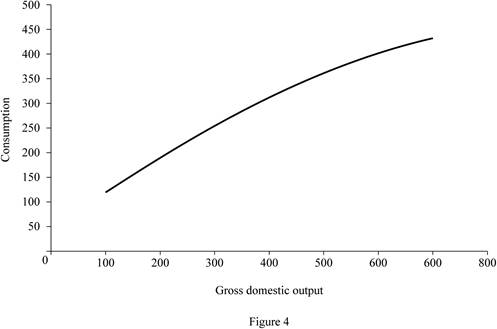

Multiplier value is differing for each level of GDP. When the tax rate increases, it reduces the value of MPC. Since the value of MPC decreases, the value of multiplier will also decrease.

Figure 4 illustrates the level of consumption at different level of gross domestic product (GDP) for progressive tax.

In Figure 4, the horizontal axis measures the gross domestic output and the vertical axis measures the consumption level.

Concept introduction:

Consumption schedule: Consumption schedule refers to the quantity of consumption at different levels of income.

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Sup part (e):

Marginal propensity to consume and multiplier.

Sup part (e):

Explanation of Solution

Figure 1, Figure 2, Figure 3 and Figure 4 reveals that the proportional and progressive tax system reduces the value of MPC, so that the value of multiplier also decreases. The regressive tax system (Lump sum tax) does not alter the MPC. Since there is no change in the MPC, the multiplier remains the same.

Concept introduction:

Marginal propensity to consume (MPS): Marginal propensity to consume refers to the sensitivity of change in the consumption level due to the changes occurred in the income level.

Progressive tax: Progressive tax refers to the higher income people paying higher tax amount than the lower income people.

Proportional tax: Proportional tax rate refers to the fixed tax rate regardless of income and the tax rate and is the same for all levels of income.

Regressive tax: Regressive tax refers to the higher income people paying lower percentage of tax amount and lower income people paying higher percentage of tax amount.

Multiplier: Multiplier refers to the ratio of change in the real GDP to the change in initial consumption at constant price rate. Multiplier is positively related to the marginal propensity to consumer and negatively related with the marginal propensity to save.

Want to see more full solutions like this?

- 17. Given that C=$700+0.8Y, I=$300, G=$600, what is Y if Y=C+I+G?arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. Write explanation in paragraphs and if you use currency use USD currency: 10. What is the mechanism or process that allows the expenditure multiplier to “work” in theKeynesian Cross Model? Explain and show both mathematically and graphically. What isthe underpinning assumption for the process to transpire?arrow_forwardUse the Feynman technique throughout. Assume that you’reexplaining the answer to someone who doesn’t know the topic at all. Write it all in paragraphs: 2. Give an overview of the equation of exchange (EoE) as used by Classical Theory. Now,carefully explain each variable in the EoE. What is meant by the “quantity theory of money”and how is it different from or the same as the equation of exchange?arrow_forward

- Zbsbwhjw8272:shbwhahwh Zbsbwhjw8272:shbwhahwh Zbsbwhjw8272:shbwhahwhZbsbwhjw8272:shbwhahwhZbsbwhjw8272:shbwhahwharrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all:arrow_forwardUse the Feynman technique throughout. Assume that you’reexplaining the answer to someone who doesn’t know the topic at all: 4. Draw a Keynesian AD curve in P – Y space and list the shift factors that will shift theKeynesian AD curve upward and to the right. Draw a separate Classical AD curve in P – Yspace and list the shift factors that will shift the Classical AD curve upward and to the right.arrow_forward

- Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all: 10. What is the mechanism or process that allows the expenditure multiplier to “work” in theKeynesian Cross Model? Explain and show both mathematically and graphically. What isthe underpinning assumption for the process to transpire?arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all: 15. How is the Keynesian expenditure multiplier implicit in the Keynesian version of the AD/ASmodel? Explain and show mathematically. (note: this is a tough one)arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all: 13. What would happen to the net exports function in Europe and the US respectively if thedemand for dollars rises worldwide? Explain why.arrow_forward

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning