1.

Calculate the price for the part using a markup of 45% of full

1.

Explanation of Solution

Calculate the price for the part using a markup of 45% of full manufacturing cost as follows:

Working note (1):

Calculate the total variable cost.

Working note (2):

Calculate the total fixed cost.

Working note (3):

Calculate the total manufacturing cost.

Working note (4):

Calculate the total selling and administrative.

Working note (5):

Calculate the total life cycle cost.

Working note (6):

Calculate the manufacturing cost per unit.

Working note (7):

Calculate the life cycle cost per unit.

2.

Calculate the price for the part using a markup of 25% of full life-cycle cost.

2.

Explanation of Solution

Calculate the price for the part using a markup of 25% of full life-cycle cost as follows:

3.

Calculate the price for the part using a desired gross margin percentage to sales of 40%.

3.

Explanation of Solution

Calculate the price for the part using a desired gross margin percentage to sales of 40% as follows:

4.

Calculate the price for the part using a desired life-cycle cost percentage to sales of 25%.

4.

Explanation of Solution

Calculate the price for the part using a desired life-cycle cost percentage to sales of 25% as follows:

5.

Calculate price for the part using a desired before tax

5.

Explanation of Solution

Calculate price for the part using a desired before tax return on investment of 15%t as follows:

Working note (8):

Calculate the total investment rate.

6.

Calculate the contribution margin and operation profit for each method and choose the appropriate price.

6.

Explanation of Solution

Calculate the contribution margin and operation profit for each method and choose the appropriate price as follows:

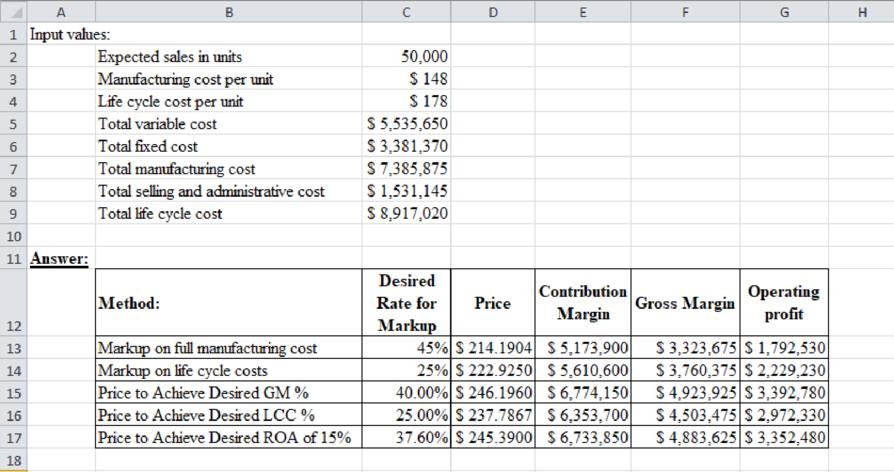

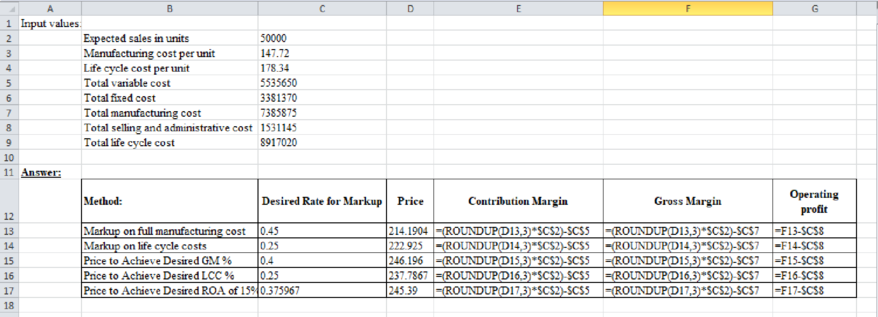

Table (1)

Excel workings:

Table (1)

Price to achieve desired ROA of 15% is better price for the company, because the operating profit from this price is more than the other.

Want to see more full solutions like this?

Chapter 13 Solutions

COST MANAGEMENT (W/CONNECT ACCESS)(LOOS

- I need help with question is correct answer and accountingarrow_forwardWhat is the total manufacturing overhead costarrow_forwardBenjamin Manufacturing reports beginning and ending work in process inventories of $12,400 and $20,600, respectively. If the cost of goods manufactured during the period is $205,000, what is the total manufacturing cost for the period?arrow_forward

- Please provide the answer to this general accounting question using the right approach.arrow_forwardRiverstone Company began the year with inventory worth $87,500. During the year, they purchased additional inventory for $325,000. At the end of the year, a physical count showed inventory worth $93,200. Calculate the Cost of Goods Sold (COGS) for the period using the periodic inventory system.arrow_forwardCompute the company's predetermined overhead ratearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education