Stock transactions for corporate expansion

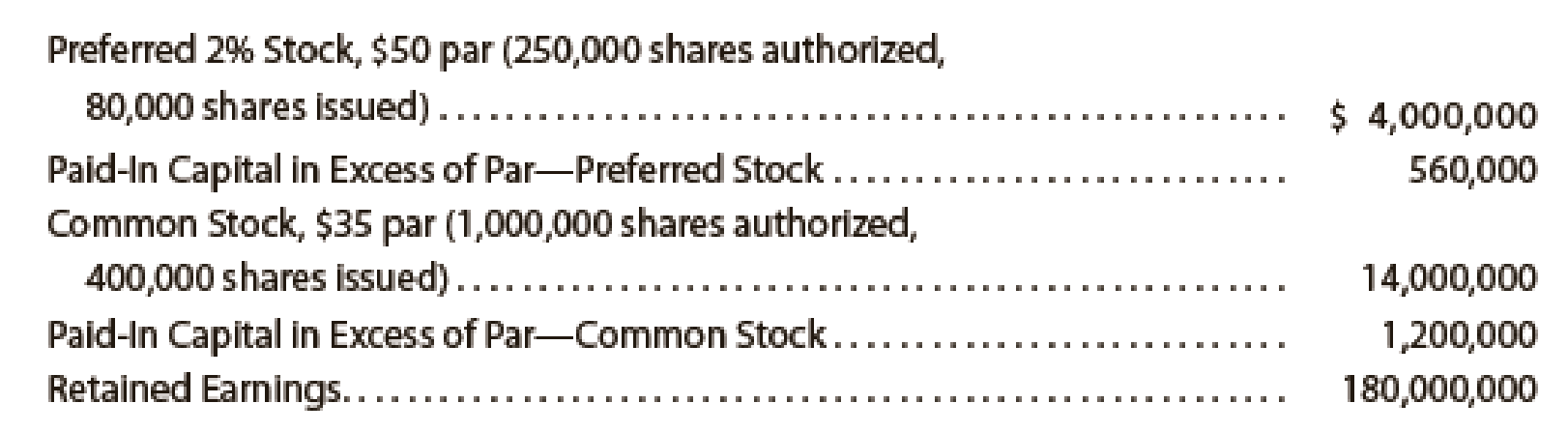

On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor:

At the annual stockholders’ meeting on March 31, the board of directors presented a plan for modernizing and expanding plant operations at a cost of approximately $11,000,000. The plan provided (a) that a building, valued at $3,375,000, and the land on which it is located, valued at $1,500,000, be acquired in accordance with preliminary negotiations by the issuance of 125,000 shares of common stock valued at $39 per share, (b) that 40,000 shares of the unissued

May 11. Issued 125,000 shares of common stock in exchange for land and a building, according to the plan.

20. Issued 40,000 shares of preferred stock, receiving $52 per share in cash.

31. Borrowed $4,000,000 from Laurel National, giving a 5% mortgage note.

Instructions

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardMontu Consultants Corporation obtained a building, its surrounding land, and a computer system in a lump-sum purchase for $375,000. An appraisal set the value of the land at $184,500, the building at $144,000, and the computer system at $121,500. At what amount should Montu Consultants record each new asset on its books?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI am searching for a clear explanation of this financial accounting problem with valid methods.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

- Donna Steakhouse, a high-end restaurant, began its operations in 2018. Its fixed assets had a book value of $1,250,000 in 2019. The restaurant did not purchase any fixed assets in 2019. The annual depreciation expense on fixed assets was $125,000, and the accumulated depreciation account had a balance of $250,000 on December 31, 2019. What was the original cost of fixed assets owned by the restaurant in 2018 when it started its operations?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardSamantha Sullivan's monthly pay stub indicates that her monthly gross income is $5,800. However, $1,250 is withheld for income and Social Security taxes, $320 is withheld for her health and dental insurance, and another $350 is contributed to her retirement plan. How much is Samantha's disposable income?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage