1.

Trading securities:

These are short-term investments in debt and equity securities with an intention of trading and earning profits due to changes in market prices.

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

To journalize: The stock investment transactions in the books of Incorporation Z.

1.

Explanation of Solution

Prepare journal entry for the purchase of 4,800 shares of Incorporation AP, at $26 per share, and a brokerage commission of $192.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2016 | |||||

| February | 14 | Investments–Incorporation AP Stock | 124,992 | ||

| Cash | 124,992 | ||||

| (To record purchase of shares for cash) | |||||

Table (1)

- Investments–Incorporation AP Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Incorporation AP’s stock.

Prepare journal entry for the purchase of 2,300 shares of Incorporation

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2016 | |||||

| April | 1 | Investments–Incorporation AR Stock | 43,792 | ||

| Cash | 43,792 | ||||

| (To record purchase of shares for cash) | |||||

Table (2)

- Investments–Incorporation AR Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Incorporation AR’s stock.

Prepare journal entry for sale of 600 shares of Incorporation AP, at $32, with a brokerage of $100.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2016 | |||||

| June | 1 | Cash | 19,100 | ||

| Gain on Sale of Investments | 3,476 | ||||

| Investments–Incorporation AP Stock | 15,624 | ||||

| (To record sale of shares) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Loss on Sale of Investments is a loss or expense account. Since losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Investments–Incorporation AP Stock is an asset account. Since stock investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the realized gain (loss) on sale of stock.

Step 1: Compute cash received from sale proceeds.

Step 2: Compute cost of stock investment sold.

Step 3: Compute realized gain (loss) on sale of stock.

Note: Refer to Steps 1 and 2 for value and computation of cash received and cost of stock investment sold.

Prepare journal entry for the dividend received from Incorporation AP for 4,200 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2016 | |||||

| June | 27 | Cash | 840 | ||

| Dividend Revenue | 840 | ||||

| (To record receipt of dividend revenue) | |||||

Table (4)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Incorporation AP’s stock.

Prepare

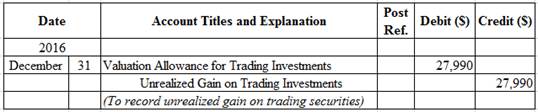

Figure (1)

- Valuation Allowance for Trading Investments is a contra-asset account. The account is credited because the market price was increased (gain) to $181,150 from the cost of $153,160.

- Unrealized Gain on Trading Investments is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since gain has occurred and increase stockholders’ equity value, and an increase in stockholders’ equity value is debited.

Working Notes:

Compute the unrealized gain (loss) as on December 31.

Step 1: Compute the fair value of the portfolio of the trading investment.

| Security | Number of Shares | Fair Market Value | = | Fair Market Value of Investment | |

| Incorporation AP | 4,200 shares | $33.00 | = | $138,600 | |

| Incorporation AR | 2,300 shares | 18.50 | = | 42,550 | |

| Total | $181,150 | ||||

Table (5)

Step 2: Compute the cost per share of Incorporation AP.

Step 3: Compute the cost per share of Incorporation AR.

Step 4: Compute the cost of the portfolio of the trading investment, as on December 31, 2016.

| Security | Number of Shares | Cost per Share | = | Cost of Investment | |

| Incorporation AP | 4,200 shares | $26.04 | = | $109,368 | |

| Incorporation AR | 2,300 shares | 19.04 | = | 43,792 | |

| Total | $153,160 | ||||

Table (6)

Note: Refer to Steps 3 and 4 for cost per share of Incorporation AP and Incorporation AR.

Step 5: Compute the unrealized gain (loss) as on December 31, 2016.

| Details | Amount ($) |

| Trading investments at fair value, December 31 (From Table-5) | $181,150 |

| Less: Trading investments at cost, December 31 (From Table-6) | (153,160) |

| Unrealized loss on trading investments | $27,990 |

Table (7)

Prepare journal entry for the purchase of 1,200 shares of Incorporation AT, at $65 per share, and a brokerage commission of $120.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2017 | |||||

| March | 14 | Investments–Incorporation AT Stock | 78,120 | ||

| Cash | 78,120 | ||||

| (To record purchase of shares for cash) | |||||

Table (8)

- Investments–Incorporation AT Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Incorporation AT’s stock.

Prepare journal entry for the dividend received from Incorporation AP for 4,200 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2017 | |||||

| June | 26 | Cash | 882 | ||

| Dividend Revenue | 882 | ||||

| (To record receipt of dividend revenue) | |||||

Table (9)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Incorporation AP’s stock.

Prepare journal entry for sale of 480 shares of Incorporation AT at $60, with a brokerage of $50.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| 2017 | |||||

| July | 30 | Cash | 28,750 | ||

| Loss on Sale of Investments | 2,498 | ||||

| Investments–Incorporation AT Stock | 31,248 | ||||

| (To record sale of shares) | |||||

Table (10)

Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Loss on Sale of Investments is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Investments–Incorporation AT Stock is an asset account. Since stock investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the realized gain (loss) on sale of stock.

Step 1: Compute cash received from sale proceeds.

Step 2: Compute cost of stock investment sold.

Step 3: Compute realized gain (loss) on sale of stock.

Note: Refer to Steps 1 and 2 for value and computation of cash received and cost of stock investment sold.

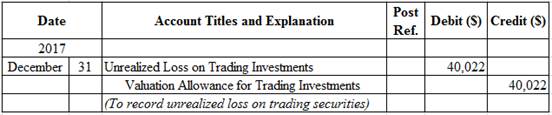

Prepare adjusting entry for valuation of trading securities transaction.

Figure (2)

- Unrealized Loss on Trading Investments is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since loss has occurred and losses decrease stockholders’ equity value, and a decrease in stockholders’ equity value is debited.

- Valuation Allowance for Trading Investments is a contra-asset account. The account is credited because the market price was decreased (loss).

Working Notes:

Compute the unrealized gain (loss) as on December 31, 2017.

| Details | Amount ($) |

| Unrealized loss as on December 31, 2017 | $12,032 |

| Add: Unrealized gain as on December 31, 2016 (From Table-7) | 27,990 |

| Unrealized loss on trading investments | $40,022 |

Table (11)

2.

To indicate: The presentation of trading investments on the current assets section of the

2.

Explanation of Solution

Balance sheet presentation:

| Incorporation Z | ||

| Balance Sheet (Partial) | ||

| December 31, 2017 | ||

| Assets | ||

| Current assets: | ||

| Trading investments (at cost) | $200,032 | |

| Less valuation allowance for trading investments | (12,032) | |

| Trading investments (at fair value) | $188,000 | |

Table (12)

3.

To discuss: The reporting of trading investments on the financial statements

3.

Explanation of Solution

Unrealized gain or loss is the result of change in trading investments cost and fair values, and reported as Other Revenues (Losses) on the income statement. The unrealized gain will be added to the net income and unrealized loss will be deducted from the net income. In 2016, Incorporation Z would report $27,990 of unrealized gain as Other Income on the income statement. In the 2017, Incorporation Z would report $40,022 of unrealized loss as Other Losses on the income statement.

Want to see more full solutions like this?

Chapter 13 Solutions

Working Papers, Volume 1, Chapters 1-15 for Warren/Reeve/Duchac's Corporate Financial Accounting, 13th + Financial & Managerial Accounting, 13th

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning