a.

To determine: The Maximum Price per Share.

Introduction: The

The cost of debt is the effective interest rate of cost which a business earns on their current debts. Debt involves in the formation of capital structure. As the debt is considered as a deduction expenditure, the cost of debt is usually determined as after-tax cost in order to formulate similar to the cost of equity.

a.

Answer to Problem 21QP

The Maximum Price per Share is $62.17

Explanation of Solution

Determine the Total Market Value

Therefore the Total Market Value is $52,000,000

Determine the Weight of Debt and Equity

Therefore the Weight of Debt is 26.92% and Equity is 73.08%

Determine the WACC of the Company

Therefore the WACC of the Company is 9.04%

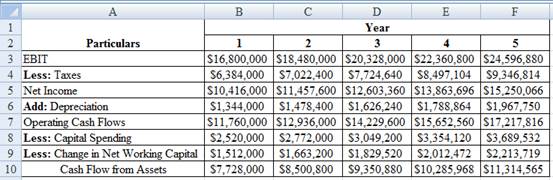

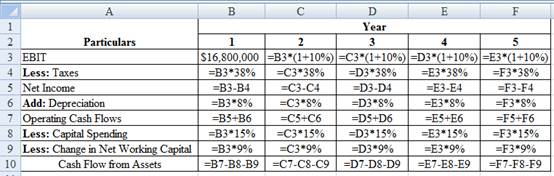

Determine the Cash Flow from Assets

Using a excel spreadsheet we compute the cash flow from assets as,

Excel Spreadsheet:

Excel Workings:

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $192,947,048.74

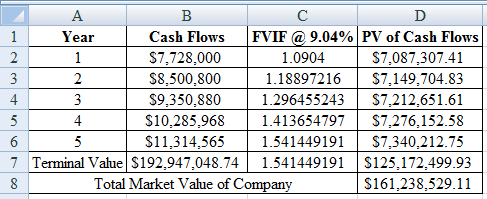

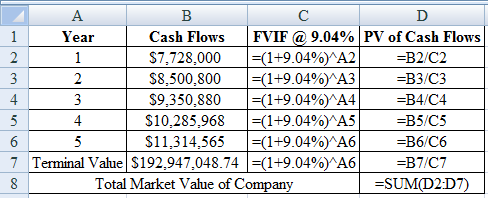

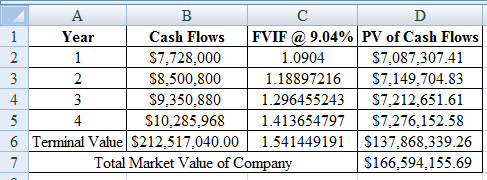

Determine the Total Market Value of the Company

Using a excel spreadsheet we calculate the total value of company as,

Excel Spreadsheet:

Excel Workings:

Therefore the Total Market Value of the Company is $161,238,529.11

Determine the Total Market Value of Equity

Therefore the Total Market Value of Equity is $121,238,529.11

Determine the Maximum Price per Share

Therefore the Maximum Price per Share is $62.17

b.

To determine: The New Estimate of Maximum Price per Share.

b.

Answer to Problem 21QP

The Maximum Price per Share is $64.92

Explanation of Solution

Determine the Earnings Before Interest on Taxes,

Therefore the Earnings Before Interest on Taxes, Depreciation and Amortization (EBITDA) is $26,564,630

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $212,517,040

Determine the Total Market Value of Company

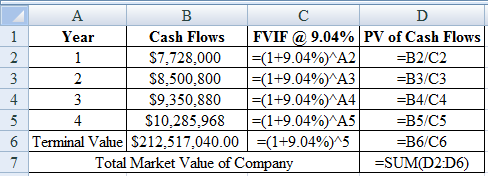

Using a excel spreadsheet we calculate the total value of company as,

Excel Spreadsheet:

Excel Workings:

Therefore the Total Market Value of Company is $166,594,155.69

Determine the Total Market Value of Equity

Therefore the Total Market Value of Equity is $126,594,155.69

Determine the New Estimate of Maximum Price per Share

Therefore the New Estimate of Maximum Price per Share is $64.92

Want to see more full solutions like this?

Chapter 13 Solutions

UPENN: LOOSE LEAF CORP.FIN W/CONNECT

- What are Deferred Tax Assets (DTA) and Deferred Tax Liabilities (DTL)? How are they created in an M&A transaction?arrow_forwardWhat’s the difference between intrinsic and book value, and how can they deviate?arrow_forwardHello I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Tell me why each of the financial statements by themselves is inadequate for evaluating a company?arrow_forward3. What are some pros and cons of market value?arrow_forwardAll else equal, should the WACC be higher for a company with a $100 million market cap or a $100 billion market cap?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning