a.

To determine: The Maximum Price per Share.

Introduction: The

The cost of debt is the effective interest rate of cost which a business earns on their current debts. Debt involves in the formation of capital structure. As the debt is considered as a deduction expenditure, the cost of debt is usually determined as after-tax cost in order to formulate similar to the cost of equity.

a.

Answer to Problem 21QP

The Maximum Price per Share is $62.17

Explanation of Solution

Determine the Total Market Value

Therefore the Total Market Value is $52,000,000

Determine the Weight of Debt and Equity

Therefore the Weight of Debt is 26.92% and Equity is 73.08%

Determine the WACC of the Company

Therefore the WACC of the Company is 9.04%

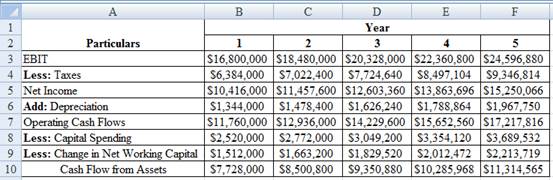

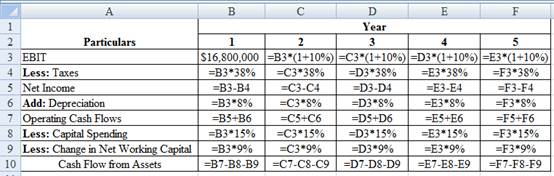

Determine the Cash Flow from Assets

Using a excel spreadsheet we compute the cash flow from assets as,

Excel Spreadsheet:

Excel Workings:

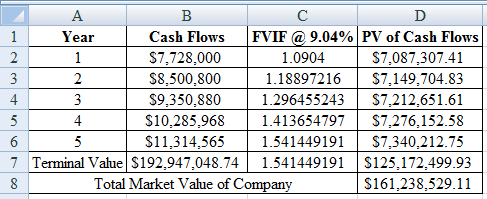

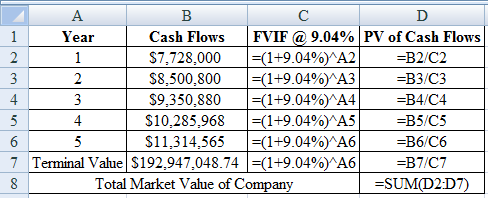

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $192,947,048.74

Determine the Total Market Value of the Company

Using a excel spreadsheet we calculate the total value of company as,

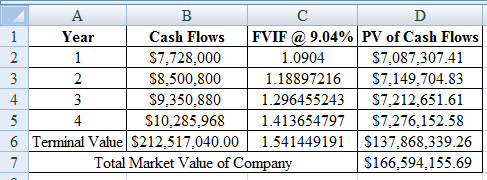

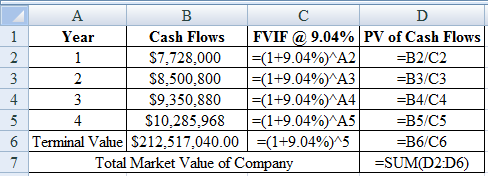

Excel Spreadsheet:

Excel Workings:

Therefore the Total Market Value of the Company is $161,238,529.11

Determine the Total Market Value of Equity

Therefore the Total Market Value of Equity is $121,238,529.11

Determine the Maximum Price per Share

Therefore the Maximum Price per Share is $62.17

b.

To determine: The New Estimate of Maximum Price per Share.

b.

Answer to Problem 21QP

The Maximum Price per Share is $64.92

Explanation of Solution

Determine the Earnings Before Interest on Taxes,

Therefore the Earnings Before Interest on Taxes, Depreciation and Amortization (EBITDA) is $26,564,630

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $212,517,040

Determine the Total Market Value of Company

Using a excel spreadsheet we calculate the total value of company as,

Excel Spreadsheet:

Excel Workings:

Therefore the Total Market Value of Company is $166,594,155.69

Determine the Total Market Value of Equity

Therefore the Total Market Value of Equity is $126,594,155.69

Determine the New Estimate of Maximum Price per Share

Therefore the New Estimate of Maximum Price per Share is $64.92

Want to see more full solutions like this?

Chapter 13 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- What does a high price-to-earnings (P/E) ratio indicate? a) A company is undervalued.b) A company is overvalued.c) High investor confidence.d) Low profitability.arrow_forwardThe risk that cannot be eliminated through diversification is called: a) Market riskb) Credit riskc) Diversifiable riskd) Operational riskarrow_forwardNo AI The risk that cannot be eliminated through diversification is called: a) Market riskb) Credit riskc) Diversifiable riskd) Operational riskarrow_forward

- Don't use chatgpt Which of the following is a primary market transaction? a) Buying shares on a stock exchangeb) Buying bonds from a bondholderc) Initial Public Offering (IPO)d) Trading in derivativesarrow_forwardWhich of the following is a primary market transaction? a) Buying shares on a stock exchangeb) Buying bonds from a bondholderc) Initial Public Offering (IPO)d) Trading in derivativesarrow_forwardNo chatgpt! What is the term for a bond's fixed interest payment? a) Yieldb) Couponc) Principald) Discountarrow_forward

- No ai Which of the following is a primary market transaction? a) Buying shares on a stock exchangeb) Buying bonds from a bondholderc) Initial Public Offering (IPO)d) Trading in derivativesarrow_forwardWhat is the term for a bond's fixed interest payment? a) Yieldb) Couponc) Principald) Discountarrow_forwardNo Ai What is the term for a bond's fixed interest payment? a) Yieldb) Couponc) Principald) Discountarrow_forward

- I need help!! 12. A beta value of 1.5 indicates: a) Less risk than the marketb) Same risk as the marketc) 50% more risk than the marketd) 50% less risk than the marketarrow_forwardA portfolio with the highest expected return for a given level of risk is called: a) Risk-free portfoliob) Efficient portfolioc) Diversified portfoliod) Arbitrage portfolioarrow_forwarddon't use chatgpt!! The process of determining the present value of future cash flows is known as: a) Amortizationb) Discountingc) Capitalizationd) Compoundingarrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning