a)

Prepare all necessary journal entries to record the given transactions.

a)

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare all necessary journal entries to record the given transactions:

| Date | Accounts title and Explanation | Debit ($) | Credit ($) |

| 1 | Rent expense | $35,000 | |

| Contributions - Unrestricted | $35,000 | ||

| (To record the rent expenses paid ny the net assets) | |||

| 2 | Cash | $335,000 | |

| Contributions receivable | $100,000 | ||

| Contributions - Unrestricted | $185,000 | ||

| Contributions - Temporarily restricted | $250,000 | ||

| (To record the cash receipt and contribution receivables) | |||

| 3. | Salaries & benefits expense | $224,560 | |

| Cash | $208,560 | ||

| Salaries & benefits payable | |||

| (To record the salaries and benefits expenses) | |||

| 4 | Contributions receivable | $100,000 | |

| Contributions - Temporarily restricted | $94,260 | ||

| Discount on contributions receivable | $5,740 | ||

| (To record the contribution receivable) | |||

| 5. | Equipment & furniture | $21,600 | |

| Cash | $12,000 | ||

| Contributions - Unrestricted | $9,600 | ||

| (To record the purchase of furniture and equipment) | |||

| 6 | Telephone expense | $5,200 | |

| Printing & postage expense | $12,000 | ||

| Utilities expense | $8,300 | ||

| Supplies expense | $4,300 | ||

| Cash | $26,200 | ||

| Accounts payable | $3,600 | ||

| (To record the expenses partly paid and partly payable) | |||

| 7 | For this transaction no | ||

| 8 | Provision for uncollectible pledges | $10,000 | |

| Allowance for uncollectible pledges -Unrestricted | $10,000 | ||

| (To record the provision for uncollectible pledges) | |||

| $3,360 | |||

| Allowance for depreciation - equipment & furniture | $3,360 | ||

| (To record the depreciation expense) | |||

| 9 | Public health education program | $105,952 | |

| Community service program | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| Salaries & benefits expense | $224,560 | ||

| Rent expense | $35,000 | ||

| Telephone expense | $5,200 | ||

| Printing & postage expense | $12,000 | ||

| Utilities | $8,300 | ||

| Supplies expense | $4,300 | ||

| Provision for uncollectible accounts | $10,000 | ||

| Depreciation expense | $3,360 | ||

| (To record the | |||

| 10 | Net assets released satisfaction of purpose restriction - Unrestricted | $105,952 | |

| Net assets released-satisfaction of purpose restriction- Unrestricted | $105,952 | ||

| (To record the release of net assets) | |||

| 11 | Contributions— Temporarily restricted (transactions 1, 2 and 5) | $229,600 | |

| Net assets-Unrestricted | $73,120 | ||

| Public health education | $105,952 | ||

| Community service | $90,816 | ||

| Management & general | $60,544 | ||

| Fund-raising | $45,408 | ||

| (To record the closing entry for contributions- Unrestricted) | |||

| Contributions - Temporarily restricted (transactions 2 & 4) | $344,260 | ||

| Net assets-Temporarily restricted | $344,260 | ||

| (To record the closing entry for the contributions – Temporarily restricted) | |||

| Net assets - Temporarily restricted | $105,952 | ||

| Net assets released—satisfaction of purpose restriction - Temporarily restricted | $105,952 | ||

| (To record the closing entry for the net assets Temporarily restricted) | |||

| Net assets released—satisfaction of purpose restriction - Unrestricted | $105,952 | ||

| Net assets - Unrestricted | $105,952 | ||

| (To record the closing entry for the net assets-Unrestricted) | |||

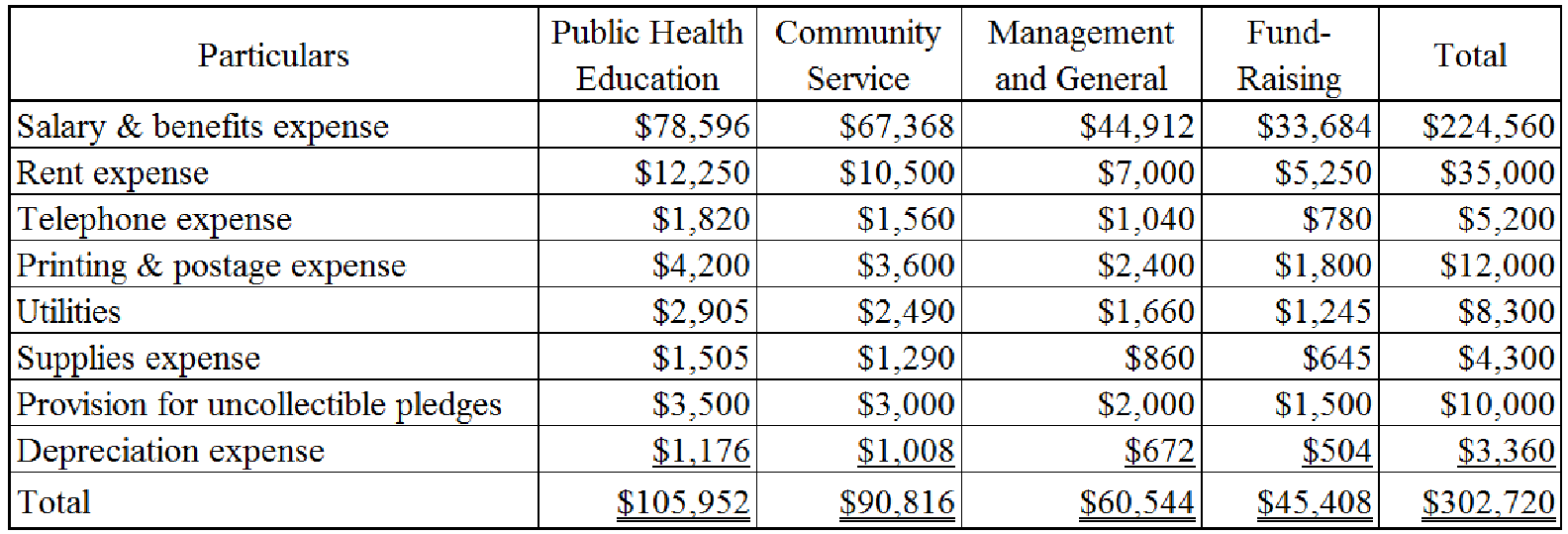

Table (1)

Notes to the above table:

- Compute the resource allocation based on the available information (transaction 9):

Table (2)

b.

Prepare the statement of activity for the year ended December 31, 2017.

b.

Explanation of Solution

Prepare the statement of activity for the year ended December 31, 2017:

| Entity I | |||

| Statement of activities | |||

| For the year ended December 31, 2017 | |||

| Particulars | Unrestricted | Temporarily restricted | total |

| Revenue and other Support: | |||

| Contributions-net assets released from restriction | $ 229,600 | $ 344,260 | $ 573,860 |

| Satisfaction of purpose | $105,952 | ($105,952) | |

| Total revenue & other support (A) | $335,552 | $238,308 | $573,860 |

| Expenses: | |||

| Public health education | $105,952 | 105,952 | |

| Community services | $90,816 | 90,816 | |

| Management & general | $60,544 | 60,544 | |

| Fund-raising | $45,408 | 45,408 | |

| Total expenses (B) | $302,720 | 302,720 | |

| Increase in net assets (A) – (B) | $32,832 | $238,308 | $271,140 |

| Beginning net assets | 0 | 0 | 0 |

| Ending net assets | $ 32,832 | $ 238,308 | $ 271,140 |

Table (3)

Therefore, the total ending net assets are $271,140.

c)

Prepare a

c)

Explanation of Solution

Statement of financial position: It is an itemized list of total assets and “liabilities and net assets.” The assets are classified into current and noncurrent assets. The liabilities are also classified into current and noncurrent liabilities. The assets should be equal to the liabilities and net assets.

Prepare a statement of financial position for the year ended December 31, 2017:

| Entity I | |

| Statement of Financial Positions | |

| For the year ended December 31, 2017 | |

| Assets | Amount ($) |

| Cash | $88,240 |

| Contributions receivable (less allowance for uncollectible accounts of $10,000 and discount on contributions receivable of $5,740) | $184,260 |

| Equipment and furniture (less allowance for |

$18,240 |

| Total Assets | $290,740 |

| Liabilities: | |

| Accounts payable | $3,600 |

| Salaries & benefits payable | $16,000 |

| Total liabilities | $19,600 |

| Net Assets: | |

| Unrestricted | $32,832 |

| Temporarily restricted | $238,308 |

| Total net assets | $271,140 |

| Total liabilities and net assets | $290,740 |

Table (4)

d)

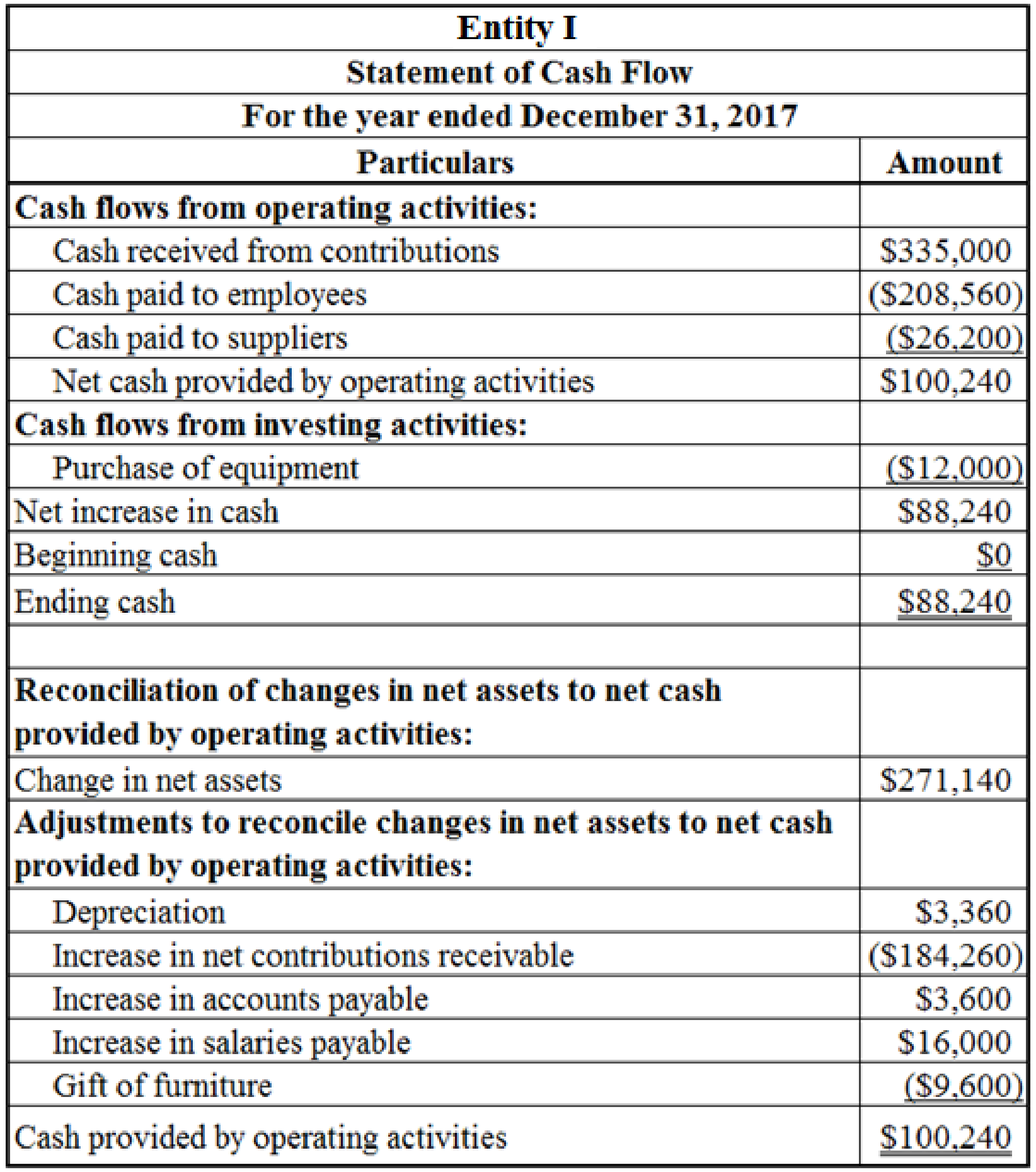

Prepare a statement of

d)

Explanation of Solution

Prepare a statement of cash flow for the year ended December 31, 2017:

Table (5)

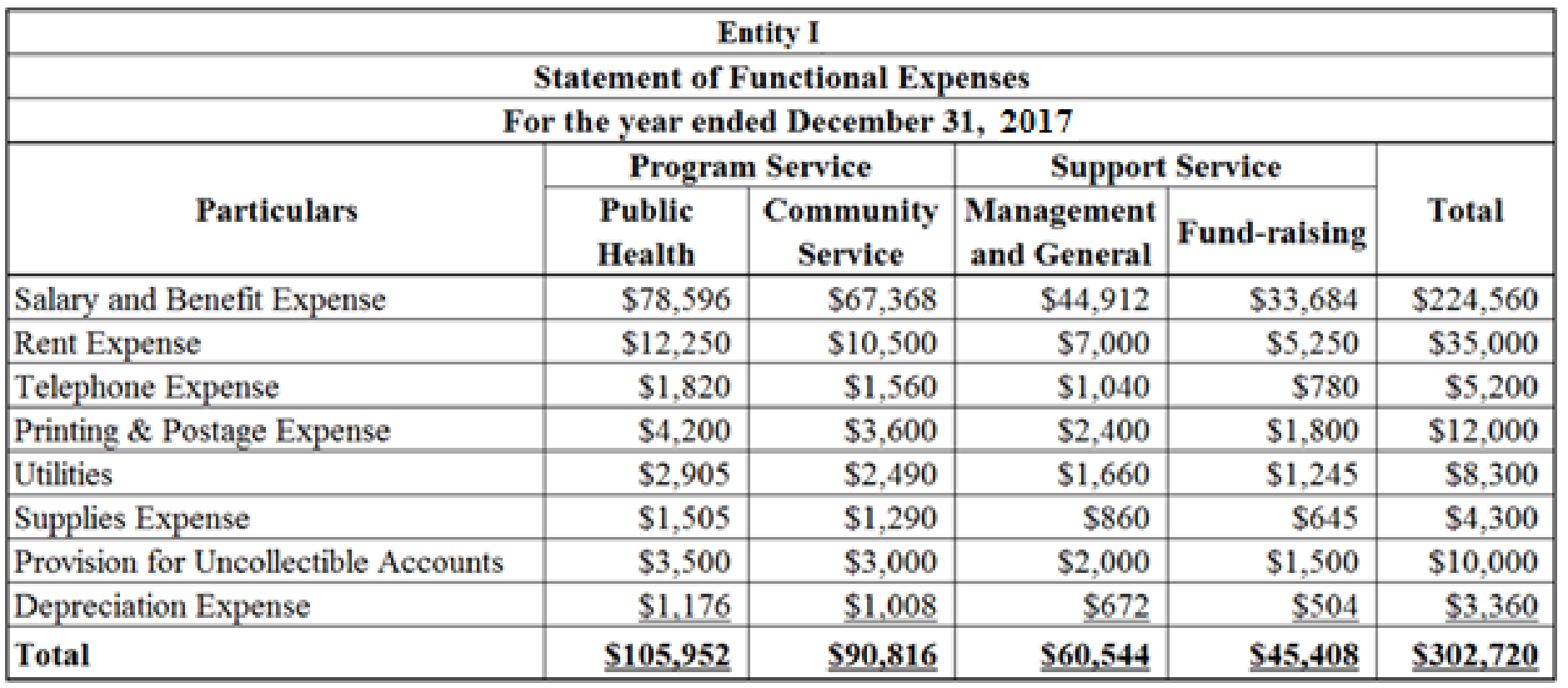

e)

Prepare the schedule of expenses by nature and function for the year ended December 31, 2017.

e)

Explanation of Solution

Prepare the schedule of expenses by nature and function for the year ended December 31, 2017:

Table (6)

Want to see more full solutions like this?

Chapter 13 Solutions

ACCOUNTING F/GOVT+NONPROFIT CONNECT+>I

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardA company reported the following information for its most recent year of operation: purchases, $175,000; beginning inventory, $35,000; and cost of goods sold, $180,000. How much was the company's ending inventory?need helparrow_forwardI need help with this problem and accountingarrow_forward

- At the beginning of the year, Vertex Technologies, Inc. determined that estimated overhead costs would be $540,000, while actual overhead costs for the year totaled $562,000. Furthermore, it was determined that the estimated allocation basis would be 60,000 machine hours, while production actually required 63,500 machine hours. What was the dollar amount of underallocated or overallocated manufacturing overhead?arrow_forwardArmani Manufacturing produces widgets at a variable cost of $12 per unit. Fixed costs are $180,000 per year. If each widget sells for $27, how many units must be sold to break even?arrow_forwardWhat characterizes the aggregate constraint principle in accounting? (a) Economic constraints don't affect reporting (b) Only individual transactions matter (c) Resources available limit total possible economic activity reporting (d) Business size determines all limitationsarrow_forward

- Icarus Tools produces 4,100 units. Each unit was expected to require 2.2 labor hours at a cost of $12 per hour. Total labor cost was $107,100 for 9,000 hours worked. Direct labor is measured in labor hours. What is the flexible budget variance for direct labor?arrow_forwardThe actual cost of direct labor per hour is $29.75 and the standard cost of direct labor per hour is $31.20. The direct labor hours allowed per finished unit is 0.85hours. During the current period, 7,500 units of finished goods were produced using 4,100 direct labor hours. How much is the direct labor rate variance?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education