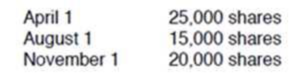

Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of $100 par value, 8%

For 2011, Ponce Towers, Inc., had income from continuing operations of $545,000 and a $72,000 loss from discontinued operations (net of tax).

As vice president of finance for the firm, you have been asked to calculate earnings per share for 2011. The worksheet EPS has been provided to assist you.

Compute the earnings per share for 2011.

Explanation of Solution

Compute the earnings per share for 2011.

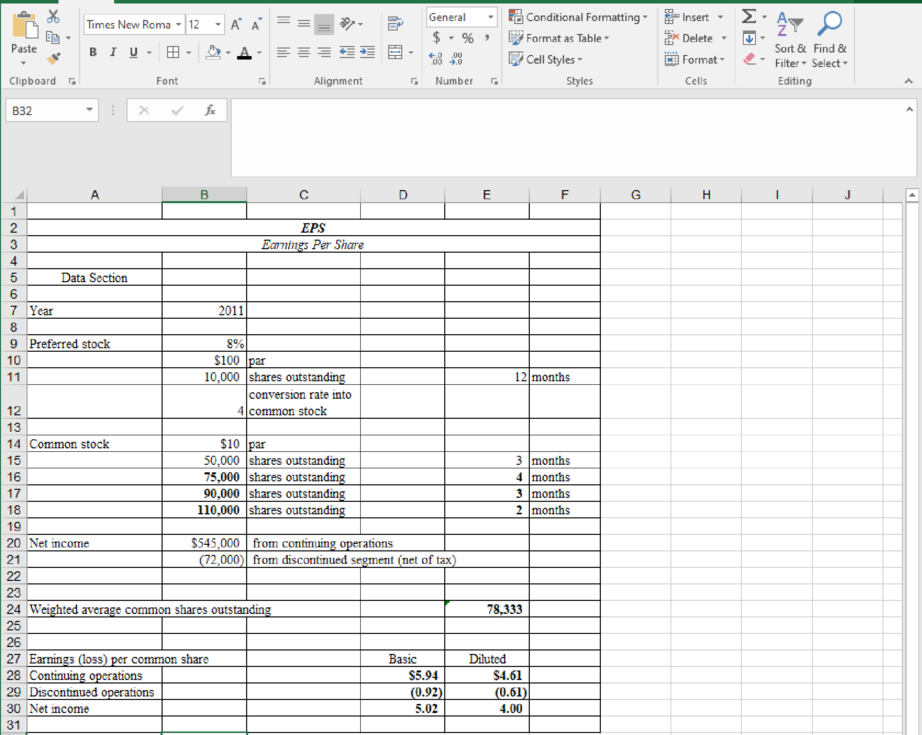

Table (1)

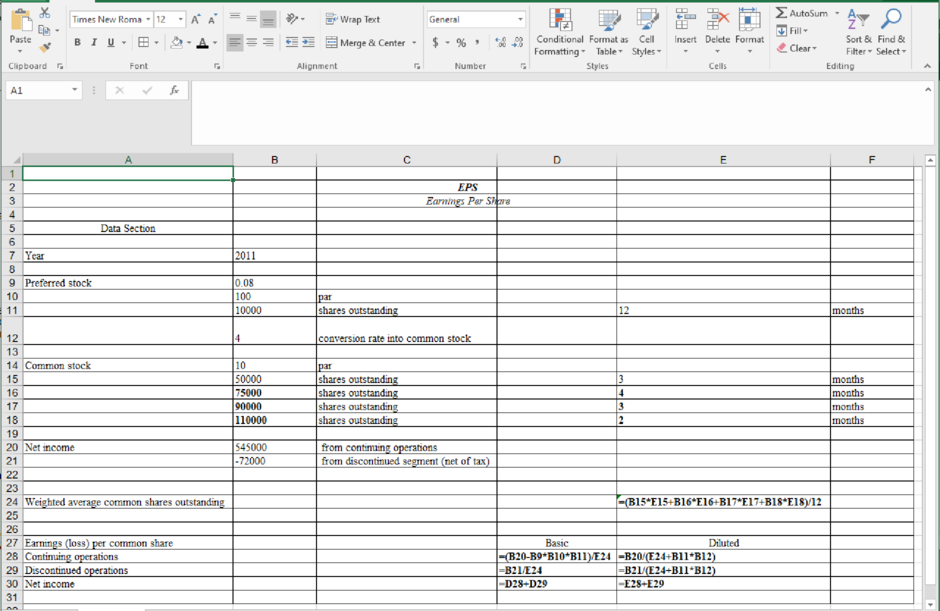

The formulae used for the above table are as follows:

Table (2)

Want to see more full solutions like this?

Chapter 13 Solutions

Excel Applications for Accounting Principles

- Please provide the answer to this general accounting question using the right approach.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardWhich circumstances require modified nominal account treatment? A. Nominal accounts never need modification B. Standard closing entries always suffice C. Special purpose entities demand unique closing procedures D. Year-end procedures remain constant. MCQarrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardOn August 1, 2012, Simmons Corporation loaned $40,000 to Thompson Inc. for one year at an annual interest rate of 7%. Under the terms of the promissory note, Thompson Inc. will repay the principal and pay one year's interest on August 31, 2013. What would be the total amount of receivable related to this loan on Simmons Corporation's December 31, 2012 balance sheet? (Round your answer nearest Dollar) A) $41,167 B) $26,500 C) $25,750 D) $12,875arrow_forwardSolve this Accounting MCQ 77arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning