Financial Accounting

10th Edition

ISBN: 9781260481563

Author: Libby, Robert

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Question

Chapter 13, Problem 1Q

To determine

State the primary users of the financial statements.

Expert Solution & Answer

Answer to Problem 1Q

State the users of the financial statements.

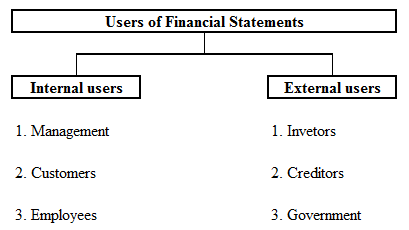

Picture (1)

Explanation of Solution

Internal users:

- 1. Management: The management uses the financial statements to understand the profitability and fianacial position of the company period to period, so that it can make decisions on operational and financing activities of the comapny.

- 2. Customers: customers will consider the financial statements to select the suppliers, who has financial ability to supply the goods or services as required by the customer.

- 3. Employees: A company might provide financial statements to its employees to increase the level of employee participation in and understanding of the business.

External users:

- 1. Investors: Investors will consider the financial statements to understand the performance of the company. It help the investors to take decesions on their future investments.

- 2. Creditors: Creditors will consider the financial statements, to estimate the capacity of the company to repay the loans and interest charges.

- 3. Government: The Government consider the financial statements to determine whether the company paid the appropriate amount of taxes or not.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Ironforge Manufacturing, Inc., is a company that manufactures industrial equipment. During the year, Ironforge purchased $2,140,000 of direct materials and placed $1,970,000 worth of direct materials into production. Ironforge's beginning balance in the Materials Inventory account was $385,000. What is the ending balance in Ironforge's Materials Inventory account? Right answer

Disney Distributors is preparing its merchandise purchases budget. Budgeted sales are $725,000 for July and $790,000 for August. Cost of goods sold is expected to be 55% of sales. The company's desired ending inventory is 20% of the following month's cost of goods sold. Compute the required purchases for July.

Preston Company sold 5,250 units in November at a price of $78 per unit. The variable cost is $59 per unit. Calculate the total contribution margin. A. $99,750 B. $100,450 C. $309,750 D. $409,500

Chapter 13 Solutions

Financial Accounting

Ch. 13 - Prob. 1QCh. 13 - 2. When considering an investment in stock,...Ch. 13 - 3. How does product differentiation differ from...Ch. 13 - 4. What are the two general methods for making...Ch. 13 - 5. What are component percentages? Why are they...Ch. 13 - Prob. 6QCh. 13 - 7. What do profitability ratios focus on? What is...Ch. 13 - 8. What do turnover ratios focus on? What is an...Ch. 13 - 9. What do liquidity ratios focus on? What is an...Ch. 13 - 10. What do solvency ratios focus on? What is an...

Ch. 13 - Prob. 11QCh. 13 - 12. Explain how a company’s accounting policy...Ch. 13 - 13. Explain why rapid growth in total sales might...Ch. 13 - 1. A company has total assets of $500,000 and...Ch. 13 - Prob. 2MCQCh. 13 - 3. Which of the following ratios is used to...Ch. 13 -

The two components of the return on asset ratio...Ch. 13 -

Which of the following ratios is required by...Ch. 13 - 6. A company has quick assets of $300,000 and...Ch. 13 - 7. The inventory turnover ratio for Natural Foods...Ch. 13 - 8. Given the following ratios for four companies,...Ch. 13 - 9. A decrease in selling and administrative...Ch. 13 - 10. A creditor is least likely to use what ratio...Ch. 13 - M13-1 Inferring Financial Information Using...Ch. 13 - Inferring Financial Information Using Component...Ch. 13 - Computing the Return on Equity Ratio

Compute the...Ch. 13 - Computing the Return on Asset Ratio

Compute the...Ch. 13 - Analyzing the Inventory Turnover Ratio

A...Ch. 13 - Prob. 6MECh. 13 - Analyzing Financial Relationships

Ramesh Company...Ch. 13 - Prob. 8MECh. 13 - Inferring Financial Information Using a Ratio...Ch. 13 - Analyzing the Impact of Accounting...Ch. 13 - E13-1 Using Financial Information to Identify...Ch. 13 - E13-2 Using Financial Information to Identify...Ch. 13 - E13-2 Using Financial Information to Identify...Ch. 13 - Using Financial Information to Identify...Ch. 13 - Prob. 5ECh. 13 - Matching Each Ratio with Its Computational...Ch. 13 - Computing Turnover Ratios

Procter & Gamble is a...Ch. 13 - Computing Turnover Ratios |

Sales for the year for...Ch. 13 - Analyzing the Impact of Selected Transactions on...Ch. 13 - Analyzing the Impact of Selected Transactions on...Ch. 13 - Inferring Financial Information from Ratios

Dollar...Ch. 13 - Prob. 12ECh. 13 - Prob. 13ECh. 13 - Analyzing Ratios

Company X and Company Y are two...Ch. 13 - Analyzing an Investment by Comparing Selected...Ch. 13 - Prob. 3PCh. 13 - Prob. 4PCh. 13 - Prob. 5PCh. 13 - Computing Comparative Financial Statements and ROA...Ch. 13 - Prob. 7PCh. 13 - Analyzing the Impact of Alternative Inventory...Ch. 13 - Prob. 9PCh. 13 - Coca-Cola and PepsiCo are well-known international...Ch. 13 - Prob. 2APCh. 13 - Calculating Profitability, Turnover, Liquidity,...Ch. 13 - Prob. 4APCh. 13 - Prob. 5APCh. 13 - Computing Comparative Financial Statements and ROA...Ch. 13 - Prob. 1CPCh. 13 - Prob. 2CPCh. 13 - Prob. 3CPCh. 13 - Prob. 4CPCh. 13 - Inferring Information from the Two Components of...Ch. 13 - Prob. 6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the depreciation expense per milearrow_forwardGranger Company's unadjusted COGS for 20X1 was $107,000. They had a $12,000 unfavorable direct labor efficiency variance, a $5,000 favorable direct labor rate variance, a $8,500 unfavorable direct materials purchase price variance, and a $6,500 unfavorable direct materials usage variance. They did not have any overhead variances. What was Granger Company's adjusted COGS amount for 20X1?arrow_forwardPlease solve this question General accounting and step by step explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License