Concept explainers

To compute: Beta and construct a tabulated summary.

Introduction: The model that shows the relation between systematic risk and expected

Explanation of Solution

Security market line: SML refers to a line that represents CAPM (capital asset pricing model), which further shows the level of systematic, or market, risks for various securities against the expected return of the market at a stated point of time.

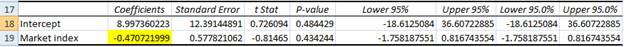

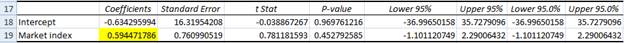

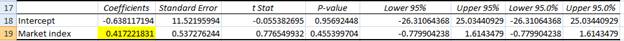

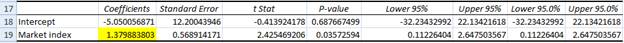

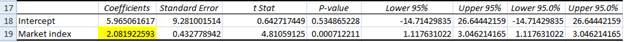

Regression can be applied to excess return to evaluate beta for each portfolio. It has been shown below:

Beta of Stock A: -0.4707

Beta of Stock B: 0.5945

Beta of Stock C: 0.4172

Beta of Stock D: 1.3799

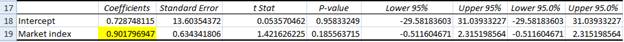

Beta of Stock E: 0.9018

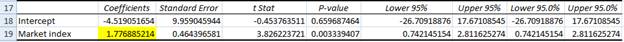

Beta of Stock F: 1.7769

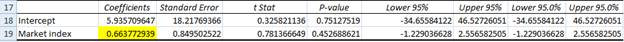

Beta of Stock G: 0.6638

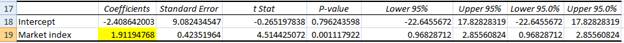

Beta of Stock H: 1.9119

Beta of Stock I: 2.0819

Tabulated summary has been constructed below:

| Stock | Beta |

| A | -0.47072 |

| B | 0.59447 |

| C | 0.41722 |

| D | 1.37988 |

| E | 0.90179 |

| F | 1.77688 |

| G | 0.66377 |

| H | 1.91194 |

| I | 2.08192 |

Want to see more full solutions like this?

- Chee Chew's portfolio has a beta of 1.27 and earned a return of 13.6% during the year just ended. The risk-free rate is currently 4.6%. The return on the market portfolio during the year just ended was 10.5%. a. Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just ended. b. Compare the performance of Chee's portfolio found in part a to that of Carri Uhl's portfolio, which has a Jensen's measure of -0.25. Which portfolio performed better? Explain. c. Use your findings in part a to discuss the performance of Chee's portfolio during the period just ended.arrow_forwardDuring the year just ended, Anna Schultz's portfolio, which has a beta of 0.91, earned a return of 8.1%. The risk-free rate is currently 4.1%, and the return on the market portfolio during the year just ended was 9.4%. a. Calculate Treynor's measure for Anna's portfolio for the year just ended. b. Compare the performance of Anna's portfolio found in part a to that of Stacey Quant's portfolio, which has a Treynor's measure of 1.39%. Which portfolio performed better? Explain. c. Calculate Treynor's measure for the market portfolio for the year just ended. d. Use your findings in parts a and c to discuss the performance of Anna's portfolio relative to the market during the year just ended.arrow_forwardNeed answer.arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning