Real-world companies often reduce the complexity of their operations in an attempt to increase profits. In late 2014 and early 2015 McDonald’s Corporation announced a series of restructuring efforts it planned to undertake to improve profitability. One of these was to reduce the number of items offered for sale in its restaurants. In October 2014, General Motors announced plans to reduce the number of vehicle production platforms on which it builds cars from 26 to four by 2025. In 2010, Supervalu, Inc., one of the largest grocery store companies in the United States, announced it was planning to reduce the number of different items it carries in its inventory by as much as 25 percent. Supervalu is one of the largest grocery store companies in the United States.

Most of the planned reduction in inventory items at Supervalu was going to be accomplished by reducing the number of different package sizes rather than by reducing entire product brands. The new approach was intended to allow the company to get better prices from its vendors and to put more emphasis on its own store brands.

Required

- a. Identify some costs savings these companies might realize by reducing the number of items they sell or use in production. Be as specific as possible, and use your imagination.

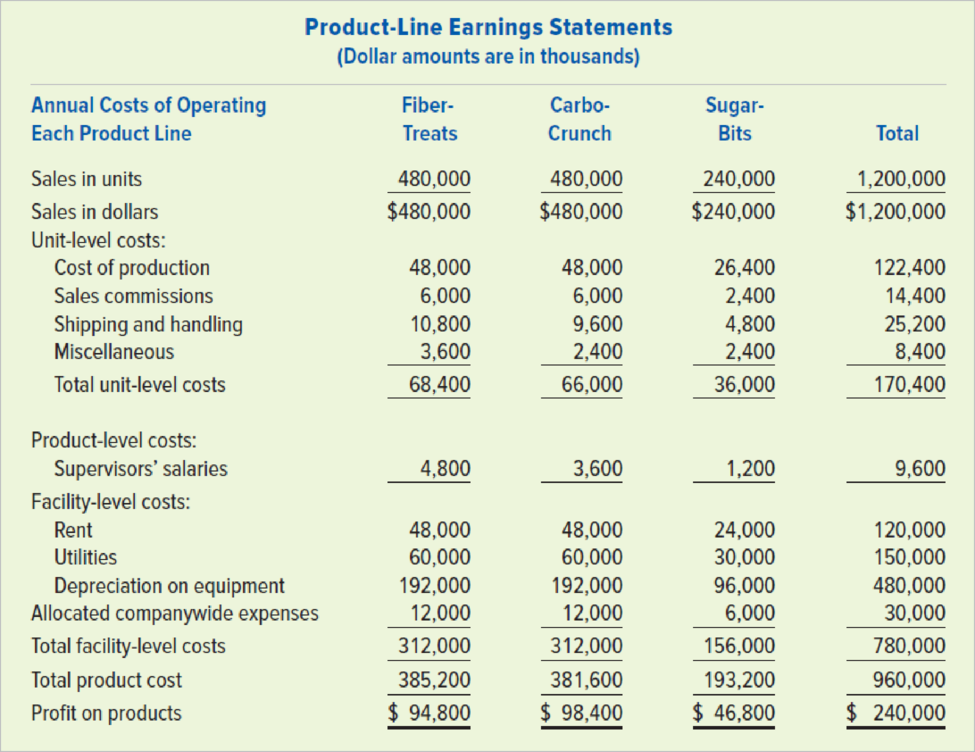

- b. Consider the additional information presented below, which is hypothetical. All dollar amounts are in thousands, unit amounts are not. Assume that Supervalu decides to eliminate one product line, Sugar-Bits, for one of its segments that currently produces three products. As a result, the following are expected to occur:

- (1) The number of units sold for the segment is expected to drop by only 40,000 because of the elimination of Sugar-Bits, since most customers are expected to purchase a Fiber-Treats or Carbo-Crunch product instead. The shift of sales from Sugar-Bits to Fiber-Treats and Carbo-Crunch is expected to be evenly split. In other words, the sales of Fiber-Treats and Carbo-Crunch will each increase by 100,000 units.

- (2) Rent is paid for the entire production facility, and the space used by Sugar-Bits cannot be sublet.

- (3) Utilities costs are expected to be reduced by $24,000.

- (4) All of the supervisors for Sugar-Bits were all terminated. No new supervisors will be hired for Fiber-Treats or Carbo-Crunch.

- (5) The equipment being used to produce Sugar-Bits is also used to produce the other two products. However, the company believes that as a result of eliminating Sugar-Bits it can dispose of equipment that has a remaining useful life of 5 years, and a projected salvage value of $20,000. Its current market value is $35,000.

- (6) Facility-level costs will continue to be allocated between the product lines based on the number of units produced.

Prepare revised product-line earnings statements based on the elimination of Sugar-Bits. (Hint: It will be necessary to calculate some per-unit data to accomplish this.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- Can you provide the accurate answer to this financial accounting question using correct methods?arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning