Concept explainers

Statement of

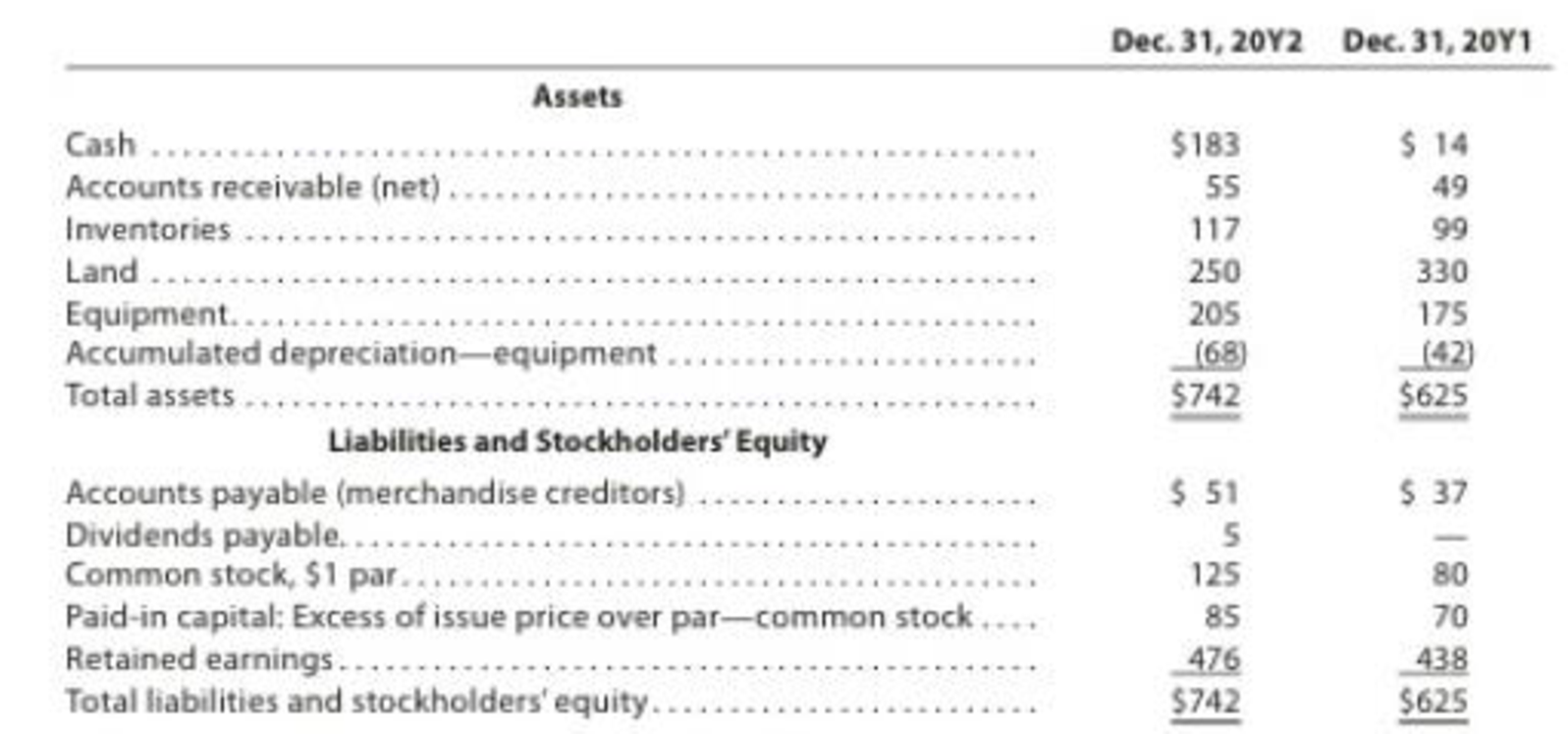

The comparative

The following additional information is taken from the records:

- A. Land was sold for $120.

- B. Equipment was acquired for cash.

- C. There were no disposals of equipment during the year.

- D. The common stock was issued for cash.

- E. There was a $62 credit to

Retained Earnings for net income. - F. There was a $24 debit to Retained Earnings for cash dividends declared.

- A. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

- B. Was Olson-Jones’s net cash flow from operations more or less than net income? What is the source of this difference?

A.

Prepare a statement of cash flows under indirect method.

Answer to Problem 17E

| O Industries | ||

| Statement of Cash Flows - Indirect Method | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Net income | 62 | |

| Adjustments to reconcile net income to net cash flow from operating activities: | ||

| Depreciation expense | 26 | |

| Gain on sale of land | (40) | |

| Changes in current operating assets and liabilities: | ||

| Increase in accounts receivable | (6) | |

| Increase in inventory | (18) | |

| Increase in accounts payable | 14 | (24) |

| Net cash provided by operating activities | $38 | |

| Cash flows from investing activities: | ||

| Cash from sale of land | 120 | |

| Cash used for purchase of equipment | (30) | |

| Net cash provided by investing activities | $90 | |

| Cash flows from financing activities: | ||

| Cash from sale of common stock | 60 | |

| Cash used for dividends | (19) | |

| Net cash provided by financing activities | $41 | |

| Increase (decrease) in cash | $169 | |

| Cash at the beginning of the year | 14 | |

| Cash at the end of the year | $183 | |

Table (4)

Explanation of Solution

Statement of cash flows: It is one of the financial statement that shows the cash and cash equivalents of a company for a particular period. It determines the net changes in cash through reporting the sources and uses of cash due to the operating, investing, and financing activities of a company.

Indirect method: Under this method, the following amounts are to be adjusted from the Net Income to calculate the net cash provided from operating activities.

Cash flows from operating activities: These are the cash produced by the normal business operations.

The below table shows the way of calculation of cash flows from operating activities:

| Cash flows from operating activities (Indirect method) |

| Add: Decrease in current assets |

| Increase in current liability |

| Depreciation expense and amortization expense |

| Loss on sale of plant assets |

| Deduct: Increase in current assets |

| Decrease in current liabilities |

| Gain on sale of plant assets |

| Net cash provided from or used by operating activities |

Table (1)

Cash flows from investing activities: Cash provided by or used in investing activities is a section of statement of cash flows. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from sale of fixed assets |

| Sale of marketable securities / investments |

| Interest received |

| Dividend received |

| Deduct: Purchase of fixed assets/long-lived assets |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (2)

Cash flows from financing activities: Cash provided by or used in financing activities is a section of statement of cash flows. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings |

| Proceeds from issuance of debt |

| Issuance of bonds payable |

| Deduct: Payment of dividend |

| Repayment of debt |

| Interest paid |

| Redemption of debt |

| Repurchase of stock |

| Net cash provided from or used by financing activities |

Table (3)

Working note:

Prepare the schedule in the changes of current assets and liabilities.

| Schedule in the Change of Current Assets and Liabilities | ||||

| Details | Amount ($) | Effect on Operating Activities | ||

| Beginning Balance | Ending Balance |

Increase/ (Decrease) | ||

| Accounts receivable | 49 | 55 | 6 | Deduct |

| Inventories | 99 | 117 | 18 | Deduct |

| Accounts payable | 37 | 51 | 14 | Add |

Table (3)

Calculate the amount of depreciation expense:

Calculate the amount gain on sale of land:

Calculate the amount of cash used to purchase of equipment:

Calculate the amount of cash from common stock:

Calculate the amount of dividends:

Therefore, the ending cash balance is $183.

B.

Explain the cash flow from operations more or less than net income.

Explanation of Solution

- Depreciation expense amount of $26 does not show any effect on cash flow from operating activities.

- The gain on sale of land of $40 will be reported in operating activities. The proceeds from sale of $120 will be reported in the investing activities section of the statement of cash flows.

- Moreover, the changes in current operating assets and liabilities are added or deducted based on the effect of below cash flows:

- Increase in accounts receivable $6 (Deducted).

- Increase in inventories $18 (Deducted).

- Increase in accounts payable $14 (Added).

Want to see more full solutions like this?

Chapter 13 Solutions

FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

- Please don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forwardQuick answerarrow_forward

- Financial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forwardPaterson Manufacturing uses both standards and budgets. For the year, estimated production of Product Z is 620,000 units. The total estimated cost for materials and labor are $1,512,000 and $1,984,000, respectively. Compute the estimates for: (a) a standard cost per unit (b) a budgeted cost for total production (Round standard costs to 2 decimal places, e.g., $1.25.)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning