Concept explainers

Statement of

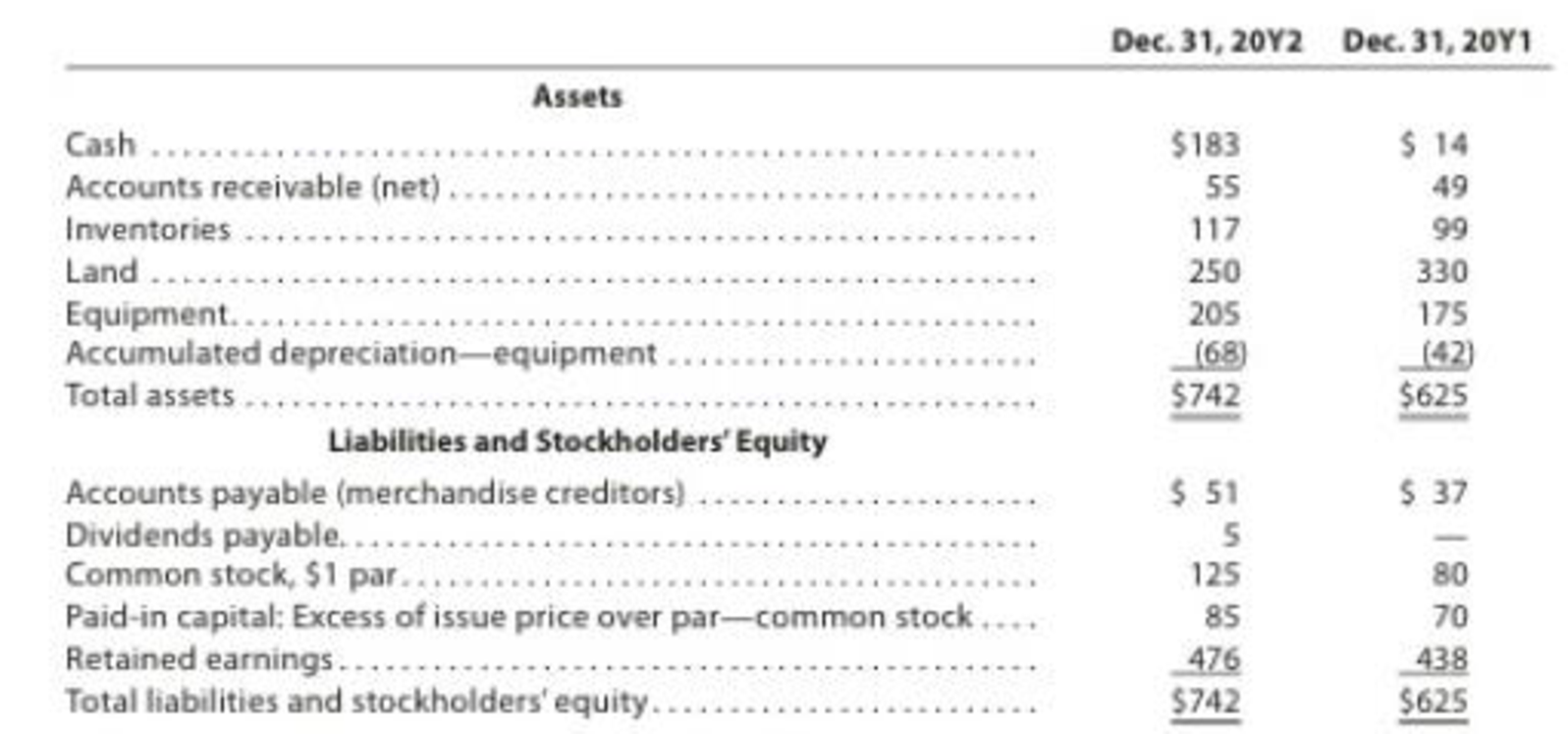

The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, is as follows:

The following additional information is taken from the records:

- A. Land was sold for $120.

- B. Equipment was acquired for cash.

- C. There were no disposals of equipment during the year.

- D. The common stock was issued for cash.

- E. There was a $62 credit to

Retained Earnings for net income. - F. There was a $24 debit to Retained Earnings for cash dividends declared.

- A. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

- B. Was Olson-Jones’s net cash flow from operations more or less than net income? What is the source of this difference?

A.

Prepare a statement of cash flows under indirect method.

Answer to Problem 17E

| O Industries | ||

| Statement of Cash Flows - Indirect Method | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Net income | 62 | |

| Adjustments to reconcile net income to net cash flow from operating activities: | ||

| Depreciation expense | 26 | |

| Gain on sale of land | (40) | |

| Changes in current operating assets and liabilities: | ||

| Increase in accounts receivable | (6) | |

| Increase in inventory | (18) | |

| Increase in accounts payable | 14 | (24) |

| Net cash provided by operating activities | $38 | |

| Cash flows from investing activities: | ||

| Cash from sale of land | 120 | |

| Cash used for purchase of equipment | (30) | |

| Net cash provided by investing activities | $90 | |

| Cash flows from financing activities: | ||

| Cash from sale of common stock | 60 | |

| Cash used for dividends | (19) | |

| Net cash provided by financing activities | $41 | |

| Increase (decrease) in cash | $169 | |

| Cash at the beginning of the year | 14 | |

| Cash at the end of the year | $183 | |

Table (4)

Explanation of Solution

Statement of cash flows: It is one of the financial statement that shows the cash and cash equivalents of a company for a particular period. It determines the net changes in cash through reporting the sources and uses of cash due to the operating, investing, and financing activities of a company.

Indirect method: Under this method, the following amounts are to be adjusted from the Net Income to calculate the net cash provided from operating activities.

Cash flows from operating activities: These are the cash produced by the normal business operations.

The below table shows the way of calculation of cash flows from operating activities:

| Cash flows from operating activities (Indirect method) |

| Add: Decrease in current assets |

| Increase in current liability |

| Depreciation expense and amortization expense |

| Loss on sale of plant assets |

| Deduct: Increase in current assets |

| Decrease in current liabilities |

| Gain on sale of plant assets |

| Net cash provided from or used by operating activities |

Table (1)

Cash flows from investing activities: Cash provided by or used in investing activities is a section of statement of cash flows. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from sale of fixed assets |

| Sale of marketable securities / investments |

| Interest received |

| Dividend received |

| Deduct: Purchase of fixed assets/long-lived assets |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (2)

Cash flows from financing activities: Cash provided by or used in financing activities is a section of statement of cash flows. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings |

| Proceeds from issuance of debt |

| Issuance of bonds payable |

| Deduct: Payment of dividend |

| Repayment of debt |

| Interest paid |

| Redemption of debt |

| Repurchase of stock |

| Net cash provided from or used by financing activities |

Table (3)

Working note:

Prepare the schedule in the changes of current assets and liabilities.

| Schedule in the Change of Current Assets and Liabilities | ||||

| Details | Amount ($) | Effect on Operating Activities | ||

| Beginning Balance | Ending Balance |

Increase/ (Decrease) | ||

| Accounts receivable | 49 | 55 | 6 | Deduct |

| Inventories | 99 | 117 | 18 | Deduct |

| Accounts payable | 37 | 51 | 14 | Add |

Table (3)

Calculate the amount of depreciation expense:

Calculate the amount gain on sale of land:

Calculate the amount of cash used to purchase of equipment:

Calculate the amount of cash from common stock:

Calculate the amount of dividends:

Therefore, the ending cash balance is $183.

B.

Explain the cash flow from operations more or less than net income.

Explanation of Solution

- Depreciation expense amount of $26 does not show any effect on cash flow from operating activities.

- The gain on sale of land of $40 will be reported in operating activities. The proceeds from sale of $120 will be reported in the investing activities section of the statement of cash flows.

- Moreover, the changes in current operating assets and liabilities are added or deducted based on the effect of below cash flows:

- Increase in accounts receivable $6 (Deducted).

- Increase in inventories $18 (Deducted).

- Increase in accounts payable $14 (Added).

Want to see more full solutions like this?

Chapter 13 Solutions

Financial And Managerial Accounting

- Reading and Interpreting Audit OpinionsRivian Automotive financial statements include the following audit report from KPMG LLP. -----------------------------------------------------------------------------------------------------------------------------------------------Report of Independent Registered Public Accounting FirmTo the Stockholders and Board of DirectorsRivian Automotive, Inc.:Opinion on the Consolidated Financial Statements We have audited the accompanying consolidated balance sheets of Rivian Automotive, Inc. and subsidiaries (the Company) as of December 31, 2022 and 2021, the related consolidated statements of operations, comprehensive loss, changes in contingently redeemable convertible preferred stock and stockholders' (deficit) equity, and cash flows for each of the years in the three-year period ended December 31, 2022, and the related notes (collectively, the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in…arrow_forwardIn a recent year, Adobe Inc. reports net income of $4,756 million. Its stockholders’ equity is $14,051 million and $14,797 million at the start and end of the fiscal year, respectively. a. Compute its return on equity (ROE) for the year. Round answers to the nearest whole dollar amount. Numerator Denominator Result Return on equity Answer 1 Answer 2 b. Adobe repurchased $6,550 million of its common stock during the year. Did this repurchase increase or decrease ROE? NOTE: Assume there was no change in net income related to the stock repurchase. c. If Adobe had not repurchased common stock during the year, what would ROE have been? Note: Enter answer as a percentage rounded to the nearest one decimal place (ex: 24.8%).arrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answerarrow_forward

- Computing and Interpreting Financial Statement RatiosFollowing are selected ratios of Norfolk Southern. Return on Assets (ROA) Component FY4 FY3 Profitability (Net income/Sales) 25.7% 27.0% Productivity (Sales/Average assets) 0.329 0.291 a. Was the company profitable in FY4? Answer 1b. In which year was the company more profitable? Answer 2c. Is the change in productivity a positive or negative development? Answer 3d. Compute the company’s ROA for both years. Note: Enter your answer as a percentage rounded to one decimal place (Ex: 29.4%).FY4 Answer 4%FY3 Answer 5%e. From the information, which of the following best explains the change in ROA during FY4?arrow_forwardExpand upon it and add to itarrow_forwardDefine these terms: A) Information Asymmetry. B) Material misstatement in the audited financial statements. C) The term "Professional Skepticism." D) Contribution margin ratio. E) Gross Margin, also known as Gross Profit Margin.arrow_forward

- No Ai Which of the following errors will cause the trial balance to not balance?A. Omission of a transactionB. Entry posted twiceC. Transposing digits in one sideD. Debiting one account and crediting anotherarrow_forwardDon't use ChatGPT!! Which of the following errors will cause the trial balance to not balance?A. Omission of a transactionB. Entry posted twiceC. Transposing digits in one sideD. Debiting one account and crediting anotherarrow_forwardWhich of the following is a temporary account?A. Retained EarningsB. Service RevenueC. Accounts PayableD. Inventoryarrow_forward

- Which of the following errors will cause the trial balance to not balance?A. Omission of a transactionB. Entry posted twiceC. Transposing digits in one sideD. Debiting one account and crediting anotherarrow_forwardMime Delivery Service is owned and operated by Pamela Kolp. The following selected transactionswere completed by Mime Delivery Service during October:1. Received cash from the owner as an additional investment, $7,500.2. Paid creditors on account, $815.3. Billed customers for delivery services on account, $3,250.4. Received cash from customers on account, $1,150.5. Paid cash to the owner for personal use, $500.Required:Indicate the effect of each transaction on the accounting equation elements (Assets, Liabilities,Owner’s Equity, Drawing, Revenue, and Expense) by listing the numbers identifying the transactions,(1) to (5). Also, indicate the specific item within the accounting equation element that is affected, i.e.(1) Asset (Cash) increases by $; Owner’s Equity (Pamela Kolp, Capital) increases by $.arrow_forwardWhen a company incurs an expense but does not yet pay it, what is the entry?A. Debit Expense, Credit CashB. Debit Liability, Credit ExpenseC. Debit Expense, Credit LiabilityD. No entry needed helparrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning