Managerial Accounting + Connect Access Card

7th Edition

ISBN: 9781260581263

Author: John Wild

Publisher: McGraw-Hill College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 14QS

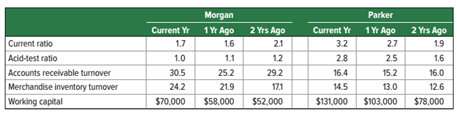

Morgan Company and Parker Company are similar firms operating in the same industry. Write a half-page report comparing Morgan and Parker using the available information. Your discussion should include their ability to meet current obligations and to use current assets efficiently.

Analyzing short-term financial condition A1

Team Project Assume that the two companies apply for a one-year loan from the team. Identify additional information the companies must provide before the team can make a loan decision.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Help me Accounting

Please provide the accurate answer to this general accounting problem using appropriate methods.

Please explain the solution to this general accounting problem with accurate explanations.

Chapter 13 Solutions

Managerial Accounting + Connect Access Card

Ch. 13 - Prob. 1MCQCh. 13 - Prob. 2MCQCh. 13 - Prob. 3MCQCh. 13 - Prob. 4MCQCh. 13 - Prob. 5MCQCh. 13 - Prob. 1DQCh. 13 - Prob. 2DQCh. 13 - Prob. 3DQCh. 13 - Prob. 4DQCh. 13 - Prob. 5DQ

Ch. 13 - Prob. 6DQCh. 13 - Prob. 7DQCh. 13 - Prob. 8DQCh. 13 - Prob. 9DQCh. 13 - Prob. 10DQCh. 13 - Prob. 11DQCh. 13 - Prob. 12DQCh. 13 - Where on the income statement does a company...Ch. 13 - Prob. 14DQCh. 13 - Prob. 15DQCh. 13 - Samsung Refer to Samsung’s financial statements in...Ch. 13 - Prob. 17DQCh. 13 - Prob. 1QSCh. 13 - Prob. 2QSCh. 13 - Prob. 3QSCh. 13 - Prob. 4QSCh. 13 - Prob. 5QSCh. 13 - Prob. 6QSCh. 13 - Prob. 7QSCh. 13 - Prob. 8QSCh. 13 - Prob. 9QSCh. 13 - Prob. 10QSCh. 13 - Prob. 11QSCh. 13 - Prob. 12QSCh. 13 - Prob. 13QSCh. 13 - Morgan Company and Parker Company are similar...Ch. 13 - Which of the following gains or losses would...Ch. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - Prob. 3ECh. 13 - Prob. 4ECh. 13 - Prob. 5ECh. 13 - Exercise 13-6 Common-size percents P2

Simon...Ch. 13 - Prob. 7ECh. 13 - Exercise 13-8 Liquidity analysis and...Ch. 13 - Exercise 13-9 Risk and Capital structure analysis...Ch. 13 - Exercise 13-10 Efficiency and Profitability...Ch. 13 - Exercise 13-11 profitability analysis P3 Refer to...Ch. 13 - Prob. 12ECh. 13 - Prob. 13ECh. 13 - Prob. 14ECh. 13 - Prob. 15ECh. 13 - Exercise Interpreting financial ratios Refer to...Ch. 13 - Prob. 17ECh. 13 - Prob. 18ECh. 13 - Prob. 1PSACh. 13 - Prob. 2PSACh. 13 - Prob. 3PSACh. 13 - Problem 13-4A Calculation of financial statement...Ch. 13 - Prob. 5PSACh. 13 - Prob. 6PSACh. 13 - Prob. 1PSBCh. 13 - Prob. 2PSBCh. 13 - Prob. 3PSBCh. 13 - Prob. 4PSBCh. 13 - Prob. 5PSBCh. 13 - Problem 13-6BAIncome statement computations and...Ch. 13 - Use the following selected data from Business...Ch. 13 - Use Apple’s financial statements in Appendix A to...Ch. 13 - Prob. 2AACh. 13 - Prob. 3AACh. 13 - Prob. 1BTNCh. 13 - Prob. 2BTNCh. 13 - Prob. 3BTNCh. 13 - Prob. 4BTNCh. 13 - ENTREPRENEURIAL DECISION A1 P1 P2 P3 BTN 13-7...Ch. 13 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Understanding Credit; Author: UCBStudentAffairs;https://www.youtube.com/watch?v=EBdXREhOuME;License: Standard Youtube License