1. a.

Prepare the

1. a.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Available for sale securities: these are the securities which are not intended to be sold in the near future and there is no intension to hold the securities till their maturity.

Prepare the journal entries to record the investment in shares transactions, using fair value method, and classify the securities as available-for-sale securities.

Record the purchase of Company G’s shares on January 1, 2015.

Step 1: Determine the number of shares purchased.

Corporation S purchased 20% shares of Company G for

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| January 1, 2015 | Investment in Available-for-sale Securities | $160,000 | |

| Cash | $160,000 | ||

| (To record the purchase of 20% shares of Company G) |

Table (1)

Record the dividend income received on December 31, 2015.

Corporation S received

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2015 | Cash | $6,000 | |

| Dividend income | $6,000 | ||

| (To record the amount of dividend income received from investment) |

Table (2)

Record the unrealized gain or loss on available-for-sale securities, as on December 31, 2015.

Step 1: Determine the amount of unrealized holding loss or gain.

Step 2: Record the

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2015 | Unrealized holding gain or loss: Available-for-sale securities | $8,000 | |

|

Allowance for change in fair value of investment | $8,000 | ||

| (To record the unrealized holding loss on investment) |

Table (3)

Record the dividend income received on December 31, 2016.

Corporation S received

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2016 | Cash | $7,000 | |

| Dividend income | $7,000 | ||

| (To record the amount of dividend income received from investment) |

Table (4)

Record the unrealized gain or loss on available-for-sale securities, as on December 31, 2016.

Step 1: Determine the amount of unrealized holding loss or gain.

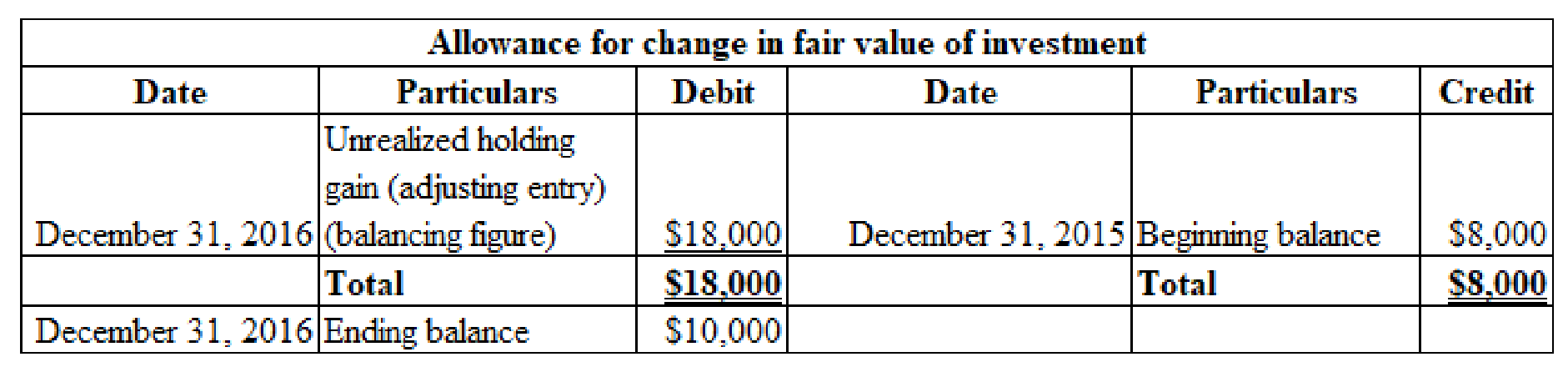

Step 2: Determine the amount of allowance to be adjusted to have $10,000 debit balance in allowance account at the end of the year 2016, using T-account.

Credit balance in allowance account on December 31, 2015 is $8,000.

Table (5)

Step 3: Record the adjusting entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2016 | Allowance for change in fair value of investment | $18,000 | |

|

Unrealized holding gain or loss: Available-for-sale securities | $18,000 | ||

| (To adjust the unrealized holding gain on investment) |

Table (6)

Note:

Under the fair value method of recording the investment, no entry is required for recording the investee company’s net income.

1. b.

Prepare the journal entries to record the investment in shares transactions, using equity method.

1. b.

Explanation of Solution

Record the purchase of Company G’s 20% outstanding common stock:

| Date | Account Title and Explanation | Debit | Credit |

| January 1, 2015 | Investment in Stock: Company G | $160,000 | |

| Cash | $160,000 | ||

| (To record the purchase of 20% shares of Company G) |

Table (7)

Record the income from investment.

Step 1: Determine the amount of investment income.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2015 | Investment in Stock: Company G | $16,000 | |

| Investment income | $16,000 | ||

| (To record the income earned from investment) |

Table (8)

Record the receipt of dividend.

Step 1: Determine the amount of cash received as dividend.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2015 | Cash | $6,000 | |

| Investment in Stock: Company G | $6,000 | ||

| (To record the receipt of cash dividend) |

Table (9)

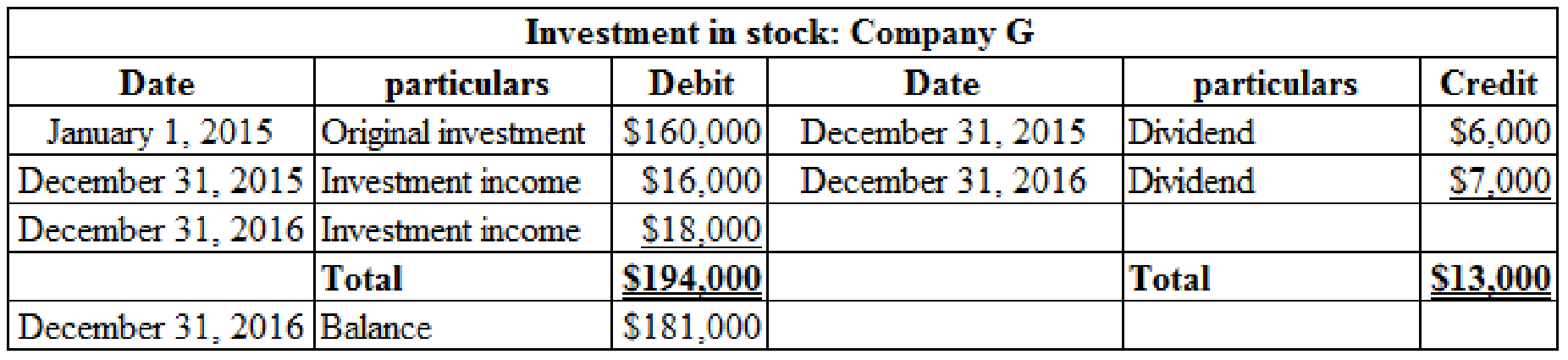

Record the income from investment.

Step 1: Determine the amount of investment income.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2016 | Investment in Stock: Company G | $18,000 | |

| Investment income | $18,000 | ||

| (To record the income earned from investment) |

Table (10)

Record the receipt of dividend.

Step 1: Determine the amount of cash received as dividend.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2016 | Cash | $7,000 | |

| Investment in Stock: Company G | $7,000 | ||

| (To record the receipt of cash dividend) |

Table (11)

Note: Under the equity method of recording the investment, no entry is required for recording the increase in the investee company’s market value.

2. a.

Prepare the journal entries to record the sale of 10,000 of Company G’s shares, using fair value method, and classify the securities as available-for-sale securities.

2. a.

Explanation of Solution

Record the sale of 10,000 shares of Company G for $4.25 per share on January 4, 2017, under fair value method.

Corporation S sold Company G’s shares and received cash of $42,500

Determine the cost of investment in available-for-sale securities sold on January 4, 2017.

Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| January 4, 2017 | Cash | $42,500 | |

|

Investment in Available-for-sale Securities | $40,000 | ||

|

Gain on sale of Available-for-sale Securities | $2,500 | ||

| (To record the gain on sale of available-for-sale of securities) |

Table (12)

On January 4, 2017, reverse the unrealized gain that had accumulated at the end of December 31, 2016 for 10,000 numbers of shares sold.

The previously recorded $10,000 unrealized gain and allowance for 40,000 shares should be reversed as follows for 10,000 shares sold

| Date | Account Title and Explanation | Debit | Credit |

| January 4, 2017 | Unrealized holding gain or loss: Available-for-sale securities | $2,500 | |

|

Allowance for change in fair value of investment | $2,500 | ||

| (To reverse the allowance and the unrealized gain on holding the Securities of 10,000 shares) |

Table (13)

2. b.

Prepare the journal entries to record the sale of 10,000 of Company G’s shares, using equity method.

2. b.

Explanation of Solution

Record the sale of 10,000 shares of Company G for $4.25 per share on January 4, 2017, under equity method.

Determine the balance in Corporation S’s investment account on January 4, 2017.

Table (14)

Record the realized gain or loss from sale of 10,000 shares of Company G.

| Date | Account Title and Explanation | Debit | Credit |

| January 4, 2017 | Cash | $42,500 | |

| Loss on sale of equity investment | $2,750 | ||

| Investment in Stock: Company G | $45,250 | ||

| (To record the loss on sale of investment) |

Table (15)

Want to see more full solutions like this?

Chapter 13 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- Below is information for Blue Company. Using this information, answer the following questions on the "Calculation" tab in the file. Show your work (how you got your answer) and format appropriately. Blue company has prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 to 1,500 units): Sales $ 40,000 Variable expenses 24,000 Contribution margin 16,000 NOTE: Use the amounts in the original fact pattern to the left as your basis for the questions below. Fixed expenses 12,000 Net operating income $ 4,000 Questions: 1. What is the contribution margin per unit? 2. What is the contribution margin ratio? 3. What is…arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardGeneral accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning