Subsequent events

• LO13–6

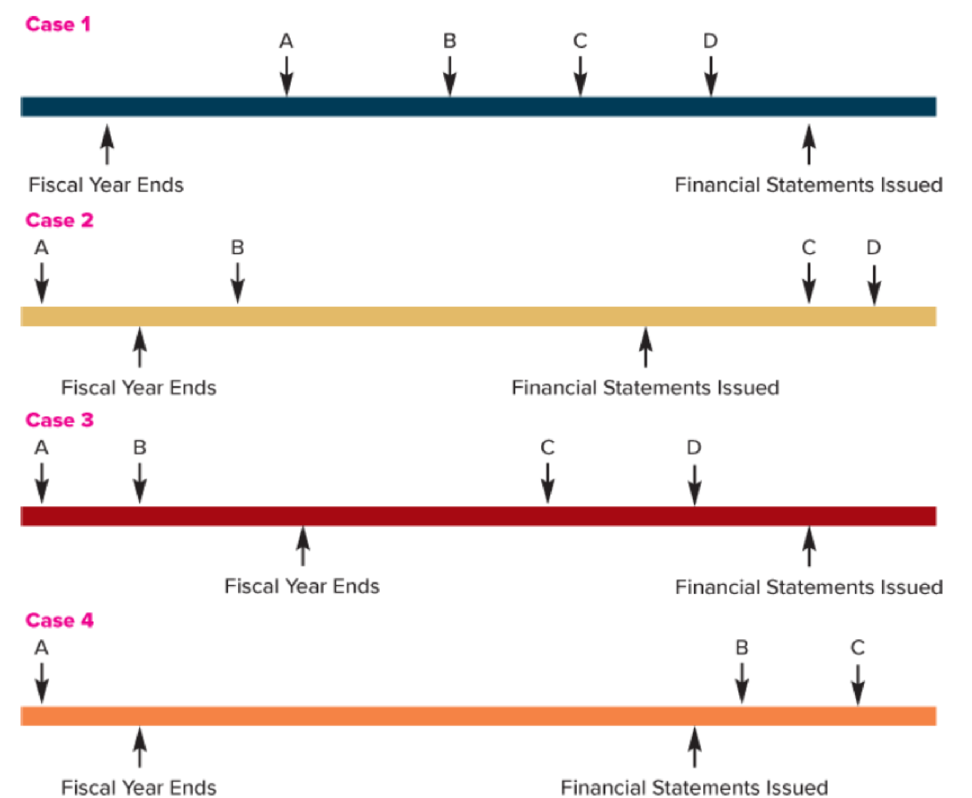

Lincoln Chemicals became involved in investigations by the U.S. Environmental Protection Agency in regard to damages connected to waste disposal sites. Below are four possibilities regarding the timing of (A) the alleged damage caused by Lincoln, (B) an investigation by the EPA, (C) the EPA assessment of penalties, and (D) ultimate settlement. In each case, assume that Lincoln is unaware of any problem until an investigation is begun. Also assume that once the EPA investigation begins, it is probable that a damage assessment will ensue and that once an assessment is made by the EPA, it is reasonably possible that a determinable amount will be paid by Lincoln.

Required:

For each case, decide whether (1) a loss should be accrued in the financial statements with an explanatory note, (2) a disclosure note only should be provided, or (3) no disclosure is necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Intermediate Accounting w/ Annual Report; Connect Access Card

- Need help this questionarrow_forwardProvide answerarrow_forwardA business purchased a machine that had a total cost of $180,000 and a residual value of $15,000. The asset is expected to service the business for a period of 8 years or produce a total of 800,000 units. The machine was purchased on January 1st of the current year and has been in service for one complete year. Now assume the business uses the units-of-production method. If the asset produces 150,000 units in year one and 180,000 units in year two, what is the book value at the end of year two?arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage