Subsequent events

• LO13–6

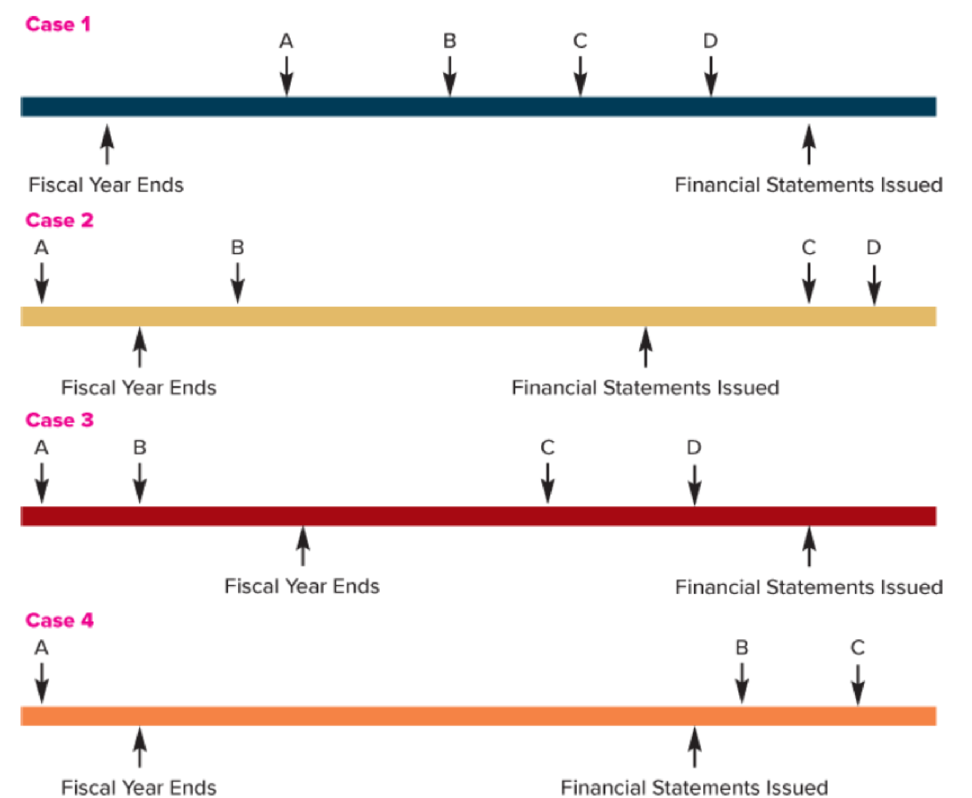

Lincoln Chemicals became involved in investigations by the U.S. Environmental Protection Agency in regard to damages connected to waste disposal sites. Below are four possibilities regarding the timing of (A) the alleged damage caused by Lincoln, (B) an investigation by the EPA, (C) the EPA assessment of penalties, and (D) ultimate settlement. In each case, assume that Lincoln is unaware of any problem until an investigation is begun. Also assume that once the EPA investigation begins, it is probable that a damage assessment will ensue and that once an assessment is made by the EPA, it is reasonably possible that a determinable amount will be paid by Lincoln.

Required:

For each case, decide whether (1) a loss should be accrued in the financial statements with an explanatory note, (2) a disclosure note only should be provided, or (3) no disclosure is necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

INTERMEDIATE ACCOUNTING WITH AIR FRANCE-KLM 2013 ANNUAL REPORT

- Allstate Premium Watches, Inc. had a Return on Assets (ROA) of 8.5%, a profit margin of 15.2%, and sales of $18 million. Calculate Allstate Premium Watches' total assets. (Enter your answer in millions.)arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardgeneral accounting question ?arrow_forward

- What is the ending inventory valuearrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardHorizon Industries has sales of $250,000 and the cost of goods available for sale of $215,000. If the gross profit rate is 38.75%, the estimated cost of the ending inventory under the gross profit method is?arrow_forward

- Could you explain the steps for solving this financial accounting question accurately?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardWinslow Corporation planned to use $75 of material per unit but actually used $72 of material per unit. The company planned to produce 2,200 units but actually produced 1,900 units. What is the production-volume variance?arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage