Subsequent events

• LO13–6

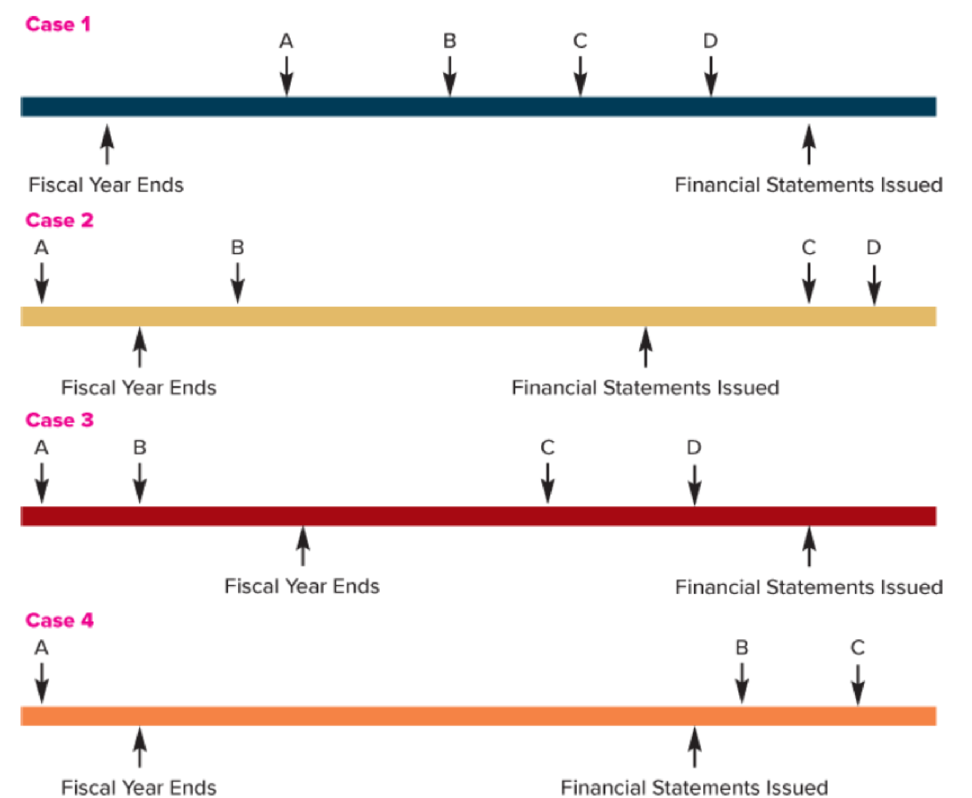

Lincoln Chemicals became involved in investigations by the U.S. Environmental Protection Agency in regard to damages connected to waste disposal sites. Below are four possibilities regarding the timing of (A) the alleged damage caused by Lincoln, (B) an investigation by the EPA, (C) the EPA assessment of penalties, and (D) ultimate settlement. In each case, assume that Lincoln is unaware of any problem until an investigation is begun. Also assume that once the EPA investigation begins, it is probable that a damage assessment will ensue and that once an assessment is made by the EPA, it is reasonably possible that a determinable amount will be paid by Lincoln.

Required:

For each case, decide whether (1) a loss should be accrued in the financial statements with an explanatory note, (2) a disclosure note only should be provided, or (3) no disclosure is necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

INTERMEDIATE ACCOUNTING

- I need help with this financial accounting problem using accurate calculation methods.arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardPlease provide the solution to this financial accounting question using proper accounting principles.arrow_forward

- Can you provide the valid approach to solving this financial accounting question with suitable standards?arrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forward

- Please explain the accurate process for solving this financial accounting question with proper principles.arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage