Accounting: What the Numbers Mean

11th Edition

ISBN: 9781259535314

Author: David Marshall, Wayne William McManus, Daniel Viele

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.7E

Exercise 13.7

LO 2

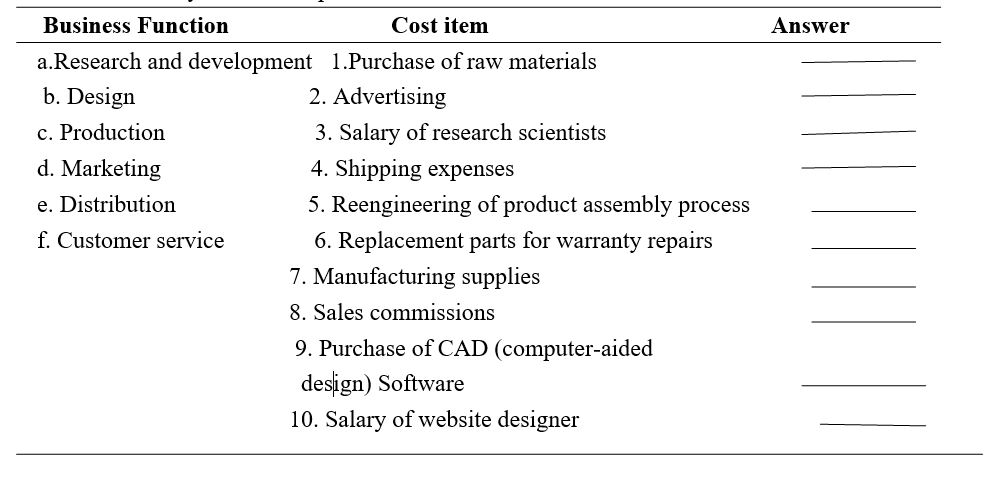

Value chain classifications Match each of the following cost items with the value chain business function where you would expect the cost to be incurred:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please Solve this one with Financial Accounting method. Get Solution in time

Hello Tutor I need Answer of this Financial Accounting Question Solution with Detailed Answer

Accounting

Chapter 13 Solutions

Accounting: What the Numbers Mean

Ch. 13 - Prob. 13.1MECh. 13 - Mini-Exercise 13.2 LO 5, 6 Calculate predetermined...Ch. 13 - Mini-Exercise 13.3 LO 6 Underapplied overhead...Ch. 13 - Mini-Exercise 13.4 LO 7 Statement of cost of goods...Ch. 13 - Prob. 13.5MECh. 13 - Prob. 13.6MECh. 13 - Exercise 13.7 LO 2 Value chain classifications...Ch. 13 - Prob. 13.8ECh. 13 - Exercise 13.9 LO 3, 4 Cost classifications For...Ch. 13 - Exercise 13.10

LO 3, 4

Cost classifications For...

Ch. 13 - Exercise 13.11

LO 4

Cost classifications Aussie...Ch. 13 - Exercise 13.12

LO 4

Cost classifications College...Ch. 13 - Exercise 13.13

LO 5

Product costing—various issues...Ch. 13 - Exercise 13.14

LO 5

Product costing—manufacturing...Ch. 13 - Exercise 13.15

LO 5, 6

Manufacturing...Ch. 13 - Exercise 13.16 LO 5, 6 Manufacturing...Ch. 13 - Prob. 13.17ECh. 13 - Prob. 13.18ECh. 13 - Prob. 13.19ECh. 13 - Exercise 13.20

LO 8

Variable versus absorption...Ch. 13 - Problem 13.21

LO 9

Activity-based costing MedTech,...Ch. 13 - Prob. 13.22PCh. 13 - Prob. 13.23PCh. 13 - Prob. 13.24PCh. 13 - Prob. 13.25PCh. 13 - Prob. 13.26PCh. 13 - Prob. 13.27PCh. 13 - Prob. 13.28PCh. 13 - Case 13.29 LO 4, 5, 7 Cost of goods manufactured,...Ch. 13 - Prob. 13.30CCh. 13 - Prob. 13.31CCh. 13 - Prob. 13.32C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following errors took place in journalizing and posting transactions:a. The payment of $3,125 from a customer on account was recorded as a debit to Cash and a credit toAccounts Payable.b. Advertising expense of $1,500 paid for the current month was recorded as a debit to MiscellaneousExpense and a credit to Advertising Expense.c. The purchase of supplies of $2,690 on the account was recorded as a debit to Office Equipment anda credit to Supplies.d. The receipt of $3,750 for services rendered was recorded as a debit to Accounts Receivable and acredit to Fees Earned.Required:Prepare journal entries to correct the errors.Each error correction carries equal marks.arrow_forwardRequired:a) Journalize the following transactions using the direct write-off method of accounting foruncollectible receivables:Aug. 7. Received $175 from Roosevelt McLair and wrote off the remainder owed of $400 asuncollectible.Nov. 23. Reinstated the account of Roosevelt McLair and received $400 cash in full payment.b) Journalize the following transactions using the allowance method of accounting for uncollectiblereceivables:Feb. 12. Received $750 from Manning Wingard and wrote off the remainder owed of $2,000 asuncollectible.June 30. Reinstated the account of Manning Wingard and received $2,000 cash in full payment.Each journal carries equal marksarrow_forwardIf someone tracks, tallys and totals a current liabilities for an accounting period, and then seeks to apply this value in a calculation to assess our liquidity, what’s the difference between the current ratio and the “acid-test” (or “quick”) ratio? Does the difference between these two metrics even matter?arrow_forward

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License